A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

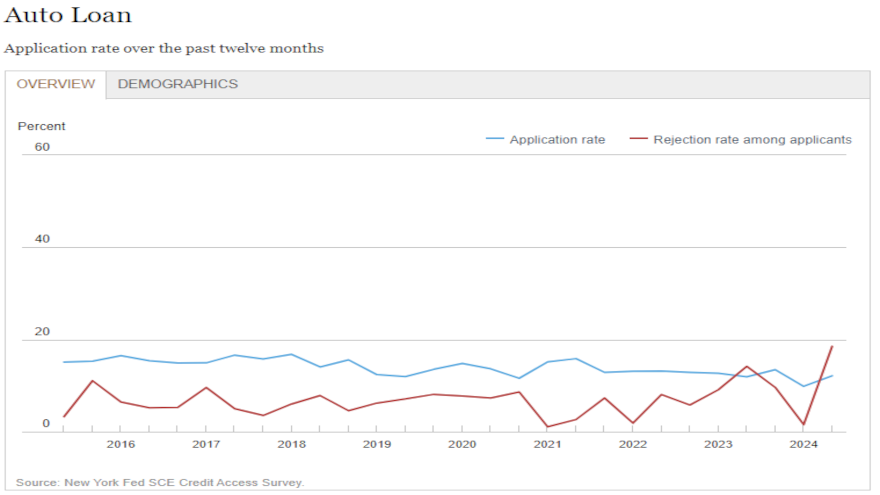

NY Fed spots spike in auto finance rejections

Monday, Jul. 29, 2024, 11:40 AM

Nick Zulovich, Senior Editor

It’s the heat of summer nationwide, but perhaps you could make the argument that things are frozen when considering auto financing and interest rates. Evidence of how frosty things might be within auto financing surfaced from the most recent findings ... [Read More]

Former iA American CRO joins RoadVantage as president

Friday, Jul. 26, 2024, 10:24 AM

SubPrime Auto Finance News Staff

RoadVantage modified its leadership team in multiple ways this week, welcoming John Lutman as president of the F&I company, which offers a full portfolio of vehicle service contracts and ancillary products through certified agents. With Lutman coming aboard, RoadVantage slid ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

AutoPayPlus sees client demand necessitate 30% growth in workforce

Friday, Jul. 26, 2024, 10:23 AM

SubPrime Auto Finance News Staff

AutoPayPlus has good reasons to be in a celebratory mood this summer. The payment processing company recently hosted an employee gathering because AutoPayPlus’ workforce has grown by 30% year-over-year, sparked in part because of “innovative business process enhancements, increasing customer ... [Read More]

CFPB circular focuses on whistleblowing guidelines for financial institutions

Thursday, Jul. 25, 2024, 10:39 AM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) is blowing a whistle, so to speak, about whistleblowing. On Wednesday, the bureau issued a circular to law enforcement agencies and regulators explaining how companies may be breaking the law by requiring employees to ... [Read More]

Loanbridge.AI & AutoSquared.AI partner to speed up repossessions & trim impound fees

Wednesday, Jul. 24, 2024, 11:35 AM

SubPrime Auto Finance News Staff

With Cox Automotive chief economist Jonathan Smoke making note of them this week, vehicle repossessions might be an even higher priority for finance companies nowadays. To help with the situation, Loanbridge.AI and AutoSquared.AI reiterated their partnership is aimed to improve ... [Read More]

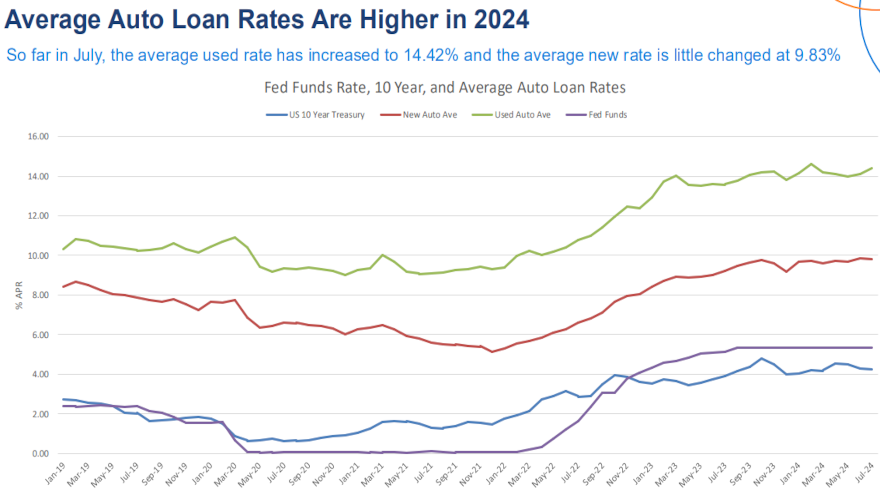

Cox Automotive: Average used APR up 80 basis points so far in July

Wednesday, Jul. 24, 2024, 11:33 AM

SubPrime Auto Finance News Staff

Cox Automotive chief economist Jonathan Smoke squeezed in an online video update about auto financing while also being a keynote presenter in San Antonio this week for the Texas Independent Automobile Dealers Association’s annual convention. Citing data collected via Dealertrack, ... [Read More]

Glenview Finance rolls out eContracting platform

Tuesday, Jul. 23, 2024, 11:30 AM

SubPrime Auto Finance News Staff

Glenview Finance’s Credit Builder subprime financing platform recently debuted its new eContracting system. The company said it’s a comprehensive solution that can have deals funded in less than an hour. Glenview Finance sees this new system as dramatically improving the ... [Read More]

Finance companies facing ‘tough’ credit conditions, too

Monday, Jul. 22, 2024, 12:03 PM

Nick Zulovich, Senior Editor

Dealertrack regularly watches what conditions are like for consumers to obtain auto financing; a landscape that’s been tightening in recent months.

What about the credit environment for finance companies to get the resources they need to book originations? Especially in the non-prime and subprime spaces?

While perhaps an interest rate reprieve is arriving sometime this year, Kyle Birch, who is president of North America operations at GM Financial, described the rough sledding the industry is experiencing ... [Read More]

PODCAST: Latest views on fraud & ransomware with Point Predictive’s Frank McKenna

Friday, Jul. 19, 2024, 10:17 AM

SubPrime Auto Finance News Staff

Point Predictive’s Frank McKenna returned for another episode of the Auto Remarketing Podcast for a discussion about what’s happening on the fraud front. McKenna recapped his keynote appearance at this year’s Non-Prime Auto Financing Conference hosted by the NAF Association ... [Read More]

Kontos: ‘Inflation dragon has not been slain’

Thursday, Jul. 18, 2024, 11:08 AM

Nick Zulovich, Senior Editor

While members of the Federal Reserve spoke publicly this week about movements associated with inflation and data that’s indicating them, ADESA chief economist Tom Kontos was a little more hesitant when giving his assessment about inflation to Cherokee Media Group. ... [Read More]

X