A Buyer’s Guide for Independent Dealer, BHPH, and Auto Finance Leaders Reducing Risk, Unlocking Opportunity Independent dealers and finance companies...

Read More

Warren demands details about repossessions from 12 auto lenders, BHPH operations, industry associations

Friday, Feb. 6, 2026, 10:30 AM

Eubanks becomes executive vice president of client strategy at Resolvion

Friday, Feb. 6, 2026, 10:29 AM

MBSi and VINchex roll out automated lien verification solution to address wrongful repossessions

Wednesday, Feb. 4, 2026, 02:31 PM

How agentic AI is impacting collections

Agentic AI is among the slew of topics being bandied about this week at NADA Show 2026 in Las Vegas. The subject also was discussed during Used Car Week 2025 in the same city. Used Car Week Hall of Famer ... Listen Here

Thursday, Feb. 5, 2026, 02:21 PM

The real cost of inaction when it comes to transport fraud

Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

More dialogue about current complexities of fleet management with David Prusinski of Vehicle Management Systems (VMS)

A limited number of qualified maintenance technicians. A robust mix of gasoline-, diesel- and electric-fueled vehicles. There’s no shortage of challenges for fleet managers nowadays. To help wade through the environment with valuable perspectives, David Prusinski, who is CEO of ... Listen Here

Thursday, Jan. 29, 2026, 03:30 PM

GWC Warranty unveils new resource to build transparency & loyalty

Tuesday, Dec. 6, 2022, 11:00 PM

SubPrime Auto Finance News Staff

GWC Warranty wanted to give dealers recommendations to develop new processes designed to increase customer satisfaction and build loyalty. So this week, the provider and administrator of automotive F&I products released a free eBook titled, “A Dealer’s Guide to Transparency ... [Read More]

Texas repo assignment leads to discovery of elaborate fraud scheme

Tuesday, Dec. 6, 2022, 10:48 PM

SubPrime Auto Finance News Staff

James Waldron recently recovered more than just a high-line Mercedes-Benz. The CEO of Texas-based 1st Adjusters helped to lead federal officials to quite a fraud scheme that included several other luxury vehicles. Advantage Automotive Analytics recapped the incident for SubPrime ... [Read More]

Resource Hub

Best Practices, Ideas, and Tools for Business

Used Car Turn Vendor Management Checklist

Vehicles touch multiple vendors before they ever hit the lot, and when approvals, communication, and invoices are scattered, delays are...

Read More

6 key findings from KBRA’s decade lookback at auto ABS space

Tuesday, Dec. 6, 2022, 04:25 PM

SubPrime Auto Finance News Staff

Kroll Bond Rating Agency (KBRA) released research on Monday assessing changes in the auto loan asset-backed security (ABS) sector, prompting experts to say the segment has demonstrated “both stability and volatility over the past decade.” The firm’s resulting report evaluated ... [Read More]

Dealertrack Registration and Title Solutions blends into Reynolds Certified Interface Program

Monday, Dec. 5, 2022, 03:55 PM

SubPrime Auto Finance News Staff

Two prominent technology service providers for dealerships and finance companies now are working together to smooth the titling process. Cox Automotive announced on Monday a new integration that geared to drive dealer value by connecting Dealertrack’s Registration and Title Solutions ... [Read More]

COMMENTARY: FTC continues its active regulation of dealers by rules and consent decrees

Friday, Dec. 2, 2022, 04:05 PM

Randy Henrick, Ignite Consulting Partner

The Federal Trade Commission (FTC) seems to be in full assault mode when it comes to regulating auto dealers. It is doing so by proposing new rules and by entering consent decrees with allegedly offending dealers. And 2022 has been ... [Read More]

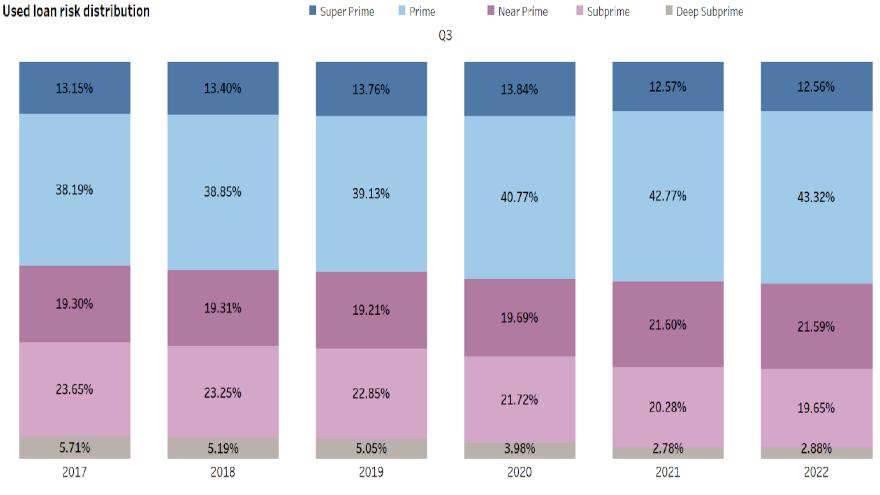

Experian: Amount financed for used vehicles slowed in Q3

Thursday, Dec. 1, 2022, 05:09 PM

SubPrime Auto Finance News Staff

With used-vehicle prices easing a bit, the amount of risk that finance companies are absorbing into their portfolios is starting to abate a bit, too. According to Experian’s State of the Automotive Finance Market Report: Q3 2022, the average amount ... [Read More]

Nordis Technologies partners with Solutions by Text to boost customer communications

Wednesday, Nov. 30, 2022, 04:24 PM

SubPrime Auto Finance News Staff

Nordis Technologies and Solutions by Text (SBT) contend that a growing number of auto finance company customers want to receive statement alerts and payment reminders by text, especially with direct links to online account management and payment portals. To enhance ... [Read More]

PODCAST: PAR North America VP on future of repossessions

Wednesday, Nov. 30, 2022, 04:23 PM

SubPrime Auto Finance News Staff

Ahead of his appearance on stage during Used Car Week 2022 in San Diego, PAR North America’s Ryan Hawley took time for this episode of the Auto Remarketing Podcast. Hawley described how the forwarding industry is getting ready for an ... [Read More]

PODCAST: Revisiting complexities of product refunds

Wednesday, Nov. 30, 2022, 04:00 PM

SubPrime Auto Finance News Staff

Following their keynote presentation at Used Car Week 2022 in San Diego, a trio of experts reiterated how complex product refunds can be for finance companies following a vehicle repossession or total-loss insurance claim. Anne Holtzman and Peter Krall of ... [Read More]

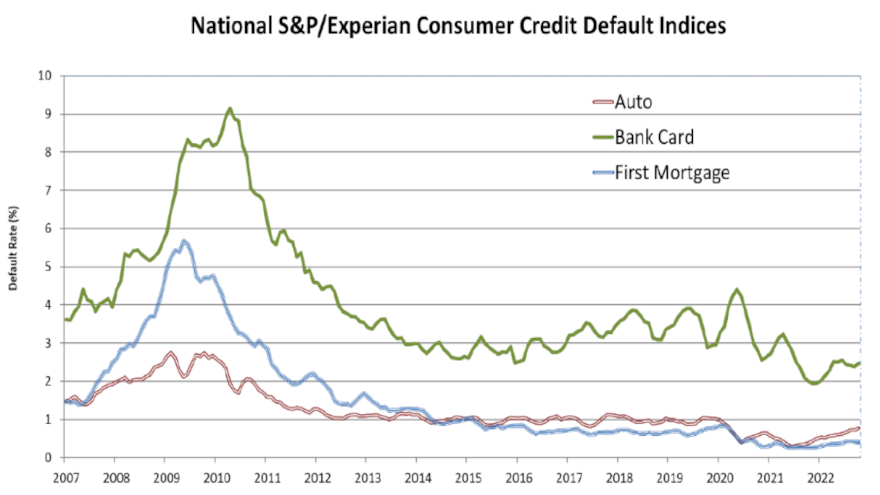

October auto defaults make second-highest rise of 2022

Tuesday, Nov. 29, 2022, 04:07 PM

SubPrime Auto Finance News Staff

Auto defaults made the second-highest sequential jump so far this year in October, according to the S&P/Experian Consumer Credit Default Indices. S&P Dow Jones Indices and Experian reported that data through October showed the auto reading at 0.77%, which was ... [Read More]

X