A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

Servicing Solutions adds new VP of sales

Wednesday, Jul. 28, 2021, 04:03 PM

SubPrime Auto Finance News Staff

Servicing Solutions recently bolstered its team with the addition of Jeremy Hettman as vice president of sales, bringing nearly 20 years of consultative sales experience to the company. In this key role, Servicing Solutions said that Hettman will lead business ... [Read More]

SAFCO lands $204.5M in new financing via 2 providers

Friday, Jul. 23, 2021, 02:03 PM

SubPrime Auto Finance News Staff

Southern Auto Finance Co. (SAFCO) now has more financial resources to operate in the subprime auto finance space. The company announced this week that it finalized new partnerships with Capital One and One William Street that are providing a new ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Former CFPB director joins firm focused on cryptocurrency & machine learning

Friday, Jul. 23, 2021, 02:02 PM

SubPrime Auto Finance News Staff

The former director of the Consumer Financial Protection Bureau now has a new position in the private sector. Kathy Kraninger — who also is scheduled to appear for a fireside chat during the Non-Prime Auto Financing Conference hosted by the ... [Read More]

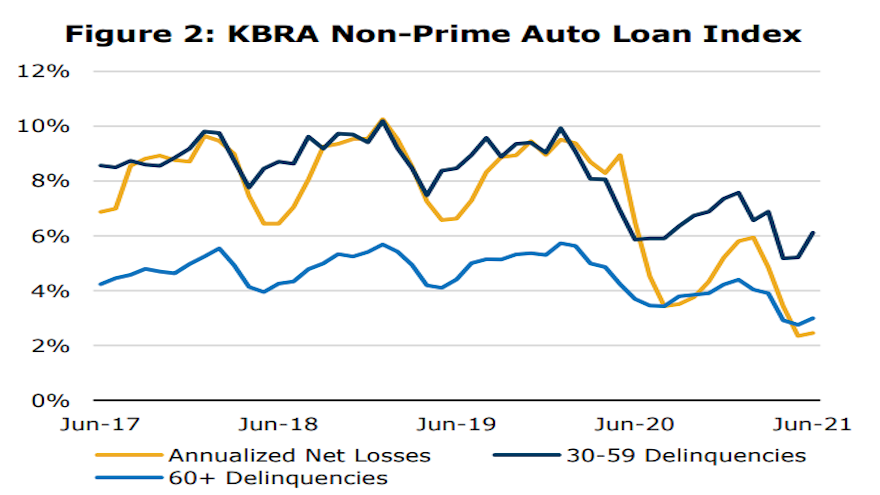

KBRA: Delinquency seasonality could be coming later this year

Thursday, Jul. 22, 2021, 03:20 PM

SubPrime Auto Finance News Staff

A day after S&P Dow Jones Indices and Experian reported that auto defaults sunk to a new all-time low in June, Kroll Bond Rating Agency (KBRA) released its latest indexes based on performance in the securitization market, illustrating how the ... [Read More]

ARA seeking nominations for 2021 NARS Industry Awards

Wednesday, Jul. 21, 2021, 02:39 PM

SubPrime Auto Finance News Staff

The American Recovery Association announced that nominations still are open for the 2021 NARS Industry Awards, which will honor exceptional members of the repossession industry during the North American Repossessors Summit set for October. Submissions can be made for five ... [Read More]

PODCAST: Experian’s Michele Bodda on employment & income trends

Wednesday, Jul. 21, 2021, 02:36 PM

SubPrime Auto Finance News Staff

Perhaps one of the most difficult challenges for finance companies to overcome through the pandemic was verifying an applicant’s employment and income. Michele Bodda, president of Experian Mortgage, Employer Services and Verification Solutions, appeared on this episode of the Auto ... [Read More]

UPDATED: Both auto & mortgage defaults now at all-time lows

Tuesday, Jul. 20, 2021, 02:49 PM

Nick Zulovich, Senior Editor

If finance companies based their decisions on how to run and staff their collections and recovery departments based only the metrics included in the S&P/Experian Consumer Credit Default Indices, they truly might be a one-man — or woman — band ... [Read More]

National Auto Care reinforces M&A team to add more to F&I portfolio

Monday, Jul. 19, 2021, 02:47 PM

SubPrime Auto Finance News Staff

National Auto Care (NAC) made four agency acquisitions last year, and the F&I provider wants to be in a position to finalize even more this year. With M&A growth in mind, NAC on Monday announced the addition of Walter Hoffman, ... [Read More]

Senate Banking Committee Republicans want answers from CFPB director nominee

Friday, Jul. 16, 2021, 03:20 PM

SubPrime Auto Finance News Staff

The Senate wrangling over the nominee to be the new director of the Consumer Financial Protection Bureau became even more intense this week. The dozen Republican members of the Senate Banking Committee sent a letter to Rohit Chopra stemming from ... [Read More]

American Recovery Service names Osborne as chief services officer

Friday, Jul. 16, 2021, 03:16 PM

SubPrime Auto Finance News Staff

American Recovery Service (ARS) recently expanded its executive team by promoting Cortney Osborne to be chief services officer. With nearly 20 years of industry experience and moderator of the Women in Auto Finance honoree panels during Used Car Week, ARS ... [Read More]

X