A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

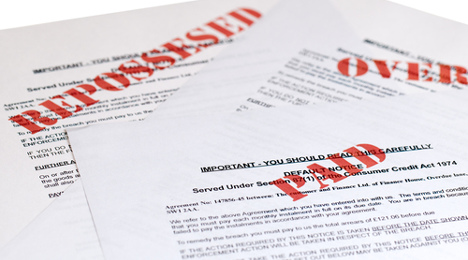

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

S&P/Experian: Rising Sales Pushes Default Uptick Drift

Wednesday, Nov. 19, 2014, 03:19 PM

SubPrime Auto Finance News Staff

The upward drift surfacing in the auto loan segment of the S&P/Experian Consumer Credit Default Indices is now six months old, but analysts are attributing the movement to the amount of metal moving out of showrooms and paper filling finance ... [Read More]

New AFSA Study Refutes CFPB Allegations

Wednesday, Nov. 19, 2014, 02:20 PM

SubPrime Auto Finance News Staff

Through findings applauded by the National Automobile Dealers Association, the American Financial Services Association offered its latest rebuttal this morning to contentions by the Consumer Financial Protection Bureau about problems with the indirect auto financing process. A comprehensive study commissioned ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

NextGear Capital Closes $433M Securitization

Monday, Nov. 17, 2014, 04:34 PM

SubPrime Auto Finance News Staff

NextGear Capital recently announced that NextGear Floorplan Master Owner Trust successfully completed the sale of $433.333 million of privately placed 144A Asset-Backed Notes, Series 2014-1. Rated by Moody's and DBRS, the securitization transaction included the issuance of $400 million of ... [Read More]

Westlake Adding Dallas Facility, Former Toyota Exec

Monday, Nov. 17, 2014, 04:32 PM

SubPrime Auto Finance News Staff

Along with expanding its senior executive team, Westlake Financial Services recently highlighted plans to open a new production center in Dallas in January. Westlake indicated the new production center will serve as a facility to provide improved servicing for current ... [Read More]

94 Graduates Complete Consumer Credit Compliance Program

Monday, Nov. 17, 2014, 04:24 PM

SubPrime Auto Finance News Staff

At the same venue as Used Car Week, the National Automotive Finance Association awarded its Certified Consumer Credit Compliance Professional designation to its first graduating class following the completion of more than 24 hours of classroom training and 29 Web-based ... [Read More]

New VP Named at defi SOLUTIONS

Friday, Nov. 14, 2014, 04:12 PM

SubPrime Auto Finance News Staff

Loan origination software company defi SOLUTIONS announced this week the appointment of a new vice president of sales. Brice Beard brings over 15 years of auto finance experience with him to take on the responsibilities of the new position, one ... [Read More]

Chernek: Cracking the Code in Subprime Financing

Friday, Nov. 14, 2014, 03:00 PM

Rebecca Chernek, Chernek Consulting

How far over the line will you go to sell cars and make a profit before you break the compliance threshold? That’s almost like asking how far over the speed limit you’re willing to go before you consider the consequences ... [Read More]

Dealertrack Reaches Milestone For Credit Application Network

Thursday, Nov. 13, 2014, 09:08 PM

SubPrime Auto Finance News Staff

News has been flowing out of Dealertrack Technologies this week, as the company announced it has hit a milestone for its Credit Application Network on top of also securing a new partnership with Kia Motors America to use its Intelligent ... [Read More]

SubPrime Webinar Series Returns Next Wednesday

Wednesday, Nov. 12, 2014, 04:20 PM

SubPrime Auto Finance News Staff

Interested in honing your ability to securely locate, recover and communicate with your portfolio of leased and financed vehicles? In real time? Tune in to the latest SubPrime Auto Finance News webinar, on Wed., Nov. 19 at 2 p.m., where ... [Read More]

Survey Shows Auto Loans as Top Growth Opportunity For Credit Unions

Wednesday, Nov. 12, 2014, 02:30 PM

Sarah Rubenoff, Staff Writer

With the new- and used-car market booming, it seems subprime buyers are getting a piece of the pie — and many of these consumers are using credit unions to fund these vehicle purchases. TransUnion released the results of an October ... [Read More]

X