A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

700Credit rolls out latest fraud-prevention tool

Monday, Jan. 30, 2023, 05:23 PM

SubPrime Auto Finance News Staff

Executives from 700Credit recently released QuickScan, a mobile document verification and fraud detection platform that can provide dealerships with real-time confirmation of the legitimacy of a customer’s driver’s license and identity. The provider of credit, compliance, soft pulls and identity ... [Read More]

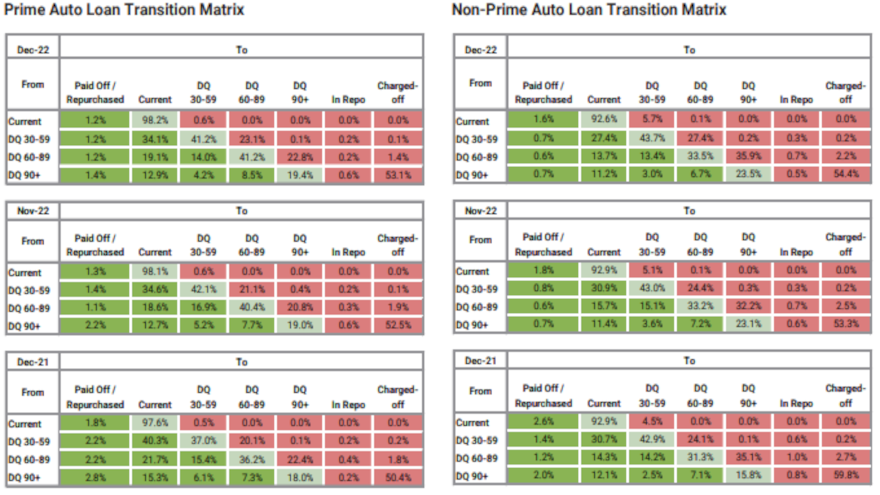

KBRA & DBRS Morningstar offer latest views of auto ABS performance

Friday, Jan. 20, 2023, 03:20 PM

SubPrime Auto Finance News Staff

During the same week as S&P/Experian Consumer Credit Default Indices noted the December auto reading, the newest analysis Kroll Bond Rating Agency (KBRA) revealed more performance softening based on data from the securitization market. KBRA said December remittance reports showed ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Sunbit fixed ops survey reinforces need for financing in service drive

Thursday, Jan. 19, 2023, 02:37 PM

SubPrime Auto Finance News Staff

Your customers’ need for financing might not just be prevalent in your dealership F&I office. The need could be significant in your service drive, too, based on a recently completed a survey of 1,100 fixed ops service professionals at more ... [Read More]

Portfolio elevates Childers to managing director, reveals new company logo

Wednesday, Jan. 18, 2023, 04:47 PM

SubPrime Auto Finance News Staff

Along with a new company branding, Portfolio announced the promotion of Cliff Childers to the position of managing director, effective immediately. The company highlighted the 21-year industry veteran leads a national sales team driving reinsurance and F&I success for auto, ... [Read More]

F&I Sentinel welcomes Zucco to leadership team

Wednesday, Jan. 18, 2023, 04:46 PM

SubPrime Auto Finance News Staff

According to a news release distributed this week, Scott Zucco joined F&I Sentinel as vice president of sales, in a move effective Jan. 3. The automotive compliance and regulatory risk mitigation solutions provider highlighted Zucco is “an accomplished sales professional ... [Read More]

ARA releases policy statement connected with FTC Safeguards Rule

Wednesday, Jan. 18, 2023, 04:43 PM

SubPrime Auto Finance News Staff

The American Recovery Association (ARA) recently released a policy statement associated with the revamped Safeguards Rule set to be implemented by the Federal Trade Commission in June. In connection with the mandate, ARA specifically believes recovery professionals should engage in ... [Read More]

Auto defaults finish 2022 with largest sequential rise in more than 5 years

Tuesday, Jan. 17, 2023, 03:59 PM

SubPrime Auto Finance News Staff

Auto defaults closed 2022 with the first double-digit rise in the default rate in more than five years. On Tuesday, S&P Dow Jones Indices and Experian released data through December for the S&P/Experian Consumer Credit Default Indices. The auto rate ... [Read More]

Westlake now servicing portfolios from Car Capital & Nicholas

Monday, Jan. 16, 2023, 03:50 PM

SubPrime Auto Finance News Staff

Westlake Portfolio Management grew its servicing department by reaching agreements with two companies that specialize in the subprime auto space. Last week, Westlake announced it formed a servicing partnership with Nicholas Financial, an auto and consumer finance company based in ... [Read More]

PassTime strengthens executive leadership with new EVP of sales

Monday, Jan. 16, 2023, 03:43 PM

SubPrime Auto Finance News Staff

PassTime reinforced its executive team last week. The provider of advanced asset tracking solutions announced it has hired Mike Roberts a new executive vice president of sales. PassTime highlighted Roberts joined the team from Kenwood USA and is an executive ... [Read More]

Legal roundup: GAP refunds in Colorado & retail fraud in Wisconsin

Friday, Jan. 13, 2023, 03:19 PM

SubPrime Auto Finance News Staff

Recent developments from both federal- and state-level law enforcement include matters associated with refunds connected to guaranteed automobile protection (GAP) as well as a dealership defrauding consumers. Connected to industry-wide compliance challenges highlighted multiple times by Allied Solutions, Colorado attorney ... [Read More]

X