Edmunds: Availability of affordable used cars grows in Q1

Chart courtesy of Edmunds.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Edmunds director of insights Ivan Drury highlighted multiple tailwinds that could help the retailing of used cars.

What could be most beneficial for dealerships of all stripes is getting a boost of older, more affordable vehicles. Drury cited a variety of positive data points as reasons why via his analysis of the first quarter.

“The return of holdout buyers should help bolster the supply of more affordable, older used vehicles. In Q1 2024, new car transactions had a trade-in 49% of the time on average, while used had a trade-in 31% of the time on average,” Drury said in this report Edmunds posted on Tuesday.

“Within this pool of trade-ins, we’re also seeing that the consumers with older trade-in vehicles have a preference for buying a newer used vehicle instead of an outright new one. Right around the vehicle trade-in age of 9 years, we observed a perfect 50/50 split in customers either buying a new vehicle or buying a newer used vehicle. Vehicles older than 9 years were more likely to be traded in for a used vehicle,” he continued.

Drury acknowledged consumers have been in “hibernation” for several years as the combination of high vehicle prices and interest rates kept potential buyers out of showrooms. But with cooling prices and increased new-vehicle supply, Drury emphasized the scene is getting better for used-car departments.

“How do we know that consumers have made a return en masse? Look no further than an increase in average trade-in ages,” Drury said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“In 2022, new-car inventory constraints forced many would-be buyers with prospective older trade-in vehicles to sit out the market and even had some traditional new-car buyers resorting to used. But as 2024 resembles a more familiar market, trade-ins of older vehicles have begun to return,” he continued.

“In Q1 2024, the average trade-in age for new vehicles climbed to 6.1 years compared to 5.3 years in Q1 2022. The average trade-in age for used vehicles increased to 9.4 years in Q1 2024, compared to 7.9 years in Q1 2022,” Drury went on to say.

But not every single part of the used-car retailing scene is rosy.

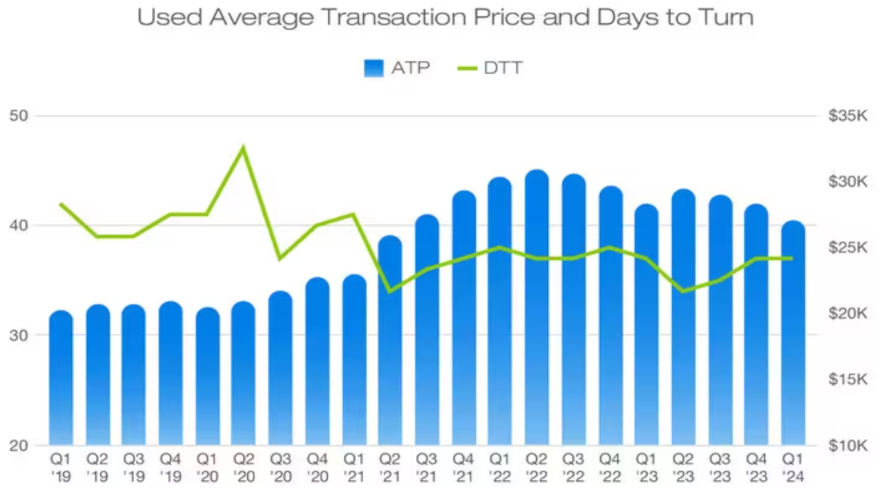

Edmunds’ data showed average transaction prices for used cars retailed in Q1 came in at $27,113. While that’s down 4.5% year-over-year, it’s a whopping 33.9% above the reading in Q1 of 2019 when Edmunds pegged it at $20,247.

Still, Drury pointed out that the average days to turn for used vehicles dropped to 37 days in Q1; the same as Q1 of last year.

What does it mean for used-car sales? Drury put it this way.

“Consumers making their way back into the market after a number of years away are likely experiencing some sticker shock when shopping for new vehicles and therefore more thoroughly evaluating their purchase options,” Drury said. “But the majority of new vehicles are far less likely to appeal to these buyers — they’ve waited for years to make a move and are likely a bit more price-sensitive than the consumers who were willing to pay above MSRP at the height of the shortages.

“Until new-car incentives make a real comeback, used vehicles will continue to offer what new vehicles cannot: affordable transportation,” he went on to say.