A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

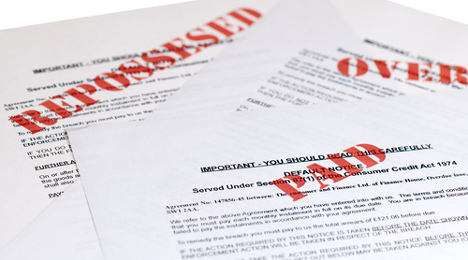

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

The ‘real’ question about potential interest rate rise

Wednesday, Sep. 16, 2015, 03:47 PM

SubPrime Auto Finance News Staff

Even one of the experts who specializes in the certified pre-owned vehicle market and is set to appear at Used Car Week for the fifth year in a row joined the discussion about what moves the Federal Reserve might make ... [Read More]

CFPB receives 8 federal recommendations for complaint database

Wednesday, Sep. 16, 2015, 03:43 PM

SubPrime Auto Finance News Staff

Multiple industry associations disagree with how the Consumer Financial Protection Bureau orchestrates its complaint database. Now a top federal examiner whose primary responsibility is “to detect and deter waste, fraud and abuse,” according to its own website, is questioning how ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

BillingTree bolsters business development team

Wednesday, Sep. 16, 2015, 03:41 PM

SubPrime Auto Finance News Staff

BillingTree hired a director of new business development on Tuesday to focus on extending access to the company’s payment services and solutions to broader markets and industries, including auto finance. Taking on this post is Greg Mallin, whose position was ... [Read More]

Industry awaits Fed decision on interest rates

Monday, Sep. 14, 2015, 03:59 PM

SubPrime Auto Finance News Staff

Perhaps auto finance companies will know more about interest rates this week since Stifel Nicolaus & Co. chief economist Lindsey Piegza called the upcoming meeting of the Federal Open Market Committee “arguably the most widely anticipated event in the aftermath ... [Read More]

Ally donates 3,000 new library books to Detroit Public Schools

Monday, Sep. 14, 2015, 03:54 PM

SubPrime Auto Finance News Staff

In honor of local students going back to school, Ally Financial recently announced that it will be donating 3,000 new library books to schools in the Detroit Public School district. Officials highlighted elementary and middle school libraries throughout the district ... [Read More]

NextGear Capital rolls out operations in Ireland

Monday, Sep. 14, 2015, 03:52 PM

SubPrime Auto Finance News Staff

NextGear Capital’s growth is blossoming beyond North America. Executives from NextGear Capital joined representatives from their NextGear Capital UK subsidiary and the Society of the Irish Motor Industry in Dublin on Monday to commemorate the company’s launch into Ireland. Officials ... [Read More]

2 dealers receive payments from Western Funding’s Triple Pay program

Friday, Sep. 11, 2015, 03:25 PM

SubPrime Auto Finance News Staff

Western Funding announced the first two dealers to receive their second payment as part of its Triple Pay program. Officials explained Triple Pay is Western Funding’s unique program that can give dealers the opportunity to build a portfolio of accounts ... [Read More]

Reynolds F&I library now available for Tennessee

Friday, Sep. 11, 2015, 03:21 PM

SubPrime Auto Finance News Staff

On Thursday, Reynolds and Reynolds launched the Reynolds LAW Tennessee F&I Library, a comprehensive catalog of standardized, legally reviewed finance and insurance documents available to automobile retailers in Tennessee. The F&I resource for dealerships in the Volunteer State extended Reynolds’ ... [Read More]

CFPB penalizes 2 debt buyers; action tops $70M

Wednesday, Sep. 9, 2015, 06:17 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau took action on Wednesday against the nation’s two largest debt buyers and collectors for allegedly using deceptive tactics to collect bad debts, which may have included auto finance recoveries. The bureau found that Encore Capital ... [Read More]

640 dealer violations trigger nearly $700K in penalties

Wednesday, Sep. 9, 2015, 03:36 PM

SubPrime Auto Finance News Staff

The latest enforcement action against a dealership in New Jersey provided another reason why Dealertrack Technologies associate general counsel Randy Henrick recently acknowledged that when he brings up the topic of compliance, “many dealers feel a headache coming on.” Before ... [Read More]

X