A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

6 top executive moves at APCO Holdings

Tuesday, Feb. 24, 2026, 10:08 AM

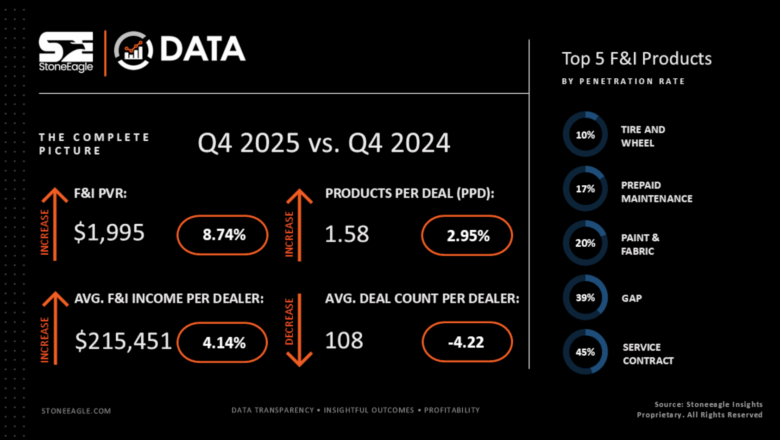

StoneEagle: PVR record in November among Q4 performances generated by dealer F&I departments

Wednesday, Feb. 25, 2026, 09:53 AM

CarMax & DOJ settle allegations of repossessing vehicles of active servicemembers

Wednesday, Feb. 25, 2026, 12:52 PM

More insight into fraud at dealerships with Experian’s Jim Maguire

Experian senior director for automotive Jim Maguire made another appearance on the Auto Remarketing Podcast to recap findings from the company’s latest dealer survey that examined the impact of fraud at dealerships. Maguire then touched on the balance dealers and ... Listen Here

Thursday, Feb. 26, 2026, 03:55 PM

Cox Automotive on guiding the modern car buyer

One of the keynote presentations from Used Car Week 2025 featured Micah Tindor and Elizabeth Stegall of Cox Automotive for a session titled, “Guiding the Modern Buyer with Trust, Tech & Smarter Trade-Ins.” Valuable study findings and dealership recommendations now ... Listen Here

Tuesday, Feb. 17, 2026, 05:17 PM

Kevin Roberts of CarGurus on 2026 Used-Car Market

Kevin Roberts, who is director of economic and market intelligence at CarGurus, is back on the show to talk about the hot start to 2026 for the retail used-car market. Roberts and Cherokee Media Group senior editor Joe Overby discuss ... Listen Here

Monday, Feb. 16, 2026, 07:18 PM

Independent Dealers Characterize Market Environment

Tuesday, Apr. 8, 2008, 12:00 AM

Nick Zulovich

CHICAGO and FORT MYERS, Fla. — How is the current economic climate impacting independent dealers? To answer this question, SubPrime Auto Finance News recently talked to a few independent dealers who work in the subprime arena, asking about the challenges they ... [Read More]

Bankruptcy Filings Mount; Federal Reserve Admits to Possible Recession

Thursday, Apr. 3, 2008, 12:00 AM

Nick Zulovich

ALEXANDRIA, Va. — Despite the tough means test, the American Bankruptcy Institute reported that due to economic issues, particularly those in the mortgage sector, consumer bankruptcy filings jumped 27 percent nationwide during the first quarter, compared to the same period ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

LeaseTrader.com Compares Risks Associated with 84-Month Auto Loans to Mortgage Industry

Thursday, Apr. 3, 2008, 12:00 AM

Nick Zulovich

MIAMI — With some manufacturers and dealers now offering 84-month financing on auto loans, this could lead to more consumers ending up in negative equity, according LeaseTrader.com. Consumers who accept these terms are at particular risk with the current consumer credit ... [Read More]

NADC Board Challenges Opposition to Dealer Arbitration Clauses

Thursday, Apr. 3, 2008, 12:00 AM

Nick Zulovich

HANOVER, Md. — The National Association of Dealer Counsel Board of Directors reported that it has submitted written comments to the House Judiciary Committee to express opposition to the Automobile Arbitration Fairness Act of 2008 (H.R. 5312). The March 17 letter ... [Read More]

Compli Partners with Law Firm to Enhance Dealer Compliance Offerings

Thursday, Apr. 3, 2008, 12:00 AM

Nick Zulovich

PORTLAND, Ore. — Compli announced that it has teamed up with Sacks Tierney P.A. to provide top-tier legal information, compliance consulting and technology to Arizona dealers. The services will be offered via Compli's Dealership Compliance Management System. Sacks Tierney, based in ... [Read More]

Experian Automotive Introduces Auto Credit Report

Tuesday, Apr. 1, 2008, 12:00 AM

Nick Zulovich

SCHAUMBURG, Ill. — Experian Automotive announced Monday that it has launched an automotive-specific credit profile report. Designed expressly for dealers and lenders, officials said Experian's Automotive Credit ProfileSM can help those financing auto loans more quickly and accurately make the best ... [Read More]

PIN: Longer Loans Continue to Gain Popularity

Tuesday, Apr. 1, 2008, 12:00 AM

Nick Zulovich

WESTLAKE VILLAGE, Calif. — In its latest market analysis, Power Information Network reported that the retail auto business is continuing to embrace longer loans. "Six-year loans (taken out at the dealership) now account for four of every 10 new-vehicle loans, almost ... [Read More]

Wolters Kluwer Now Offering Lease Agreements in e-Format

Tuesday, Apr. 1, 2008, 12:00 AM

Nick Zulovich

MINNEAPOLIS — To meet the growing demand for paperless finance transactions within the auto finance industry, Wolters Kluwer Financial Services announced Monday that it is offering dealers, work flow aggregators and lenders new standardized and customizable motor vehicle lease agreements in an ... [Read More]

CarBiz Receives Texas License

Tuesday, Apr. 1, 2008, 12:00 AM

Nick Zulovich

SARASOTA, Fla. — CarBiz recently announced that it has received a dealer license for the state of Texas. According to the company, this marks the final dealer license for CarBiz to obtain following its major acquisitions of 26 dealerships in the ... [Read More]

CFOs Reveal How Economic Concerns Are Impacting Their Businesses

Thursday, Mar. 27, 2008, 12:00 AM

Nick Zulovich

FLORHAM PARK, N.J., and NEW YORK — As many in the industry are aware, a big part of consumers' buyer power is tied up with their salaries and the health of the companies they work for. To take a glimpse into just ... [Read More]

X