A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

COMMENTARY: How will dealers overcome affordability challenges to maximize Memorial Day sales opportunities?

Tuesday, May. 21, 2024, 10:23 AM

Angelica Jeffreys, Equifax

Memorial Day weekend in the United States marks the unofficial kick-off to the summer car sales season with car dealerships nationwide utilizing the holiday weekend to attract customers with incentives, deals and promotions. Much like in recent years though, affordability ... [Read More]

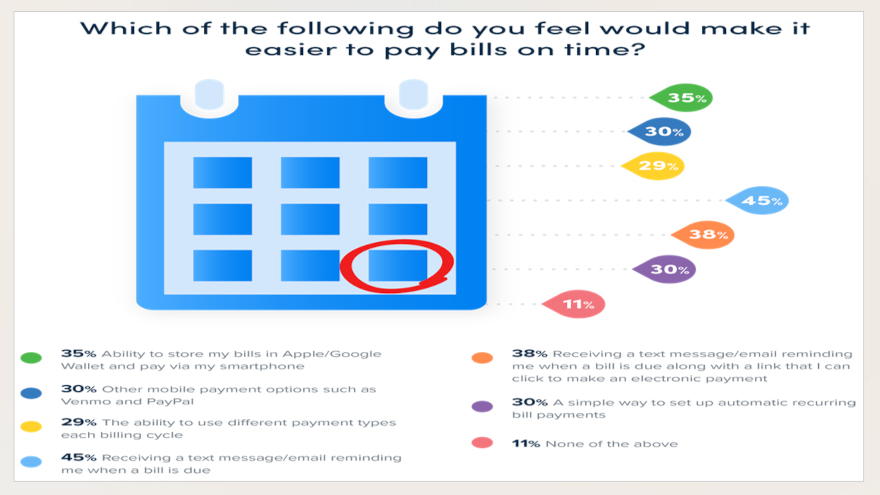

PODCAST: PayNearMe on evolving consumer preferences when making payments

Monday, May. 20, 2024, 11:06 AM

SubPrime Auto Finance News Staff

There’s a growing preference toward alternative payment methods, as well as increased demand for hyper-personalized interactions. Those are two of the top findings from the study titled “Consumer Trends Driving the Future of Loan Payments,” recently released by PayNearMe, which ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Reaction & suggestions following key CFPB victory at Supreme Court

Friday, May. 17, 2024, 10:38 AM

Nick Zulovich, Senior Editor

The Consumer Financial Protection Bureau gained a significant judicial victory this week involving a case about the constitutionality of the CFPB’s funding structure. In a 7-2 ruling, the Supreme Court said the bureau’s funding is constitutional, triggering an array of ... [Read More]

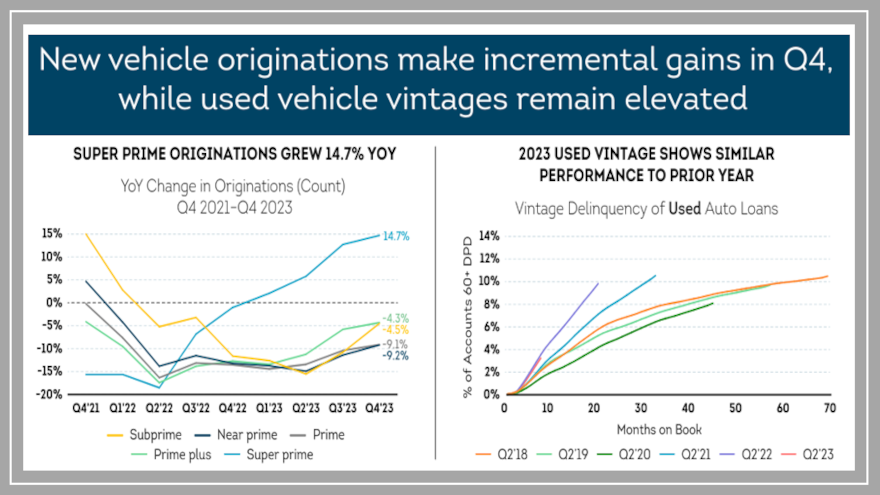

TransUnion analysis reinforces affordability challenges, especially in below-prime

Thursday, May. 16, 2024, 10:35 AM

SubPrime Auto Finance News Staff

The auto-finance data TransUnion released on Thursday reinforced the positive developments connected with affordable used vehicles that Edmunds highlighted earlier in the week. Having more used vehicles that can fit within parameters of tight family budgets might help to boost ... [Read More]

Jim Bass to receive Jack Tracey Pinnacle Award

Wednesday, May. 15, 2024, 12:41 PM

Nick Zulovich, Senior Editor

Last year, the National Automotive Finance Association established the Jack Tracey Pinnacle Award to recognize a professional at a member organization with enduring service to the non-prime auto finance industry. The award is named in honor of one of the ... [Read More]

Launcher & Gestalt Tech partner for enhanced credit data storage, reporting & analytics

Wednesday, May. 15, 2024, 11:47 AM

SubPrime Auto Finance News Staff

Last week, Launcher Solutions announced an integration partnership with Gestalt Tech and its SaaS data warehouse that can empower finance companies to take advantage of the market trends in analytics, artificial intelligence and automation. The companies said this collaboration can ... [Read More]

Open Lending & Core Specialty Insurance Holdings form partnership

Wednesday, May. 15, 2024, 11:44 AM

SubPrime Auto Finance News Staff

Open Lending Corp. recently partnered with Core Specialty Insurance Holdings, enabling Core Specialty to begin providing credit default insurance policies for Open Lending’s Lenders Protection platform. Open Lending interim CEO Chuck Jehl said through a news release, “One of the ... [Read More]

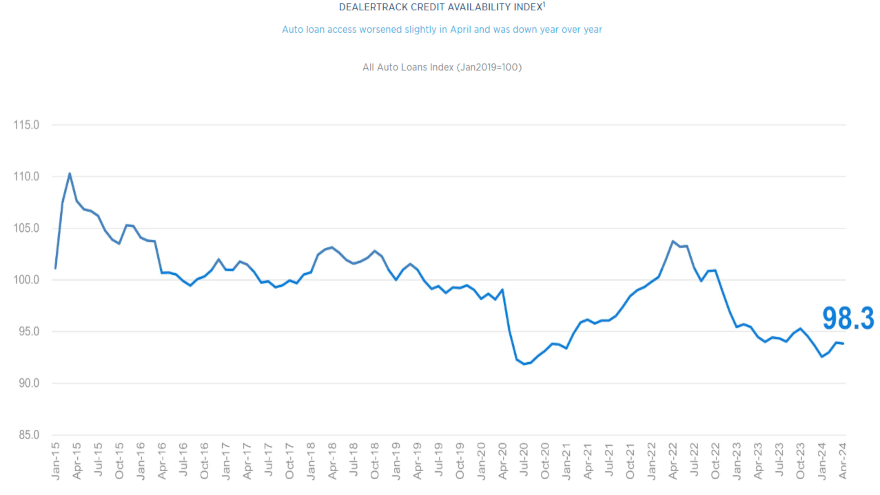

Access to auto credit tightened slightly in April

Tuesday, May. 14, 2024, 09:53 AM

SubPrime Auto Finance News Staff

Perhaps if your tax season didn’t meet your shop’s expectations, the latest reading of the Dealertrack Credit Availability Index could help explain why. Cox Automotive reported last week that the index declined to 93.8 in April, which was down 0.7% ... [Read More]

‘Extraordinary milestone’ for ComplyAuto by welcoming Miller

Monday, May. 13, 2024, 11:16 AM

SubPrime Auto Finance News Staff

ComplyAuto reached an “extraordinary milestone” on Monday, announcing that former National Automobile Dealers Association regulatory expert Brad Miller is joining the company as chief regulatory and compliance officer and head of legal. Miller spent more than 16 years at NADA ... [Read More]

PODCAST: NAF Association update with executive director Jennifer Martin

Monday, May. 13, 2024, 11:15 AM

SubPrime Auto Finance News Staff

National Automotive Finance Association executive director Jennifer Martin had a lot of positive developments to share in this episode of the Auto Remarketing Podcast. The organization is using technology to grow and serve its membership while also preparing for a ... [Read More]

X