TransUnion analysis reinforces affordability challenges, especially in below-prime

Charts courtesy of TransUnion.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

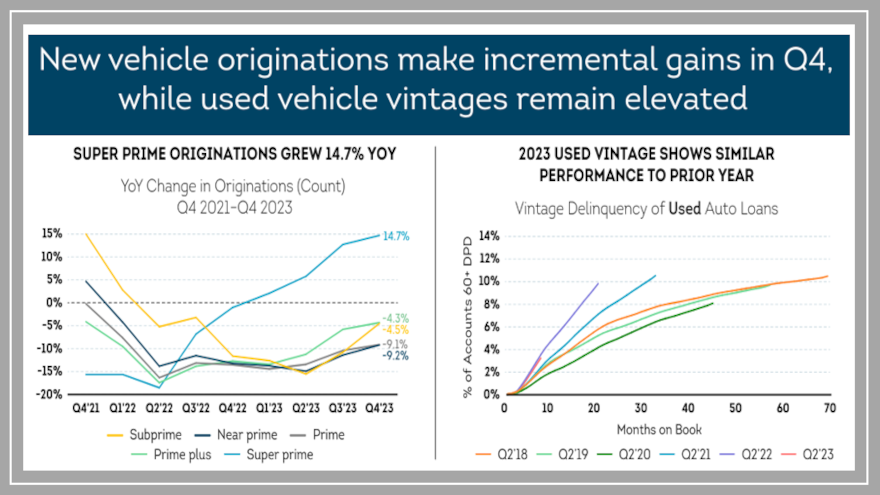

The auto-finance data TransUnion released on Thursday reinforced the positive developments connected with affordable used vehicles that Edmunds highlighted earlier in the week.

Having more used vehicles that can fit within parameters of tight family budgets might help to boost originations, which TransUnion said remain down as compared to 2019 across all risk tiers, with the largest declines seen among below-prime risk tiers.

“Affordability continues to pose a challenge for the used-vehicle market and, in particular, for below-prime consumers, who have seen a buying climate of higher interest rates, increasing lender pullback, and cross-wallet inflation,” said Satyan Merchant, senior vice president, automotive and mortgage business leader at TransUnion.

Ivan Drury of Edmunds highlighted that the average trade-in age for used vehicles increased to 9.4 years in Q1 2024, potentially creating the supply needed to meet the demand Merchant referenced.

According to the Q1 2024 Quarterly Credit Industry Insights Report (CIIR) from TransUnion, there were 5.8 million originations Q4 2023, which is in line with the total one year ago. (Originations are viewed one quarter in arrears to account for reporting lag.)

TransUnion reported the new-used split continues to trend back towards its pre-pandemic norm.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

As we inventories continue to build back following the pandemic, TransUnion said leasing for Q1 2024 represented 24% of new-vehicle registrations, still well below the 30% seen in Q1 2020, however up from 19% in Q1 2023.

“While some brands continue to see lingering shortages, new-vehicle inventories continue to recover from their pandemic-era lows. This has given the leasing market a boost, although leasing still remains well below its pre-pandemic numbers,” Merchant continued in a news release.

Analysts added the average amount financed, monthly payment, and term length have all remained relatively flat for both new and used vehicles year-over-year.

Also of note, TransUnion point out the 60-day delinquency rate ticked to 1.33% in Q1 2024.

“Higher delinquencies are likely to further constrain loan availability, potentially keeping the market tempered until interest rates begin to see declines,” Merchant said.

Q1 2024 Auto Loan Trends

| Auto Lending Metric | Q1 2024

|

Q1 2023

|

Q1 2022

|

Q1 2021

|

| Total Auto Loan Accounts

|

80.1 million

|

80.1 million

|

80.5 million

|

82.2 million

|

| Prior Quarter Originations1

|

5.8 million

|

5.8 million

|

6.5 million

|

6.6 million

|

| Average Monthly Payment NEW2

|

$744

|

$741

|

$657

|

$588

|

| Average Monthly Payment USED2

|

$525

|

$521

|

$509

|

$418

|

| Average Balance per Consumer

|

$24,035

|

$23,214

|

$21,606

|

$20,059

|

| Average Amount Financed on New Auto Loans2

|

$41,165

|

$41,547

|

$40,186

|

$36,207

|

| Average Amount Financed on Used Auto Loans2

|

$25,977

|

$26,260

|

$27,986

|

$22,295

|

| Consumer-Level Delinquency Rate (60+ DPD)

|

1.5%

|

1.3%

|

1.1%

|

1.0%

|

1Note: Originations are viewed one quarter in arrears to account for reporting lag.

2Data from S&P Global MobilityAutoCreditInsight, Q1 2024 data only for months of January & February.

Looking at personal loans

Since many shops offer both auto financing and personal loans, let’s delve into that part of the TransUnion data.

Analysts reported total unsecured personal loan balances grew 9% year-over-year in Q1. TransUnion determined balance growth was led by super prime, the only tier with double-digit growth.

According to the report, the average account balance increased by nearly 5% year-over-year to $8,737. TransUnion said average balance growth was led by subprime, followed by super prime.

Analysts added balance per consumer also grew by nearly 5% year-over-year to $11,829.

However, unsecured personal loan originations slid to 5 million for Q4 2023.

Analysts explained contraction in originations was seen across all risk tiers with the exception of super prime, where originations grew by 12.6% year-over-year.

TransUnion said borrower-level 60-day delinquencies fell year-over-year in Q1 2024 to 3.75%. However, only subprime declined while all other risk tiers saw increases year-over-year.

On a vintage basis, analysts noticed the delinquency rate for Q1 2023 originations through January 2024 is much lower than for originations for Q1 2022 originations over the same performance period but remains elevated over Q1 2021 originations.

“Total balance growth has slowed slightly after three years, with the year-over-year increase of 9% representing the first quarter since Q4 2021 that saw only a single digit increase in total balances,” TransUnion senior vice president of consumer lending Liz Pagel said in the news release.

“Unsecured personal loan originations were down slightly year-over-year as lenders are maintaining tight underwriting standards, focusing on lower risk borrowers,” Pagel continued. “These tighter underwriting standards in recent quarters likely played a role in the year-over-year decline in overall delinquencies.

“The originations decline was most pronounced in the subprime segment, which fell nearly 5% year-over-year,” she went on to say.

Overall look at credit market

Overall, TransUnion said the consumer credit market continues to show resiliency in the face of a challenging economic environment, as consumers continue to turn to credit to help manage the higher costs they are facing.

Despite interest rates that remain persistently high relative to recent history, analysts indicated certain key credit card metrics have seen steady growth in recent years, including total number of bankcards, average new bankcard account credit lines, and the total number of U.S. consumers who carry a bankcard balance.

Among other findings from report:

—As of Q1 2024, consumers hold more than 543 million bankcards in their wallets, a growth of 20 million year-over-year and more than 88 million from just three years ago.

—And more consumers are using their available credit line, as the number of consumers who carry a bankcard balance has seen steady growth as well, up 2.2% year-over-year.

—Average new account credit lines saw year-over-year growth, up 3.8% to $5,628, in part due to a greater proportion of originations among super prime, for whom new account credit lines tend to be higher.

While average new account credit lines saw year-over-year growth, Michele Raneri, vice president and head of U.S. research and consulting at TransUnion, said it is worth noting that total new account credit lines were down 2.6% due to a tightening origination environment.

“Consumers’ access to credit has grown significantly in recent years and will provide them with credit to tap into when needed,” Raneri said. “Many of these consumers are choosing to take advantage of these products that can help them manage their rising monthly household expenses, despite the fact that these products may bring with them interest rates that are higher relative to recent history.

For these consumers, the short-term pressure of inflation poses a more pressing problem to solve than the potential impact of higher interest rate credit, which includes higher monthly debt service payments,” she continued.

Delinquencies continue to rise across a number of credit products, with increases seen in credit cards, mortgages, and auto, according to TransUnion. However, analysts noticed that decrease in unsecured personal loans, largely driven by a shift to lower-risk borrowers, with a year-over-year decline in borrower-level delinquency 60 days or more past due.

While last quarter saw delinquencies increase, Raneri also said it is worth noting that we have seen a slowing in the rise in credit card delinquency along with a decline in unsecured personal loan delinquency.

“We have seen delinquencies tick up in recent quarters, which is certainly something lenders need to follow closely. At the same time, the consumer credit market remains resilient given the compounding of relatively high interest rates and persistent inflation,” Raneri said. “The prevailing hope is that as long as unemployment figures remain relatively low, serious delinquency rates may stabilize.”

To learn more about the latest consumer credit trends, register for TransUnion’s Q1 2024 Quarterly Credit Industry Insights Report free webinar via this website.