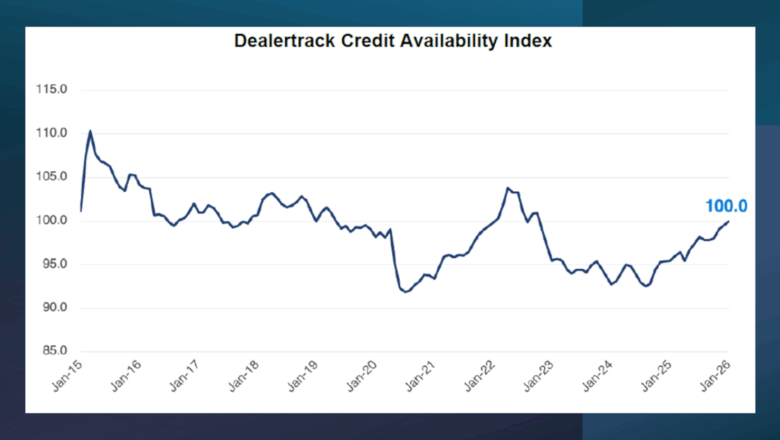

Credit availability steady in January as negative equity climbs and terms stretch

Thursday, Feb. 12, 2026, 10:55 AM

Voting closes on President’s Day for 10 industry awards to be given at NARS 2026

Wednesday, Feb. 11, 2026, 01:00 PM

Labor scene still murky, creating potential headwind for automotive

Wednesday, Feb. 11, 2026, 10:38 AM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Cox Automotive on the vanishing divide between wholesale & retail

Used Car Week 2025 extended the ongoing conversation about how the wholesale and retail portions of the used-car market aren’t quite as distinct as they used to be. Cherokee Media Group’s Bill Zadeits hosted a fireside chat about the subject ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

2025 Women in Remarketing honorees describe their careers, industry changes & more

One of the foundational parts of Used Car Week each year is the lively conversation among the Women in Remarketing honorees. Moderated again by Brenda Rios of award program sponsor, Ally, hear the valuable perspectives and wisdom from some of ... Listen Here

Friday, Feb. 13, 2026, 09:43 AM

Fitch: Easier Underwriting Hitting Auto Asset Quality Metrics

Wednesday, Mar. 5, 2014, 04:22 PM

SubPrime Auto Finance News Staff

Fitch Ratings recently reported that normalizing underwriting terms for U.S. auto loans and leases contributed to a modest deterioration in asset quality metrics during the fourth quarter. Still, firm analysts believe finance companies remain focused on emerging risks tied to ... [Read More]

Questions Arise about Industry’s New Normal

Wednesday, Mar. 5, 2014, 04:17 PM

Nick Zulovich, Editor

From captive finance companies to one-lot buy-here, pay-here dealers, the entire industry is seeing a shift to a ‘new normal,’ which includes smaller down payments, longer terms and negative equity being rolled into a larger financed amount. While metal is ... [Read More]

Subprime Buyers Finding More Financing for New Models

Tuesday, Mar. 4, 2014, 03:54 PM

SubPrime Auto Finance News Staff

Finance companies still aren’t shying away from giving contracts to subprime consumers based on the fourth-quarter information from Experian Automotive. According to its latest State of the Automotive Finance Market report, Experian highlighted today that financing became easier to obtain ... [Read More]

Frazer Integrates with Preferred Warranties’ eContract

Monday, Mar. 3, 2014, 04:58 PM

SubPrime Auto Finance News Staff

Officials highlighted that independent dealers using Frazer management software and offering Preferred Warranties extended service contracts for pre-owned vehicles can now import data from their DMS directly into Preferred’s eContract portal. Preferred’s proprietary eContract program can allow dealers to instantly ... [Read More]

Moody’s Analytics, Equifax Team for Free Webinar

Monday, Mar. 3, 2014, 04:56 PM

SubPrime Auto Finance News Staff

Moody’s Analytics and Equifax are uniting to host a free webinar aimed at answering a pair of questions. Loan originations in automotive are leading the credit rebound, but which lenders are at the forefront and which consumers are they targeting? ... [Read More]

Dealertrack Completes Acquisition of Dealer.com

Monday, Mar. 3, 2014, 04:54 PM

SubPrime Auto Finance News Staff

Dealertrack Technologies today announced the completion of its acquisition of Dealer.com, a provider of comprehensive digital marketing solutions and services for the automotive retail industry. Rick Gibbs, former chief executive officer of Dealer.com and one of its co-founders, will lead ... [Read More]

Latest House Bill Aims at Curbing CFPB’s Authority

Monday, Mar. 3, 2014, 04:52 PM

Nick Zulovich, Editor

During the same week the Consumer Financial Protection Bureau “strongly urged” companies to make credit scores more readily available, a bill passed through the U.S. House aimed at limiting the authority of the bureau, which the measure’s author called, “a ... [Read More]

CFPB Wants Credit Scores More Readily Available

Friday, Feb. 28, 2014, 09:17 PM

Nick Zulovich, Editor

If the Consumer Financial Protection Bureau gets it way, potential buyers who have a credit card account will already know their credit score before they walk on the lot or enter the F&I office looking to complete vehicle financing. On ... [Read More]

TransUnion: Subprime Delinquencies Rise in Q4, but Overall Levels Expected to Dip

Friday, Feb. 28, 2014, 09:15 PM

SubPrime Auto Finance News Staff

As delinquencies associated with subprime loans continue to rise but not at a pace that concerns TransUnion, analysts determined that overall auto loan debt per borrower increased for the 11th straight quarter. During the closing quarter of 2013, that overall ... [Read More]

Equifax: Resurgence of Subprime Finance Continues; Some November Auto Loan Averages Best in 7 Years

Friday, Feb. 28, 2014, 09:14 PM

Nick Zulovich, Editor

Along with the continued resurgence of subprime financing, Equifax highlighted that the amount of auto loans booked by both commercial banks and finance companies in November — the most recent data the company has available — came in higher than ... [Read More]

X