A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

PODCAST: Reviewing key court decision involving finance company, GAP coverage & MLA

Wednesday, Jun. 2, 2021, 03:48 PM

SubPrime Auto Finance News Staff

Getting auto financing over the finish line to vehicle delivery already can be complex. When the potential buyer falls within the confines of the Military Lending Act (MLA), it can become even more complicated. Marci Kawski, a partner in the ... [Read More]

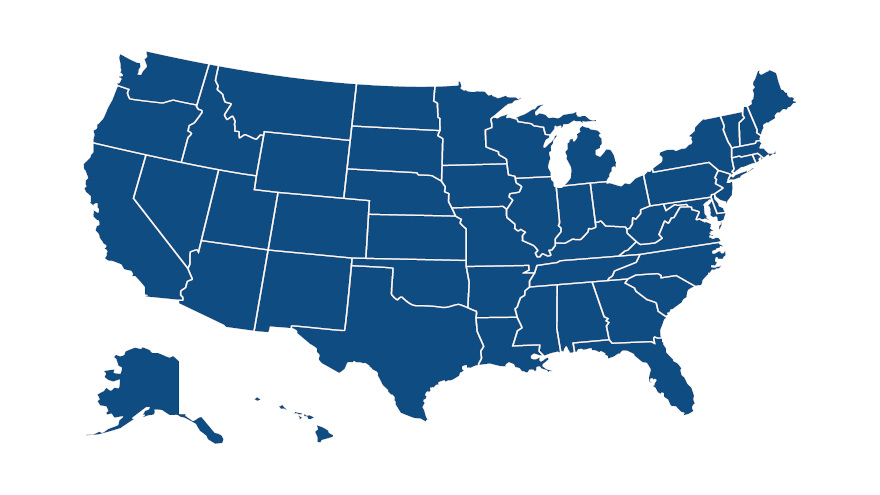

Looking at Q1 financing metrics by geography

Tuesday, Jun. 1, 2021, 02:00 PM

SubPrime Auto Finance News Staff

Along with highlighting how total outstanding balances are approaching $1.3 trillion, Experian’s Q1 2021 State of the Automotive Finance Market report also delved into some metrics based on geography. Experian pinpointed the average credit score of used-vehicle paper bought in ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

PODCAST: Why securitizations are accelerating again

Friday, May. 28, 2021, 02:52 PM

SubPrime Auto Finance News Staff

Originations aren’t the only part of auto financing accelerating nowadays. Stephen Bisbee, founder of eOriginal, which is now part of Wolters Kluwer, appeared on the Auto Remarketing Podcast to explain why securitizations are accelerating again as an attractive option for ... [Read More]

Looking for ‘telling points’ of potential changes as total outstanding balances approach $1.3 trillion

Thursday, May. 27, 2021, 03:09 PM

Nick Zulovich, Senior Editor

Escalating vehicle prices are impacting auto-finance data, too, as Experian’s Q1 2021 State of the Automotive Finance Market report showed outstanding balances jumped 10.3% year-over-year from $1.168 trillion to $1.288 trillion. So, SubPrime Auto Finance News posed this one to ... [Read More]

LAUNCHER.SOLUTIONS enhances communication tools for dealers, finance companies & consumers

Wednesday, May. 26, 2021, 03:32 PM

SubPrime Auto Finance News Staff

LAUNCHER.SOLUTIONS wants to provide a smooth communication path from application to underwriting and then on to funding and delivery. The technology provider specializing in originations recently announced the release of its new product offering, appTRAKER CONNECT for its clients using ... [Read More]

GWC Warranty names new senior vice president of sales

Wednesday, May. 26, 2021, 03:30 PM

SubPrime Auto Finance News Staff

This week, GWC Warranty welcomed an experienced executive to be its new senior vice president of sales. With a strong track record of managing top-performing territories, developing new channels of business, and building revenue-producing relationships, GWC said James Virgoe will ... [Read More]

PODCAST: Path toward reducing wrongful repossessions

Wednesday, May. 26, 2021, 03:22 PM

SubPrime Auto Finance News Staff

Wrongful repossessions might be the most heartburn-inducing, headache-creating part of auto finance. Offering an assessment of the current landscape of recoveries and more on this episode of the Auto Remarketing Podcast is Sabrina Neff, a partner in the Houston office ... [Read More]

Experts & policymakers see banking system on solid ground

Tuesday, May. 25, 2021, 02:00 PM

SubPrime Auto Finance News Staff

In what’s likely a positive sign for auto-finance companies of all sizes, both the Federal Reserve and S&P Global Ratings offered positive assessments of the current banking system for both national institutions as well as regional firms. According to the ... [Read More]

Context for another CFPB consent order involving loss damage waivers

Monday, May. 24, 2021, 01:14 AM

Nick Zulovich, Senior Editor

Venable partner Allen Denson offered some context that might help finance companies understand why the Consumer Financial Protection Bureau (CFPB) reached its second consent order in less than a year through an action involving what the regulator deemed to be ... [Read More]

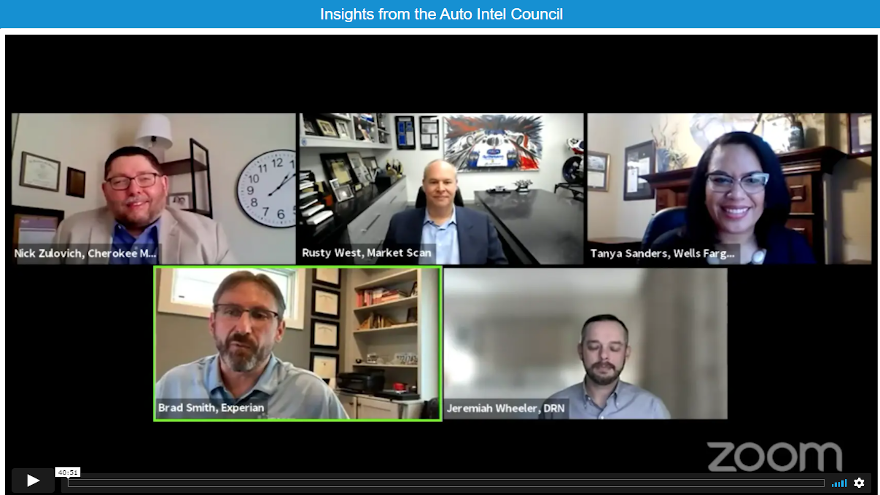

From the editor: Recapping poignant moment of AIS 2021

Friday, May. 21, 2021, 03:24 PM

Nick Zulovich, Senior Editor

One of the poignant moments during this week’s Auto Intel Summit happened on Tuesday during a panel discussion featuring representatives from the Auto Intel Council, a private, membership-based organization that includes leading intelligence companies in the automotive space. Executives from ... [Read More]

X