A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

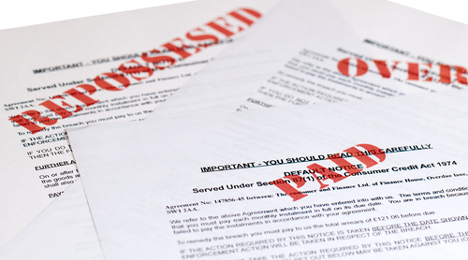

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Initial industry reaction to CFPB debt collection proposal

Friday, Jul. 29, 2016, 03:47 PM

Nick Zulovich, Senior Editor

In what might be a positive development for auto finance companies, both the American Financial Services Association and the Consumer Bankers Association picked up on the same segment of the debt collection regulatory proposal the Consumer Financial Protection Bureau unveiled ... [Read More]

6 components of CFPB’s debt collection proposal

Thursday, Jul. 28, 2016, 01:52 PM

SubPrime Auto Finance News Staff

How finance companies and buy-here, pay-here dealerships execute one of their most important functions — collections — now potentially has six additional layers of compliance requirements stemming from the regulatory proposal rolled out by the Consumer Financial Protection Bureau on ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

NextGear Capital coming to 68 CarMax auction locations

Wednesday, Jul. 27, 2016, 02:47 PM

SubPrime Auto Finance News Staff

NextGear Capital announced an agreement with CarMax on Wednesday that will allow dealers to use their NextGear Capital lines of credit at all 68 CarMax auction locations. NextGear Capital floor plans are currently accepted at more than 1,000 live and ... [Read More]

How securing a vehicle in subprime is changing lives

Wednesday, Jul. 27, 2016, 02:45 PM

Phil Getz, Navicore Solutions

As a non-profit financial counseling organization, our counselors see first-hand the impact a car and a car loan have on the financial security of individuals and their families. The value of a reliable car is pretty clear. It expands employment ... [Read More]

defi SOLUTIONS expands digital capabilities with eOriginal partnership

Tuesday, Jul. 26, 2016, 02:30 PM

SubPrime Auto Finance News Staff

The fourth significant development coming from defi SOLUTIONS in the past month arrived on Tuesday morning. This time, defi SOLUTIONS finalized a partnership with eOriginal in an effort to bring secure eContracting and eVaulting capabilities to its growing finance company ... [Read More]

GM Financial’s subprime exposure falls again in Q2

Monday, Jul. 25, 2016, 03:47 PM

Nick Zulovich, Senior Editor

General Motors Financial previously discussed how its subprime exposure would be declining as the finance company continues its strategy pivot to prime paper as the parent automaker’s captive provider. The company’s second-quarter financial statement reinforced the approach as GM Financial ... [Read More]

3 personnel changes at the CFPB

Monday, Jul. 25, 2016, 03:40 PM

SubPrime Auto Finance News Staff

Just ahead of when it rolled past five years of operation, the Consumer Financial Protection Bureau made three leadership changes involving the associate director for supervision, enforcement, and fair lending; the principal deputy general counsel; and the deputy chief operating ... [Read More]

9 groups urge Senate to pass bill rescinding CFPB auto finance guidance

Friday, Jul. 22, 2016, 03:42 PM

SubPrime Auto Finance News Staff

This week, a broad coalition of business groups involved in the making, selling, servicing, financing and auctioning of vehicles urged Congress to support Senate legislation to preserve a consumer's ability to get discounted auto financing at the dealership. In a ... [Read More]

CFPB’s impact after 5 years

Thursday, Jul. 21, 2016, 02:36 PM

Nick Zulovich, Senior Editor

Five years ago today, the Consumer Financial Protection Bureau “opened our doors,” a milestone the regulator highlighted on its website. The Dodd-Frank Act that created the CFPB receives its operational funding the Federal Reserve, which literally can print money. As ... [Read More]

Dealertrack eContracting now available to Volvo dealers nationwide

Wednesday, Jul. 20, 2016, 03:30 PM

SubPrime Auto Finance News Staff

In an effort to help dealers and finance companies benefit from the use of digital technologies, Dealertrack announced this week that Volvo Car Financial Services is now available for eContracting with Volvo dealers nationwide on the Dealertrack platform. The company ... [Read More]

X