A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

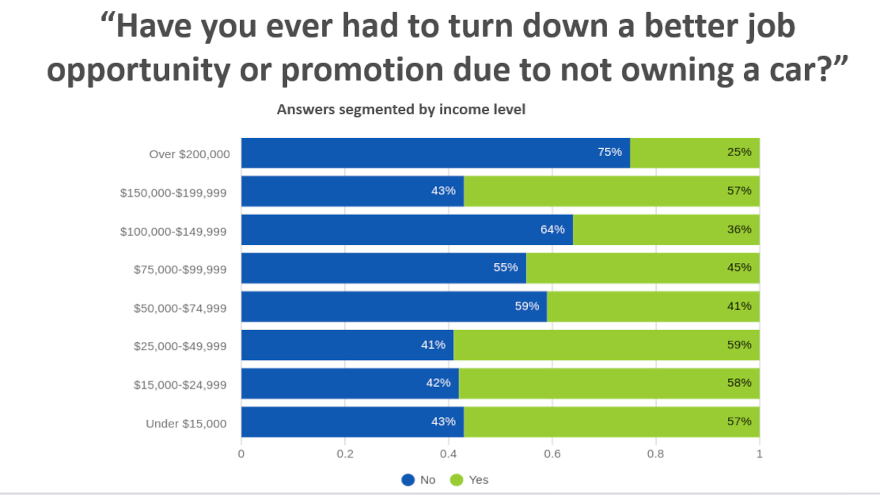

5 findings from Open Lending’s vehicle accessibility survey

Thursday, Jan. 12, 2023, 03:55 PM

SubPrime Auto Finance News Staff

Open Lending Corp. recently offered a in-depth reminder for when a finance company decides to buy that installment contract, especially for an applicant in need of reliable transportation. The provider of analytics, risk-based pricing, risk modeling and default insurance to auto ... [Read More]

Allied Solutions opens year with acquisition, promotion & integration

Wednesday, Jan. 11, 2023, 04:26 PM

SubPrime Auto Finance News Staff

Allied Solutions began 2023 with a trio of significant moves, including an acquisition, a key executive promotion as well as an integration with another service provider in the collections space. The newest announcement arrived on Tuesday when Allied Solutions said ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

Launcher integrates with Truework to provide income & employment verifications

Wednesday, Jan. 11, 2023, 04:23 PM

SubPrime Auto Finance News Staff

Launcher recently finalized another partnership to help finance companies shore up their underwriting. The technology provider specializing in originations announced an integration of Launcher’s appTRAKER Loan Origination System (LOS) with Truework, which provides immediate access to income and employment data ... [Read More]

Auto defaults remain stable, as credit availability tightens

Wednesday, Jan. 11, 2023, 04:20 PM

SubPrime Auto Finance News Staff

Following a month when the auto default rate remained steady, credit availability for new paper tightened. Those findings are among the latest observations from Cox Automotive, S&P Dow Jones Indices and Experian. Based on data through November for the S&P/Experian ... [Read More]

5 EFG executives offer 5 F&I predictions for 2023

Tuesday, Jan. 10, 2023, 03:36 PM

SubPrime Auto Finance News Staff

Like when two friends share a serious conversation over their beverage of choice, EFG Companies is trying to be straight with dealers about their F&I prospects this year. EFG said through its annual forecast released on Tuesday that it sees ... [Read More]

CPS finalizes 3 tech partnerships with more AI tools to be launched this year

Monday, Jan. 9, 2023, 03:52 PM

SubPrime Auto Finance News Staff

Consumer Portfolio Services (CPS) recently continued its robust roll out of artificial intelligence and machine learning solutions to provide greater payment flexibility and more efficient processing of retail installment contracts. The company — which provides indirect auto financing to individuals ... [Read More]

CPS finalizes 3 tech partnerships with more AI tools to be launched this year

Monday, Jan. 9, 2023, 03:52 PM

Nick Zulovich

Consumer Portfolio Services (CPS) recently continued its robust roll out of artificial intelligence and machine learning solutions to provide greater payment flexibility and more efficient processing of retail installment contracts. The company — which provides indirect auto financing to individuals ... [Read More]

AutoPayPlus names agent advisory council for 2022-23

Friday, Jan. 6, 2023, 02:28 PM

SubPrime Auto Finance News Staff

AutoPayPlus selected five experienced automotive agents to serve on its 2022-23 agent advisory council. The group recently convened to discuss the market challenges dealerships will face in the coming year and learn more about how AutoPayPlus can support agents in ... [Read More]

Jackson to become CEO of Santander Consumer USA

Friday, Jan. 6, 2023, 02:26 PM

SubPrime Auto Finance News Staff

Before the first quarter of this year closes, Santander Consumer USA will have a new top executive. Santander Holdings USA recently announced that Bruce Jackson will assume the role of head of the Santander US Auto business and CEO of ... [Read More]

Credit Acceptance responds to suit by CFPB & NY AG

Thursday, Jan. 5, 2023, 03:33 PM

Nick Zulovich, Senior Editor

Credit Acceptance responded to a robust lawsuit brought by the Consumer Financial Protection Bureau and the New York attorney general on Wednesday triggered by an investigation that began in May 2019. New York attorney general Letitia James and the CFPB said ... [Read More]

X