Lane watch: June opens with accelerated depreciation

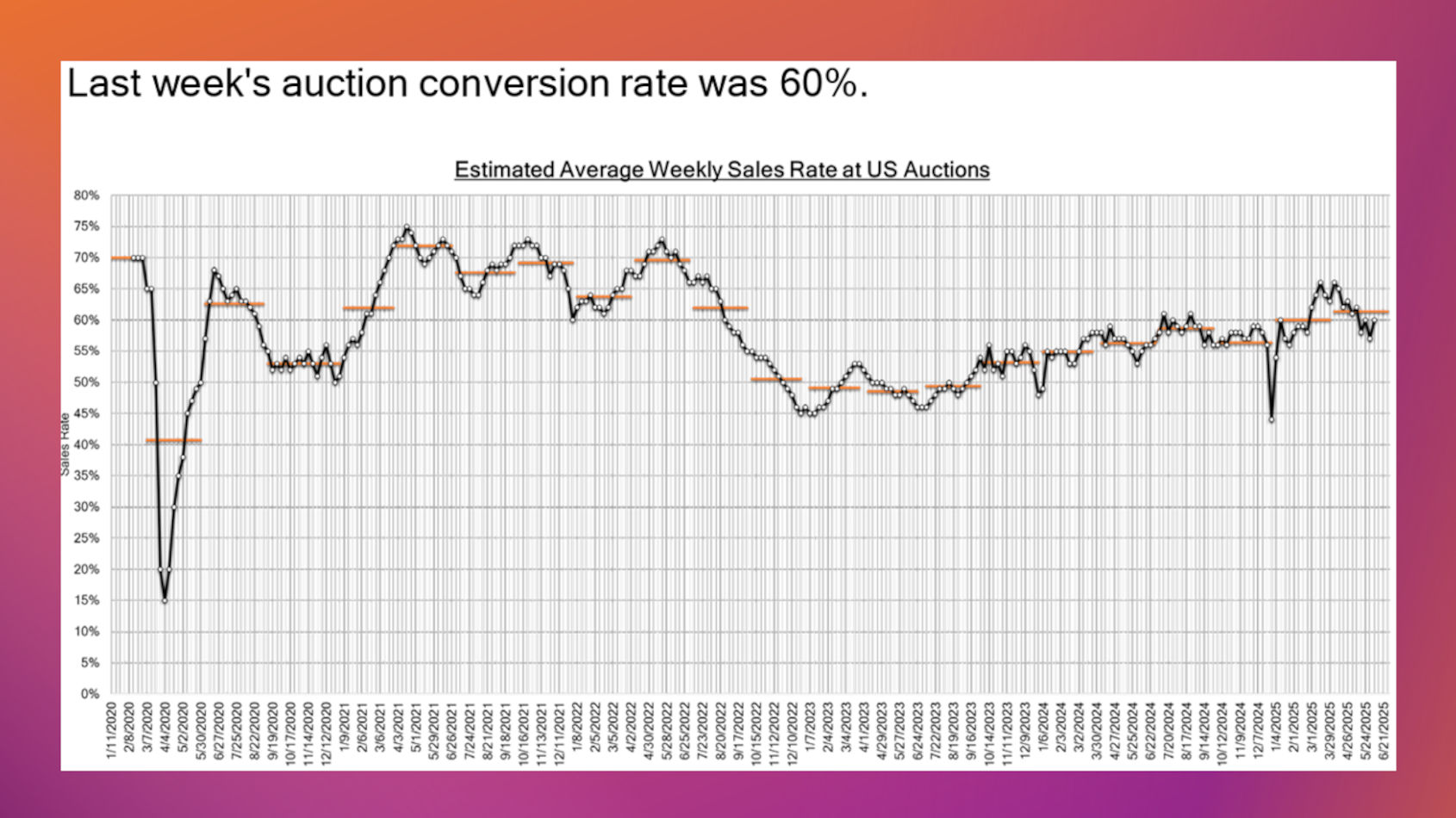

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Maybe things can really settle down in the wholesale market.

The day after Black Book shared its newest installment of Market Insights, President Trump said on Wednesday via social media, “Our deal with China is done, subject to final approval with President Xi and me.”

Perhaps the auction world also sensed an agreement involving tariffs and more was imminent since Black Book reported that overall wholesale prices softened by 0.54% last week. Analysts said that’s a decrease that surpassed the typical seasonal decline of 0.28% for this time of year.

Black Book also noted that last week’s auction conversion rate rebounded to 60%, which was the lowest level the rate was during much of the tariff talk this spring.

Meanwhile, on the retail side, Black Book said its estimated used retail days to turn is now at roughly 36 days. According to the report, the trend has remained below 40 days since April.

Turning back to the auction world, analysts noticed prices for all 22 vehicle segments dropped for the third week in a row.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book mentioned some of the most notable value moves involved:

—Subcompact cars: Down another 1.04%, extending a string of declines to five consecutive weeks that have generated an average drop of 0.84%

—Subcompact crossovers/SUVs: Down 0.79% overall, with models less than 2 years old dropping by 1.21%, their largest single-week decrease since December 2023

—Sporty cars: Down 0.33% after rising for 11 straight weeks for an average a weekly gain of 0.36%

Drilling deeper into the newest data uncovered a couple of other notable situations.

While a small cluster of vehicles, Black Book said prices for full-size cars less than 2 years old rose another 0.49%, marking the 13th time in the past 14 weeks that’s happened.

And prices for full-size crossovers/SUVs less than 2 years old tumbled by 1.01%.

With the president seemingly ready to wrap up trade policy negotiations, Black Book reiterated, “As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight.”