A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

PODCAST: New NAF Association president Micky Watts

Tuesday, Jun. 27, 2023, 10:04 AM

SubPrime Auto Finance News Staff

Micky Watts of Anderson Brothers Bank is the new president of the National Automotive Finance Association. Cherokee Media Group’s Nick Zulovich connected with Watts during this year’s Non-Prime Auto Financing Conference to recap his journey from joining the association more ... [Read More]

Osborne becomes MVTRAC COO

Monday, Jun. 26, 2023, 11:18 AM

SubPrime Auto Finance News Staff

Highlighting what he called a “remarkable milestone,” DRN and MVTRAC president Jeremiah Wheeler posted a letter on the company blog announcing the appointment of Cortney Osborne as the new COO of MVTRAC. Wheeler wrote “this transition marks an exciting chapter ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

PODCAST: Talking auto ABS with Amy Martin of S&P Global Ratings

Friday, Jun. 23, 2023, 11:02 AM

SubPrime Auto Finance News Staff

Cherokee Media Group’s Nick Zulovich again tracked down Amy Martin of S&P Global Ratings during this year’s Non-Prime Auto Financing Conference hosted by the National Automotive Finance Association. Martin highlighted the auto ABS trends catching her attention most so far ... [Read More]

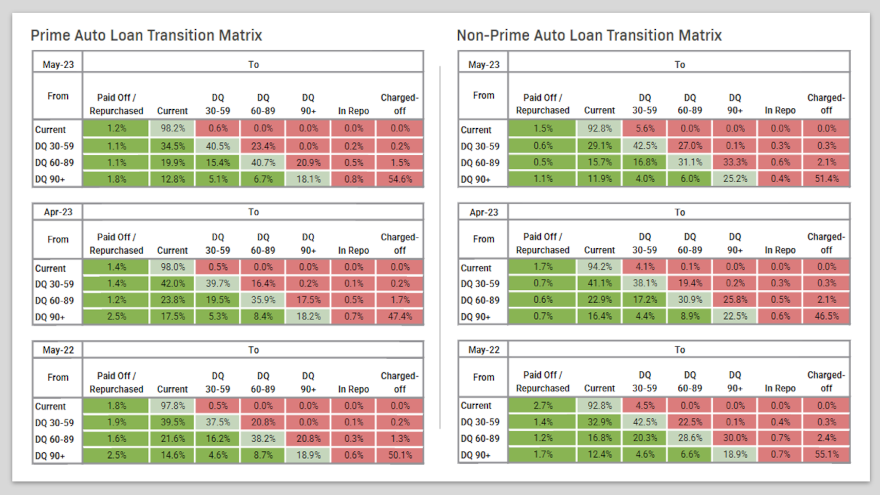

KBRA: 4 elements likely to keep credit performance on seasonal softening trajectory

Friday, Jun. 16, 2023, 11:35 AM

SubPrime Auto Finance News Staff

The newest report from Kroll Bond Rating Agency (KBRA) showed not only weaker credit performance based on securitized prime and non-prime auto finance pools, but experts also pinpointed four ingredients that might keep the trend going in that direction. KBRA ... [Read More]

2 ‘old school’ ways Dallas Chevrolet store continues to thrive

Friday, Jun. 16, 2023, 11:08 AM

Nick Zulovich, Senior Editor

Mark Eddins is owner and general manager of Friendly Chevrolet, which claims on its website that’s it has been the No. 1 volume Chevy dealer in Dallas since 1956. How Eddins and his team work toward maintaining that stature comes ... [Read More]

700Credit & WebBuy form alliance to help dealers gain credit insight on website visitors

Friday, Jun. 16, 2023, 09:30 AM

SubPrime Auto Finance News Staff

A new product alliance emerged this week involving 700Credit, a provider of credit reports, compliance solutions, soft pull products, and driver’s license authentication platforms, and WebBuy, an omnichannel digital retailing solution built to engage customers searching for vehicles on dealership’s ... [Read More]

F&I Sentinel makes 2 personnel moves

Friday, Jun. 16, 2023, 09:27 AM

SubPrime Auto Finance News Staff

F&I Sentinel made a pair of personnel moves this week, hiring a new vice president of operations and shifting its executive holding that position in an interim capacity into another position. Joining the tech-enabled service provider for compliant F&I product ... [Read More]

Interest rates remain unchanged amid wide range of expert opinions & consumer sentiments

Thursday, Jun. 15, 2023, 11:32 AM

Nick Zulovich, Senior Editor

The Federal Reserve board kept interest rates unchanged on Wednesday, halting a streak of 10 consecutive increases when policymakers had the opportunity. Cox Automotive chief economist Jonathan Smoke sees the Fed pushing rates higher again in July but doesn’t expect ... [Read More]

Zurich & Caramel collaborate to bring VSCs to digital used-vehicle markets

Wednesday, Jun. 14, 2023, 11:51 AM

SubPrime Auto Finance News Staff

Zurich North America said it now is offering its F&I vehicle protection service contracts (VSCs) through Caramel, a digital checkout platform for independent dealers and private party buyers and sellers. The company highlighted through a news release that the move ... [Read More]

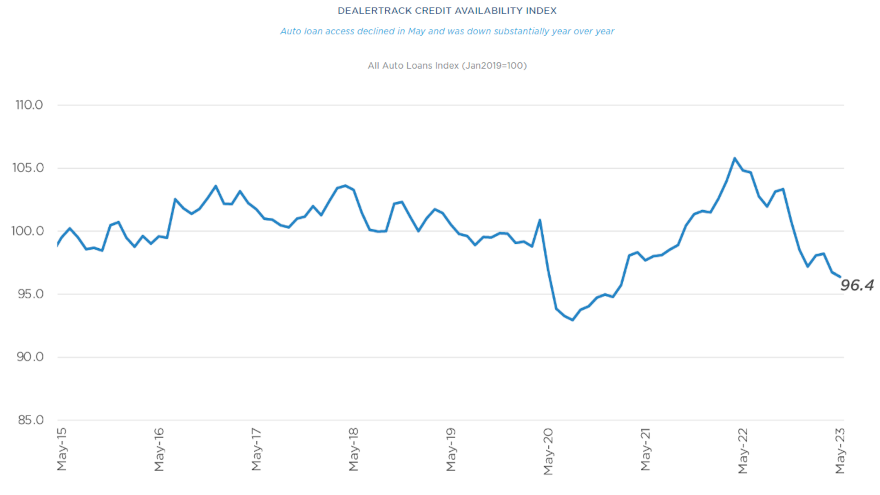

Auto credit tightens again with banks expecting it to remain that way

Tuesday, Jun. 13, 2023, 10:28 AM

SubPrime Auto Finance News Staff

Cox Automotive reported that credit availability for auto finance recently dropped to a two-year low. And the April 2023 Senior Loan Officer Opinion Survey on Bank Lending Practices orchestrated by the Federal Reserve showed that level might stay there for ... [Read More]

X