Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

CFPB rescinds abusiveness policy statement

Monday, Mar. 15, 2021, 02:59 PM

SubPrime Auto Finance News Staff

Experts projected that the Consumer Financial Protection Bureau (CFPB) would become more active with President Biden now in the White House. Randy Henrick put it this way in a previous commentary: “It is reasonable to expect changes in the automobile ... [Read More]

Declining extensions among 3 positive trends for portfolio health

Thursday, Mar. 11, 2021, 08:08 PM

Nick Zulovich, Senior Editor

Contract extensions for auto financing are trending down. Consumer expectations for their household financial situations are improving. President Biden just signed the newest federal stimulus package. As individuals and industries acknowledged the first anniversary of COVID-19, analysts and experts are ... [Read More]

Despite tie vote, CFPB director nominee advances in Senate

Thursday, Mar. 11, 2021, 04:02 PM

SubPrime Auto Finance News Staff

Vehicle traffic might be flowing faster on the Capital Beltway because multitudes of federal employees continuing to work from home. However, the process to confirm President Biden’s nomination to be the director of the Consumer Financial Protection Bureau showed that gridlock ... [Read More]

RISC offers free state-by-state guide for handling personal property

Wednesday, Mar. 10, 2021, 07:48 PM

SubPrime Auto Finance News Staff

Handling personal property left in a repossessed vehicle is one of the most difficult industry challenges. It’s one that can result in significant consequences if not completed properly, as highlighted by a consent order made public in October involving the ... [Read More]

CFPB clarifies rule prohibiting discrimination based on sexual orientation & gender identity

Wednesday, Mar. 10, 2021, 05:08 PM

SubPrime Auto Finance News Staff

The Consumer Financial Protection Bureau (CFPB) made a forceful declaration on Tuesday, stating the “industry is on notice” and that the bureau “will not tolerate illegal discrimination against the LGBTQ+ community.” The regulator issued an interpretive rule clarifying that the ... [Read More]

CarGurus study: Consumer perceptions about pre-qualification still uncertain

Tuesday, Mar. 9, 2021, 03:48 PM

SubPrime Auto Finance News Staff

The CarGurus consumer sentiment study focused on auto finance found a significant portion of participants said that receiving pre-qualification for financing before visiting the dealership would be useful. In fact, the study results released on Tuesday showed that 93% of vehicle ... [Read More]

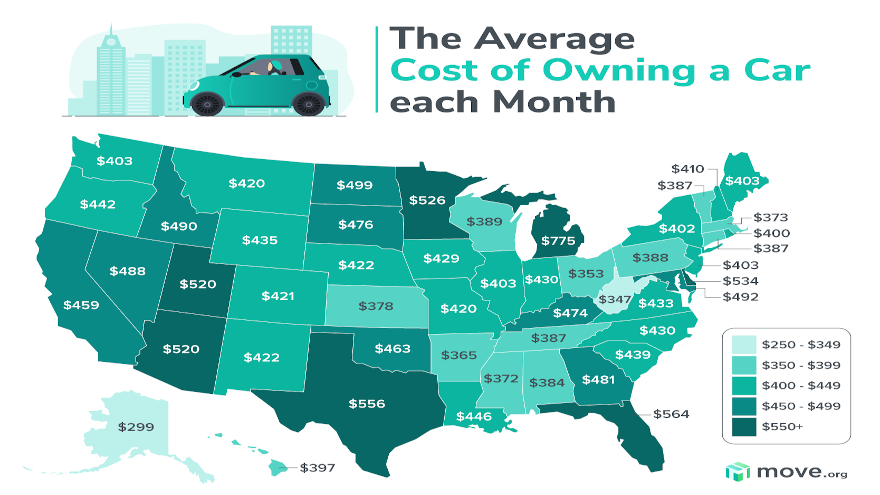

States with highest & lowest cost of vehicle ownership

Monday, Mar. 8, 2021, 03:15 PM

SubPrime Auto Finance News Staff

Dealerships and finance companies often try to educate their customers to understand that the cost of having a vehicle is more than just the monthly payment stipulated on the installment contract. Analysts at Move.org — a website dedicated to helping ... [Read More]

Why February jobs report could make your portfolio more appetizing

Friday, Mar. 5, 2021, 02:42 PM

SubPrime Auto Finance News Staff

Finance company executives and managers having a sit-down meal at a restaurant now might be even more enjoyable than for just the delicious dish and social comradery. Their outstanding portfolio might be much more appetizing, too, because of the rebound ... [Read More]

Experian: Deep subprime quarterly originations drop below 2%

Thursday, Mar. 4, 2021, 04:02 PM

SubPrime Auto Finance News Staff

The auto-finance industry’s appetite for the highest-risk paper declined to close 2020. According to Experian’s Q4 2020 State of the Automotive Finance Market report, analysts discovered deep subprime originations of all contracts booked in a quarter dipped below 2% for ... [Read More]

COMMENTARY: Near-term, special-finance outlook after frigid start to 2021

Tuesday, Mar. 2, 2021, 03:37 PM

David Meyer, Advantage GPS

America recently was under the Great Freeze of 2021, which lasted more than two weeks. Millions were without power. Businesses and schools were shuttered. Power grids strained under a brutal arctic assault. This will without a doubt negatively affect business ... [Read More]

X