Despite tariff uncertainty, dealers bullish about profits and dealership values

Image courtesy of The Presidio Group.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

In a business environment that seems uncertain and chaotic, auto dealer optimism is rising, according to the latest research from The Presidio Group.

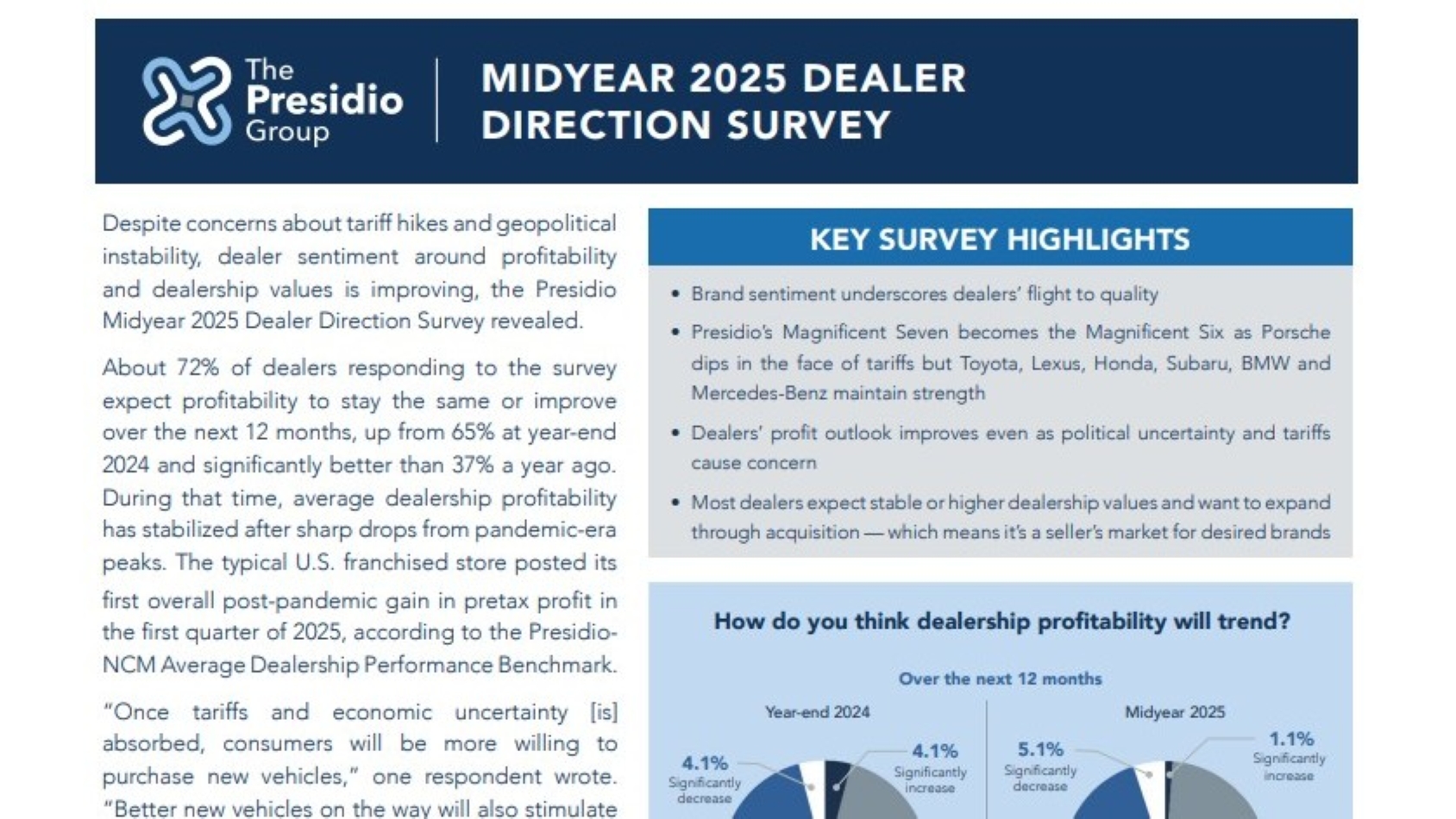

Despite concerns about tariffs and their effect on prices and the economy in general, The Presidio Midyear 2025 Dealer Direction Survey found 72% of the dealers surveyed said they expect profitability to stay the same or improve over the next 12 months, up from 65% at the end of last year and far above the 37% in the 2024 mid-year survey.

The Presidio report noted average dealership profitability has stabilized after sharp drops from pandemic-era peaks, citing the Presidio-NCM Average Dealership Performance Benchmark, which showed its first overall post-pandemic gain in pretax profit in the first quarter of 2025.

The Presidio Group quoted survey respondents saying they expect sales to improve “once tariffs and economic uncertainty are absorbed” and adding “margins are still high compared to pre-COVID.”

The survey of 182 dealers and dealership group executives representing nearly 3,000 franchise stores, conducted from May 15 through June 13, showed 73% of dealers said they expect dealership values to stay the same or improve over the next 12 months, also up from the end (64%) and middle (45%) of 2024, saying continuing consolidation and the possibility of fewer U.S. dealerships contributing to higher valuations.

That said, dealers also acknowledged a store’s value depends most of all on its brand and its location.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The list of brands at the top of the value chart has been trimmed from what Presidio called “The Magnificent Seven” to a “Magnificent Six”, with Porsche dropping out of the elite group of most desirable brands from the previous four surveys.

The Presidio Brand Desirability Ranking, derived from dealer survey responses regarding the stores that would like to own, is led by Toyota, Lexus, Subaru, Honda, BMW and Mercedes-Benz, with Porsche sinking to eighth behind Kia — five spots lower than its ranking in Presidio’s inaugural survey in Q3 2023.

“In addition to its challenging inventory allocation system and expensive facility demands, tariffs are a big contributor to the declining view of Porsche, which has no U.S. production capability,” The Presidio Group president George Karolis said. “While still highly desirable among buyers, whether Porsche recovers its previous heights could depend on how tariffs play out.”

Other brands dropping in desirability include Audi, down three spots from year-end 2024 to 14th, and Jaguar Land Rover, down five spots to 19th.

The impact of tariffs is not limited to brand values. Even with dealers showing positivity about profits and dealership values, 61% of the respondents still said they expect U.S. tariff policies to negatively impact their business, with many citing the rapid implementation of the tariffs, leaving little time for the industry to adjust.

Overall, though, dealers seem to be bullish on the industry, with many more dealers interested in buying dealerships than selling them. While just 9% of respondents indicated interest in selling stores over the next 12 months, 64% said they’d like to buy.

Generating return on investment was the top reason provided, but The Presidio Group said No. 2 was “creating opportunities for the next generation or key operational talent.”

The full survey results are available here.