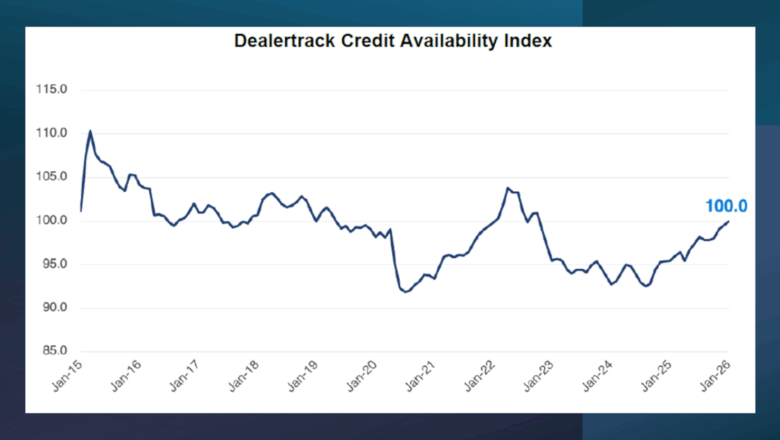

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

Voting closes on President’s Day for 10 industry awards to be given at NARS 2026

Wednesday, Feb. 11, 2026, 01:00 PM

Labor scene still murky, creating potential headwind for automotive

Wednesday, Feb. 11, 2026, 10:38 AM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

2025 Women in Remarketing honorees describe their careers, industry changes & more

One of the foundational parts of Used Car Week each year is the lively conversation among the Women in Remarketing honorees. Moderated again by Brenda Rios of award program sponsor, Ally, hear the valuable perspectives and wisdom from some of ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

Webb Explains Why Auto Loan Application Info Differs From Overall Debt Trends

Monday, Aug. 25, 2014, 03:38 PM

SubPrime Auto Finance News Staff

Manheim chief economist Tom Webb regularly tries to take questions connected to current events when he closes his monthly Auto Industry Brief. The August edition contained questions that likely came from a busy F&I manager. The questioner arrived at the ... [Read More]

Equifax Pops Subprime Bubble Talk in New White Paper

Monday, Aug. 25, 2014, 03:36 PM

SubPrime Auto Finance News Staff

As CNW Research noticed both sequential and year-over-year increases in approvals for subprime vehicle financing so far this month, two Equifax economists took their turn to again reiterate how a bubble is not forming in that segment, contrary to the ... [Read More]

Autosoft Partners with 700Credit to Simplify F&I Operations

Monday, Aug. 25, 2014, 03:33 PM

SubPrime Auto Finance News Staff

Dealer solutions provider Autosoft now offers convenient access to credit report and compliance services within its Web-based FLEX F&I application because of a new a partnership with 700Credit. On Monday, executives highlighted this partnership can help dealers quickly complete the ... [Read More]

$100 Discount Available for NAF Association Members to Attend SubPrime Forum

Friday, Aug. 22, 2014, 03:33 PM

SubPrime Auto Finance News Staff

Along with an opportunity to complete the organization’s compliance certification program, members of the National Automotive Finance Association can take advantage of a $100 registration discount to attend the SubPrime Forum, the event dedicated to auto financing at Used Car ... [Read More]

Despite Delinquency Rise, Subprime Auto Bubble Dismissed

Friday, Aug. 22, 2014, 03:27 PM

Nick Zulovich, Editor

The latest delinquency data from Experian Automotive might give more fuel to observers who believe subprime auto financing is creating a bubble similar to the one that popped in the mortgage industry and sent the economy into a tailspin more ... [Read More]

FactorTrust Partners with defi SOLUTIONS to Furnish Underbanked Data

Friday, Aug. 22, 2014, 03:24 PM

SubPrime Auto Finance News Staff

Underbanked consumer data, analytics and risk scoring solutions provider FactorTrust formed a partnership this week with defi SOLUTIONS, which developed a browser-based loan origination system (LOS). The companies highlighted they reached this alliance because non-prime auto finance companies need access ... [Read More]

CFPB Fines First Investors Financial Services Group $2.75M

Wednesday, Aug. 20, 2014, 07:15 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau announced on Wednesday that Texas-based First Investors Financial Services Group entered into a consent order because the regulator said the subprime finance company distorted consumer credit records for years. CFPB officials said First Investors failed ... [Read More]

Westlake Financial’s Receivables Hit $2 Billion

Wednesday, Aug. 20, 2014, 04:05 PM

SubPrime Auto Finance News Staff

Sparked by the best July in company history, Westlake Financial Services announced this week that it reached $2 billion in total receivables. Westlake’s portfolio now has that total receivables figure connected to more than 270,000 customer accounts. “Having a portfolio ... [Read More]

Lease Approvals Reach New High for Year Despite Subprime Drag

Wednesday, Aug. 20, 2014, 04:03 PM

SubPrime Auto Finance News Staff

Swapalease.com reported lease credit approvals during the month of July climbed to the highest monthly level of the year, reversing a trend that saw continuous decline since January largely due to an increase in the number of subprime credit applicants. ... [Read More]

New Moody’s Report, Execs’ Outlook Confirm Usual Subprime Cycle

Wednesday, Aug. 20, 2014, 04:00 PM

Nick Zulovich, Editor

Near-term predictions made this week by Moody's Investors Service fall in line with ongoing lending cycle points noticed by veteran finance company executives such as Credit Acceptance’s Brett Roberts and Brad Bradley of Consumer Portfolio Services. Moody’s analysts indicated in ... [Read More]

X