Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Westlake uses current customer base to test new cash program

Friday, Oct. 29, 2021, 02:38 PM

SubPrime Auto Finance News Staff

Westlake Financial Services is continuing to diversify its portfolio but leveraging a lending strategy that’s gained industry traction this year. Along with originating indirect auto financing, this week Westlake launched what it’s calling, Cash Now Pay Later. The company said ... [Read More]

Experian collaborates with Citadel API to expand verification solutions

Friday, Oct. 29, 2021, 02:36 PM

SubPrime Auto Finance News Staff

Experian is looking to help finance companies complete one of the most important parts of underwriting — verification of income and employment status. This week, Experian introduced new verification capabilities that can connect finance companies to more than 120 million ... [Read More]

PODCAST: StoneEagle F&I deciphers which financing trends might be sustainable at dealerships

Thursday, Oct. 28, 2021, 02:32 PM

SubPrime Auto Finance News Staff

StoneEagle F&I senior vice president of business development Joe St. John made his monthly appearance on the Auto Remarketing Podcast to discuss what’s happening in dealership finance offices. Senior editor Nick Zulovich asked about which elements helping F&I departments this ... [Read More]

Credit Bureau Connection receives investment from CapStreet Group

Friday, Oct. 22, 2021, 02:23 PM

SubPrime Auto Finance News Staff

Investment funds continue to flow into all parts of the automotive industry, with a second development arriving in recent days having a connection to auto financing and retailing. This week, the CapStreet Group — a 31-year-old firm that invests in ... [Read More]

NAC completes 10th acquisition in the past 18 months

Friday, Oct. 22, 2021, 02:21 PM

SubPrime Auto Finance News Staff

This week, National Auto Care (NAC) senior vice president of mergers and acquisitions Courtney Hoffman announced the company’s 10th acquisition in the past 18 months. Now part of the company’s F&I agency portfolio is a firm positioned to help NAC ... [Read More]

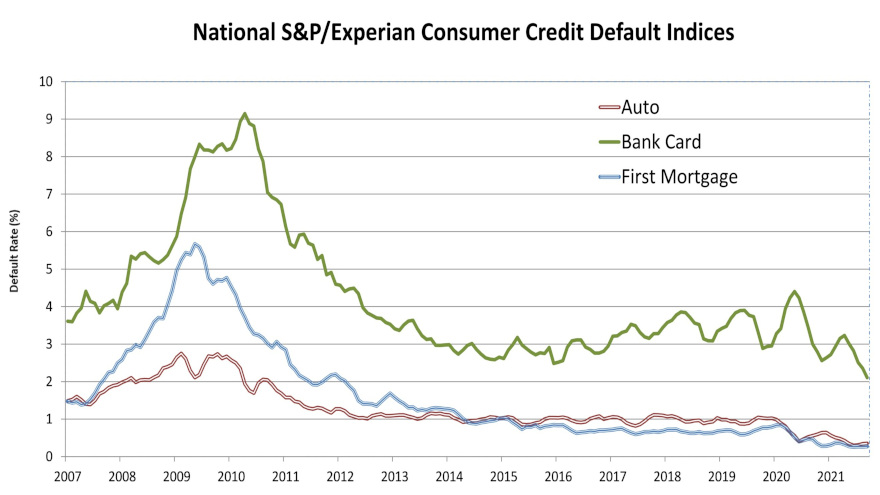

Auto default rate ticks up just 1 basis point in September

Thursday, Oct. 21, 2021, 02:49 PM

SubPrime Auto Finance News Staff

If the auto default rate ticks up only at the pace analysts have seen during the past couple of months, it could take a year — maybe longer — for the metric to return to what it was at the ... [Read More]

PODCAST: Series on digital collections continues with ways to leverage artificial intelligence

Wednesday, Oct. 20, 2021, 02:53 PM

SubPrime Auto Finance News Staff

The series of Auto Remarketing Podcasts featuring Dasceq founder and chief executive officer Abhishek Goel continues with a focus on how artificial intelligence (AI) can be the key ingredient in digital collections. Goel defines what AI is in connection with ... [Read More]

TransUnion: 18.7M consumers improved their credit scores while in hardship programs

Wednesday, Oct. 20, 2021, 02:42 PM

SubPrime Auto Finance News Staff

Perhaps here’s something that both consumers and finance companies can take as a positive from COVID-19. Despite financial challenges brought forth by the pandemic, a new study from TransUnion indicated that 18.7 million U.S. consumers that entered a financial hardship ... [Read More]

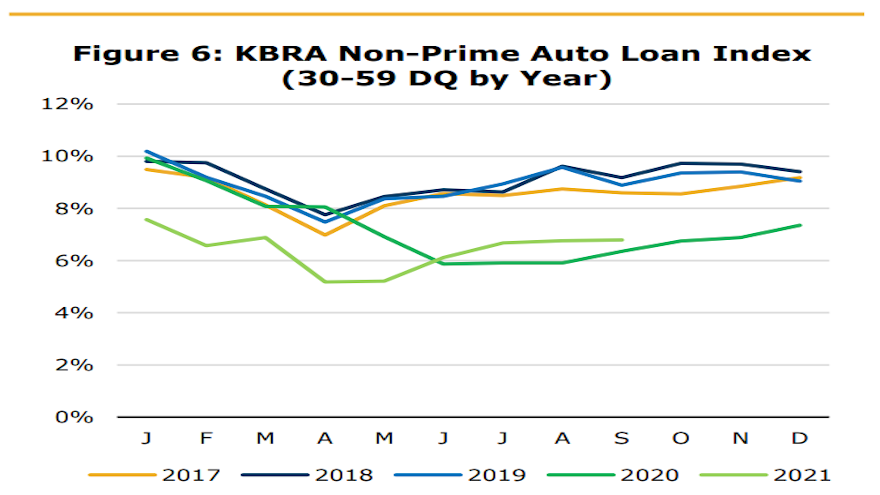

KBRA’s September indexes point toward upcoming seasonality

Tuesday, Oct. 19, 2021, 02:05 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) is seeing the likelihood strengthen that seasonal payment patterns are coming; that some of your contract holders might purchase holiday gifts rather than maintain their monthly vehicle payment. Analysts delved into the topic when they ... [Read More]

SameDay Auto Finance now using TruDecision solutions

Monday, Oct. 18, 2021, 03:03 PM

SubPrime Auto Finance News Staff

TruDecision landed another client that specializes in providing auto financing in the non-prime segment. The analytic platform-as-a-service provider announced last week that SameDay Auto Finance has integrated with the TruDecision Expert Auto Score in order increase service levels to dealers ... [Read More]

X