A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

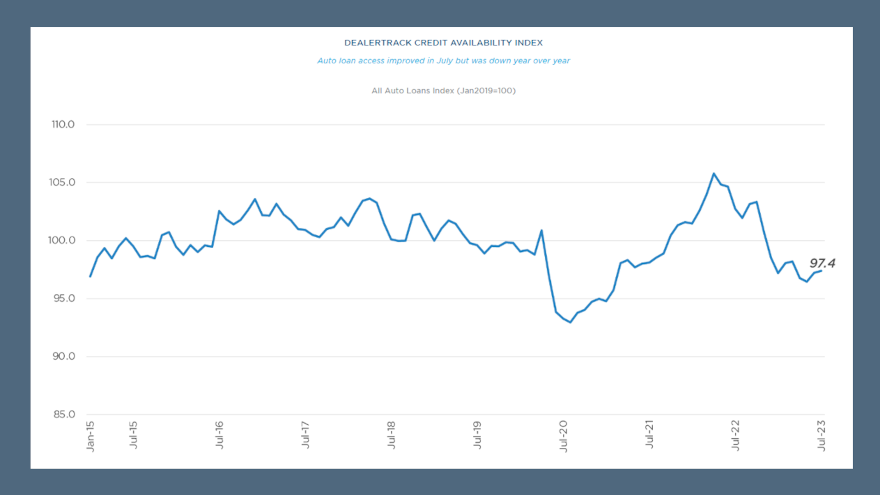

Auto credit availability improves to best level since March

Monday, Aug. 14, 2023, 12:07 PM

SubPrime Auto Finance News Staff

Cox Automotive noticed that July was the best conditions to get your paper bought since March, but the subprime share still softened. The July reading of Dealertrack Credit Availability Index came in at 97.4, marking the second straight month of ... [Read More]

Formula Automotive rolls out warranty reimbursement services

Monday, Aug. 14, 2023, 12:03 PM

SubPrime Auto Finance News Staff

Formula Automotive Consulting and Technologies, a new company specializing in warranty reimbursement for automotive dealers, announced the official launch of its consultative services. Spearheaded by fixed operations experts, Formula Automotive looks to solve the pain point of warranty rate disparity ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

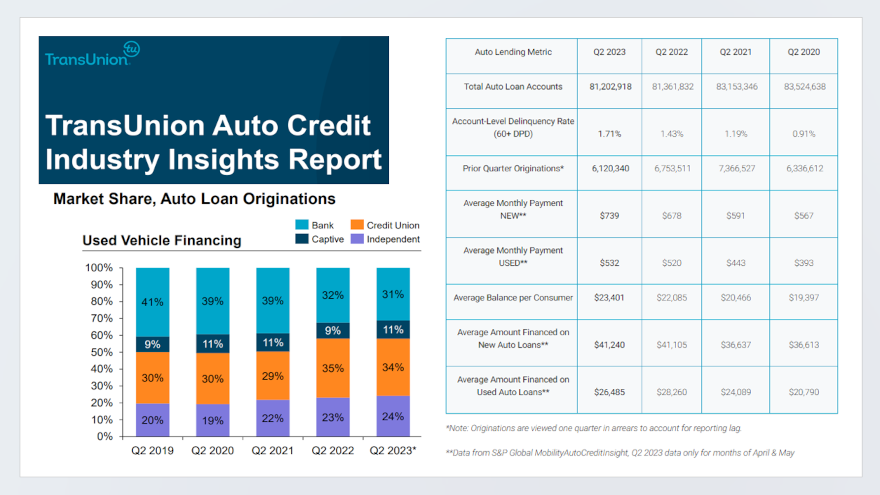

TransUnion spots 2 possible upbeat trends from Q2

Friday, Aug. 11, 2023, 10:47 AM

SubPrime Auto Finance News Staff

Perhaps two trends from the auto segment of the Q2 2023 Quarterly Credit Industry Insights Report (CIIR) from TransUnion might calm finance companies on the risk front. TransUnion reported the average amounts financed for new vehicles have stabilized year-over-year, while ... [Read More]

ARA hires Tony Long as new executive director

Thursday, Aug. 10, 2023, 10:10 AM

SubPrime Auto Finance News Staff

The American Recovery Association previously stated that the organization’s next executive director would have to possess eight distinct characteristics, including industry experience, public speaking ability and more. The ARA found its next professional leader, announcing well-known industry figure Tony Long ... [Read More]

Davis+Gilbert achieves Mansfield Certification Plus

Wednesday, Aug. 9, 2023, 12:08 PM

SubPrime Auto Finance News Staff

Davis+Gilbert announced that the law firm has achieved Mansfield Certification Plus status as part of its ongoing commitment to diversity, equity and inclusion (DEI). The firm highlighted its Certification Plus status indicates that, in addition to meeting the consideration and ... [Read More]

KBB: July marks smallest uptick in new-model retail prices in 10 years

Wednesday, Aug. 9, 2023, 12:05 PM

SubPrime Auto Finance News Staff

New vehicles might still be out of reach for many customers who land in the subprime credit tier. But the latest data from Kelley Blue Book showed that perhaps the prospects for putting a subprime consumer into a new model ... [Read More]

3 executive moves at EFG Companies

Tuesday, Aug. 8, 2023, 11:58 AM

SubPrime Auto Finance News Staff

After recently highlighting an employee survey about its positive workplace, EFG Companies expanded its leadership team on Tuesday, reflecting growth opportunities in powersports, dealership training, and profit participation programs. Among the three executive moves, EFG said Adam Ouart has been ... [Read More]

APCO Holdings recaps finalizations of 4 acquisitions

Monday, Aug. 7, 2023, 11:33 AM

SubPrime Auto Finance News Staff

It’s been a busy year on the acquisition front for APCO Holdings. On Monday, the provider and administrator of automotive F&I products and home to the EasyCare, National Auto Care, GWC Warranty and MemberCare brands recapped that it has completed ... [Read More]

TransUnion cautious about potential ‘payment shock’ when student loan payments restart

Monday, Aug. 7, 2023, 11:13 AM

SubPrime Auto Finance News Staff

A portion of the contract holders in your outstanding auto finance portfolio might be facing an additional major payment obligation next month when forbearance for federal student loans expires. And TransUnion reported 36% of consumers already holding student loan debt ... [Read More]

F&I Sentinel hires Hendriks as director of product strategy

Friday, Aug. 4, 2023, 10:21 AM

SubPrime Auto Finance News Staff

The newest hire by F&I Sentinel brings with him more than 30 years of professional experience in numerous roles at organizations including Flagship Credit, Wells Fargo, Fiserv, Sagent Lending and defi SOLUTIONS. This week, the compliance and regulatory risk mitigation ... [Read More]

X