Lane watch: Searching for the new ‘normal’ as Fourth of July approaches

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book’s wholesale market observers acknowledged the first half of the year wrapped up with them “searching for a new ‘normal.’”

That’s the primary finding from the newest installment of Market Insights, which was released on Tuesday.

The analysis indicated that wholesale prices softened another 0.46% during the week that concluded two days before the calendar flipped from June to July.

Analysts explained in the report that the wholesale market continues to prompt them to look for that new “normal” with truck and SUV depreciation holding steady compared to the previous week.

“In contrast, car depreciation has accelerated beyond typical seasonal patterns,” Black Book said. “Additionally, Tesla depreciation remains under close observation, as the manufacturer has experienced significant fluctuations in wholesale values over the past few months.”

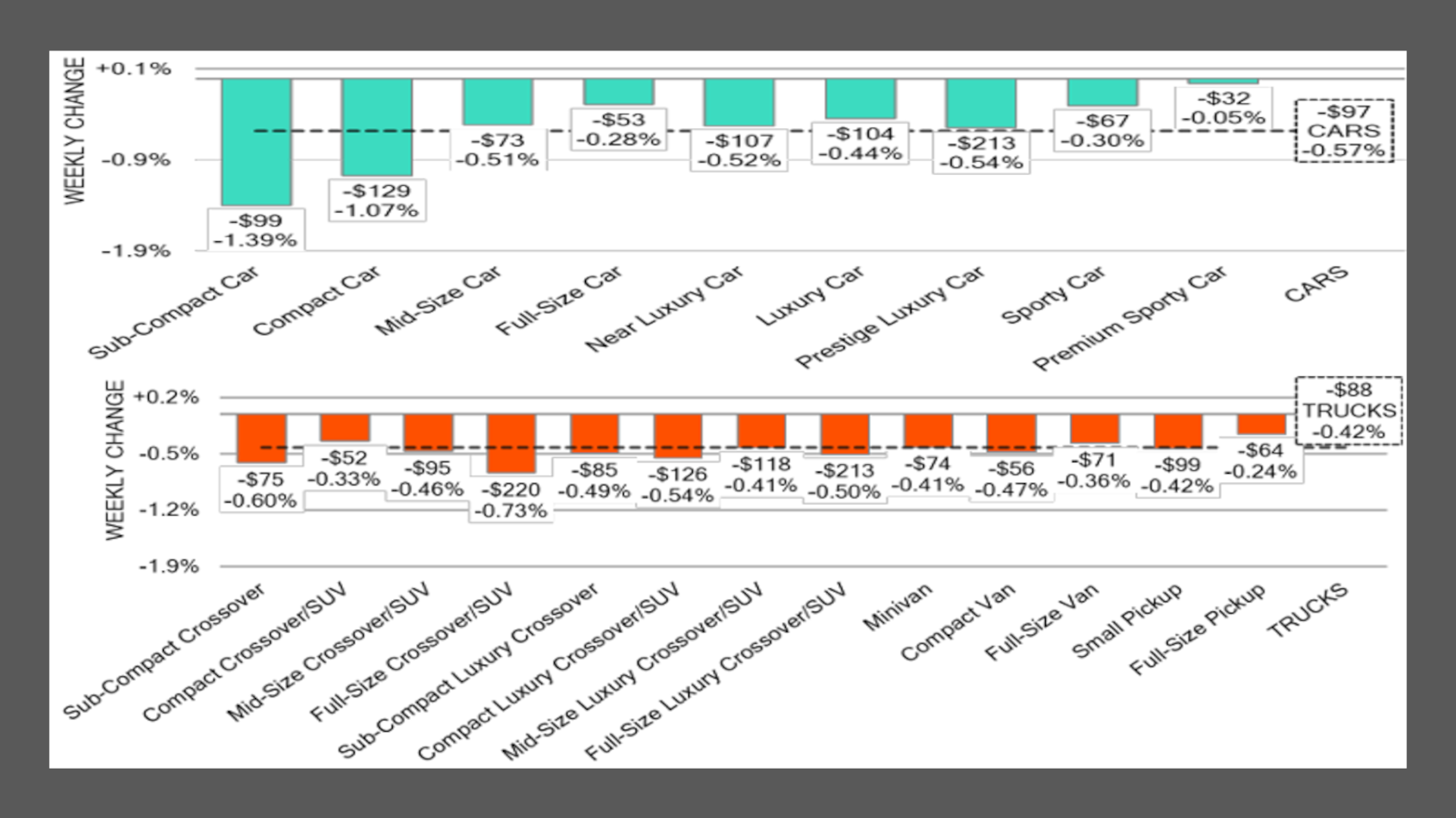

On a volume-weighted basis, Black Book reported that overall car values decreased 0.57% last week with prices within all nine segments declining.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts also noticed that compact cars experienced an “unprecedented” value decline of 1.07%. That movement marked the steepest weekly drop for those vehicles in almost a calendar year. The last instance of a single-week decline exceeding 1% was during the week that closed on July 3 of last year.

Black Book closed the car conversation by noting that the Tesla Model 3 played a key role in values within the near luxury car segment sliding by 0.52% a week ago.

In the truck department, analysts said values for all 13 segments decreased last week on a volume-weighted basis, with full-size crossover/SUVs leading the way by dropping 0.73%.

Black Book also broke down the price declines for full-size trucks, noting:

—Trucks less than 2 years old decreased 0.35%

—Trucks between 2 and 8 years old decreased 0.24%

—Trucks between 8 and 16 years old decreased 0.21%

Black Book rounded out its update by mentioning that last week’s auction conversion rate came in at 57%, and the estimated used retail days to turn moved up again and is now at roughly 38 days.

“Looking ahead to next week, with the July 4th holidays approaching, it raises questions about further depreciation,” Black Book said. “The anticipated reduced activity in the auction lanes combined with some closures on Friday could potentially impact price trends and market dynamics further.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.