A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

COMMENTARY: Projecting impact on repossessions as debt burdens grow

Monday, Mar. 10, 2025, 09:51 AM

Andy Sinclair, Repo Report

During tax season, the auto-repossession sector typically sees a dip in repossessions as customers receive additional cash and pay down their obligations. Recent data from Fitch Ratings and the Federal Reserve Bank of New York indicate a concerning rise in ... [Read More]

Protective Asset Protection launches hybrid solution that combines benefits of reinsurance and dealer-owned warranty companies

Friday, Mar. 7, 2025, 10:07 AM

SubPrime Auto Finance News Staff

Protective Asset Protection unveiled another wealth-building program option for dealerships on Thursday. Called the Protective DOWC Re Program, the company highlighted this solution merges the best of traditional reinsurance with the benefits of a Protective dealer-owned warranty company (DOWC), giving ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Reynolds’ O’Loughlin inducted in F&I Hall of Fame

Friday, Mar. 7, 2025, 10:06 AM

SubPrime Auto Finance News Staff

Terry O’Loughlin, director of compliance for Reynolds Document Services, is now a Hall of Famer. Reynolds and Reynolds highlighted this week that O’Loughlin has been inducted into the F&I Hall of Fame by the Bobit Dealer Group. During the inductee ... [Read More]

Why car business currently faces ‘noise’ and ‘chaos’

Thursday, Mar. 6, 2025, 10:27 AM

Nick Zulovich, Senior Editor

Experts are using words such as “noise” and “chaos” when describing developments coming out of Washington and what consumers are currently thinking as they try to explain what might unfold next in the car business and the general economy. Bottom ... [Read More]

From the editor: 20 honorees among 2025 Women in Collections and Recoveries

Wednesday, Mar. 5, 2025, 01:50 PM

Nick Zulovich, Senior Editor

Cherokee Media Group is proud to recognize this year’s Women in Collections and Recoveries, presented by American Recovery Service. We were privileged to receive a record number of nominations for this program, leading to 20 industry leaders being recognized. The ... [Read More]

MBSi unveils new tool to automatically verify lienholder changes to avoid wrongful repossessions

Wednesday, Mar. 5, 2025, 09:39 AM

SubPrime Auto Finance News Staff

With wrongful repossessions costing finance companies and forwarders up to an estimated $1 million annually, MBSi has introduced a solution which significantly reduces lien lost risk and associated costs. MBSi highlighted on Tuesday that Lien Verification is a new product ... [Read More]

Former Corpay, Primeritus exec now COO of Resolvion

Wednesday, Mar. 5, 2025, 09:38 AM

SubPrime Auto Finance News Staff

Resolvion has a new chief operating officer. On Tuesday, the repossession management company announced that it has appointed Darren Stavely as its COO. With more than 20 years of experience in operations, finance, and customer service, Resolvion highlighted that Stavely ... [Read More]

Hoffman becomes president of APCO Holdings

Tuesday, Mar. 4, 2025, 10:14 AM

SubPrime Auto Finance News Staff

APCO Holdings named Courtney Hoffman as its president on Tuesday. The provider of F&I products — and home to the EasyCare, GWC Warranty, Crystal Fusion and Rider’s Advantage brands — said Hoffman will also continue leading the revenue channel and ... [Read More]

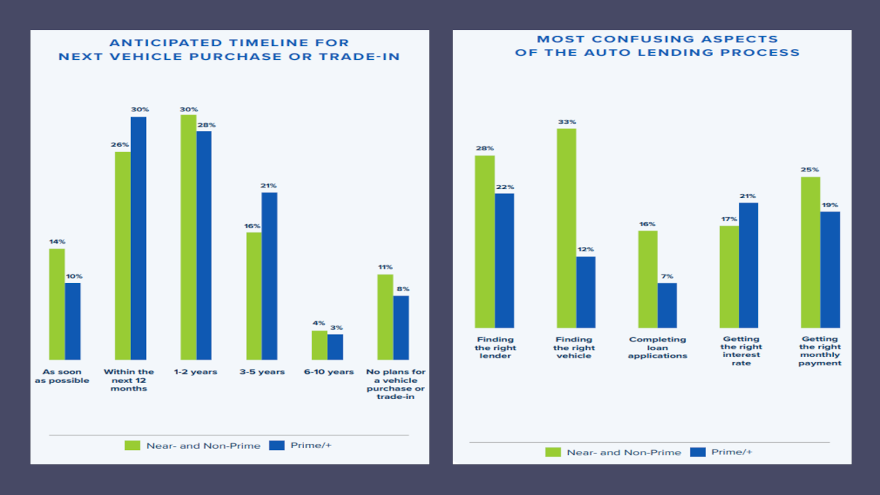

Report: 70% of consumers plan to buy a car within next 2 years

Monday, Mar. 3, 2025, 10:16 AM

SubPrime Auto Finance News Staff

If your finance company chooses to book contracts with near- and non-prime consumers, you’re likely to have a notable pool of potential customers in the next 24 months. According to the 2025 Vehicle Accessibility Report from Open Lending, 70% of ... [Read More]

CFPB director nominee shares plan to reshape bureau during Senate hearing

Friday, Feb. 28, 2025, 10:05 AM

SubPrime Auto Finance News Staff

The Senate Banking Committee hosted a two-hour hearing on Thursday to question the nominee to be director of the Consumer Financial Protection Bureau, along with nominees to be the Under Secretary of Commerce, chairman of the Council of Economic Advisors ... [Read More]

X