Manheim SVP talks $400 million tech makeover

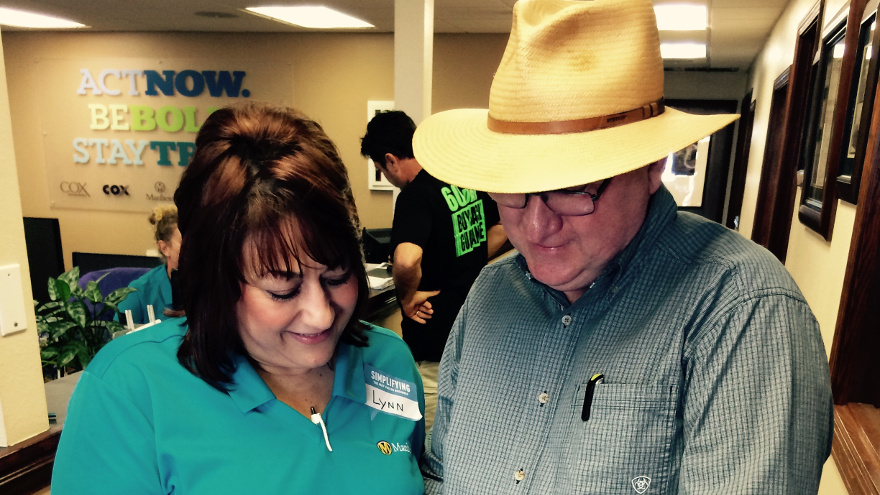

Royal Kraft of Mossy Motors checks out new auction tools via his phone with Manheim operations support team member Lynn Cahill at Manheim New Orleans. Photo courtesy of Manheim.

At 78 auction locations, Manheim has invested $400 million to bring its dealer clients simpler transactions and processes.

The auction company announced Monday that, with these upgrades, dealers now have access to tools and self-service options for their businesses that are designed to help them work more efficiently and make smarter decisions.

“The whole heartbeat of what we were doing was to make things, simple, easy and fast,” Doug Keim, Manheim's senior vice president of client experience, told Auto Remarketing during a phone interview.

Not only can dealers switch easily between physical and digital services while in the lane, new transaction-focused improvements allow them to view and pay single, multiple and/or consolidated invoice reports while at their dealership or on Manheim.com from any device.

Keim stressed that access to those reports allows clients to look at their accounts in real time, so they can make the quickest decisions.

“What had happened in our business is, we operate 78 different auctions and we really had not invested in our technology platform for several decades; so, what that meant was we weren’t able to take advantage of automation, we weren’t able to really offer our clients what I would call, any kind of current efficiency,” Keim went on to say. “We really re-engineered all of the major systems and processes, so every way that we transacted with our clients, the way that our team members did their jobs really, literally changed very, very dramatically.”

With Manhien new technology enhancements, clients can buy vehicles and services from Manheim via electronic payment or a line of credit.

“Somebody could actually order a car on their phone to buy the car, pay for the car, finance the car, order services … so pretty much any part of that car buying process really got automated,” Keim said. “We made our clients what I call 'hyper-efficient' and we made them efficient by making things very simple, easy and fast.”

Use of electronic payment or a line of credit represented 40 percent of dealer transactions on Manheim.com from January to May, according to the company's Monday news release.

To show how things were different before the new technology, Keim pointed out that, previously, dealers “would have to stand in a line to pay us for a car, they would stand in a line to buy a car; but that’s crazy in this day and age, so we automated the payments process.”

In another upgrade, along with automated payments plus Manheim data and insights, dealers have access to bills of sale, titles and gate passes.

Within the first five months of the year, clients have printed a record number of just about 500,000 gate passes, according to Manheim.

“We made it look like people’s everyday lives and how they kind of transact today, whether that’s online banking, the reports that they can generate or pull up on their phone at any time,” Keim said.

View The Latest Edition

View The Latest Edition