Debt collection complaints to CFPB top 219K

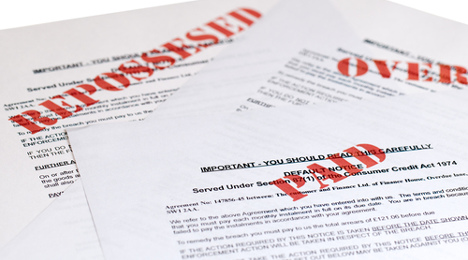

Along with additional details about the volume coming out of Florida, the Consumer Financial Protection Bureau released its latest monthly consumer complaint snapshot this week, focusing on debt collection coming on the heels of a special report on collections involving servicemembers.

The newest information from the CFPB indicated that the most common debt collection complaint is about attempts to collect on a debt the consumer reported was not owed.

As of March 1, the bureau said it has handled approximately 834,400 complaints across all products.

CFPB director Richard Cordray said this new report “shows that inaccurate information about debts continues to be a source of frustration for many consumers.

“We will continue to hold debt collectors accountable for ensuring that they are collecting the right amount from the right person,” Cordray continued.

The bureau noted that it had handled approximately 219,200 debt collection complaints as of March 1. Drilling deeper into that figure, the CFPB mentioned:

1. Collection on debts not owed

The most common debt collection complaint had to do with both first- and third-party debt collectors attempting to collect on a debt the consumer reported was not owed. These types of complaints accounted for 38 percent of all debt collection complaints submitted.

2. Debt collectors repeatedly calling consumers

Another frequent complaint from consumers was about communication tactics used by debt collectors. Consumers complained about receiving multiple calls weekly and sometimes daily from debt collectors. Consumers often complained that the collector continued to call even after being repeatedly told that the alleged debtor could not be contacted at the dialed number. Consumers also complained about debt collectors calling their places of employment.

3. Consumers unable to verify debts owed

Consumers complained that they were not given enough information to verify whether or not they owed the debt that someone was attempting to collect.

4. Most-complained-about debt collection companies

The two companies that the CFPB received the most debt collection complaints about were Encore Capital Group and Portfolio Recovery Associates. Both companies, which the bureau believes are among the largest debt buyers in the country, averaged more than 100 complaints submitted to the CFPB each month between October and December 2015.

Last year, the CFPB mentioned took enforcement actions against these two large debt buyers for using deceptive tactics to collect bad debts.

More details on collection complaints involving the military

The CFPB’s Office of Servicemember Affairs recently shared its annual report that stated servicemembers have been submitting debt collection complaints to the bureau at nearly twice the rate of non-military consumers.

In addition the report recapped CFPB enforcement actions that have returned more than $5 million to servicemembers and their families in 2015. Those developments included an action against Security National Automotive Acceptance Company (SNAAC), an Ohio-based auto finance company for engaging in abusive debt collection practices against servicemembers and their families.

“The complaints highlighted in this report show that members of the military continue to have serious problems when it comes to debt collection,” Cordray said. “The bureau will continue to closely monitor complaints from servicemembers to ensure our brave men and women are getting the protection they deserve.”

In 2015, the CFPB indicated that it received more than 19,000 complaints from members of the military community. The top three most complained about products or services were debt collection, mortgages, and credit reporting.

Involving debt collection, the bureau noted roughly 44 percent of the complaints submitted by servicemembers involved companies’ attempts to collect debt that the servicemember believes is not owed.

Additionally, the CFPB said servicemembers often complained that debt collectors would contact their commanding officers and threaten their security clearance over a debt issue.

Complaint volume from Florida

The CFPB spotlighted Florida for its latest complaint update.

As of March 1, consumers in Florida submitted 80,200 of the 834,400 complaints the CFPB has handled. Complaints from the three largest metro areas in Florida — Miami, Orlando and Tampa — accounted for nearly 60 percent of the complaints submitted from the state.

Other findings from the Florida complaints included:

— Mortgages are the most-complained-about product: Consumer complaints from Florida are more likely to be about mortgages than consumer complaints nationally. While nationally mortgages account for 26 percent of total complaints submitted to the bureau, mortgages complaints account for 30 percent of complaints from Florida.

— Florida debt collection complaints mainly mirror national trends: The bureau noticed Sunshine State residents are slightly less likely to submit complaints about debt collection. Complaints about debt collection accounted for 24 percent of total complaints from Florida, while nationally debt collection complaints account for 26 percent of total complaints submitted.

— Most-complained about companies: Equifax, Bank of America and Experian were the three most-complained about companies from consumers in Florida.

View The Latest Edition

View The Latest Edition