Carfax and J.D. Power watch retail used-car prices rise

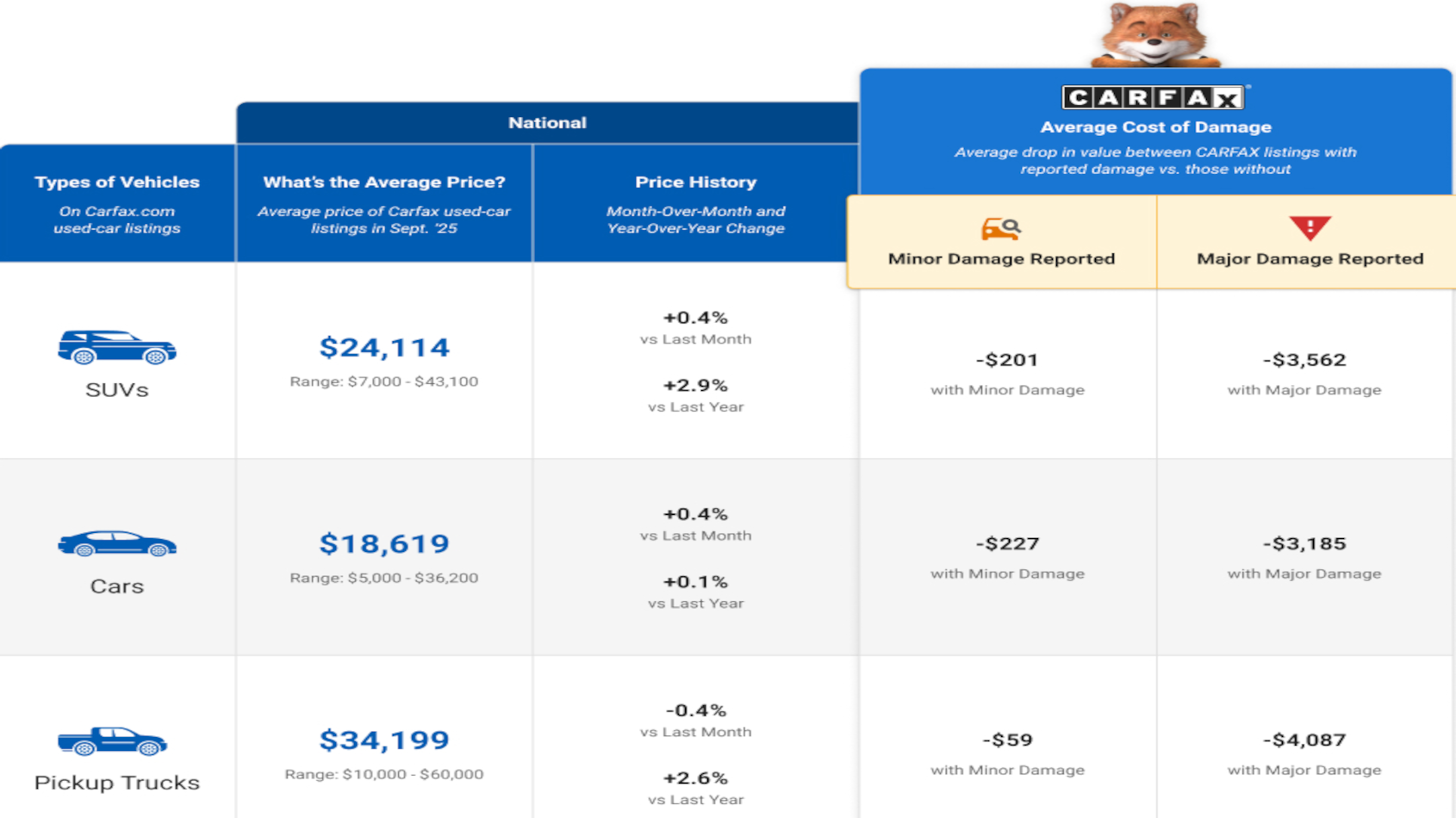

Graphic courtesy of Carfax.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Carfax and J.D. Power each shared new data this week about retail prices for used cars and more.

While analysts delved into different market segments, they noticed at least one similar pattern overall. Prices are noticeably higher now than a year ago.

Thomas King, president of the data and analytics division at J.D. Power, said the average used-vehicle price is trending toward $29,668, which is up $739 from a year ago.

“This reflects the combination of reduced supply of recent model year used vehicles — due to lower new-vehicle production during the pandemic — fewer lease maturities and manufacturers moderating discounts,” King said in a news release.

King pointed out that the rise in used-vehicle prices is good news for new-vehicle buyers, with average trade-in equity in September up $534 year-over-year to $8,430.

“That increase is partially offset by higher loan balances that exist on vehicles being traded in,” King said.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

King went on to mention that the number of new-vehicle buyers with negative equity on their trade-in is expected to reach 25.9%, which is an increase of 1.5 percentage points from September 2024.

“In aggregate, September sales results point to another month of strong demand for new vehicles. However, as has been the case for the past few months, assessing the health of the industry requires a closer look at the underlying market dynamics,” King said.

J.D. Power projected new-vehicle retail sales for September to reach 1,031,400, a 0.4% increase from September of last year. Comparing the same sales volume without adjusting for the number of selling days translates to an increase of 4.8% from 2024, according to J.D. Power.

“The biggest driver of September’s strong sales pace is temporarily inflated demand for electric vehicles,” King said. “The federal EV tax credit expires at the end of the month, which is causing many shoppers to accelerate their purchase. EV share of retail sales is expected to reach a record of 12.2% this month — up 2.6 percentage points from a year ago. On a volume basis, this equates to a 27.5% increase in EV sales — selling day adjusted — from a year ago.

Conversely, demand for non-EVs is muted, with non-EV sales down 2.5% this month from a year ago,” King continued. “The second key driver is affordability. Although again, the EV dynamic means aggregate results need careful evaluation. In totality, average vehicle prices continue to rise, discounts remain low and monthly finance payments are at record highs — all of which affects the overall sales pace.”

Meanwhile, the Carfax Used Car Index looked at what families might be considering. Carfax reported:

—The average price of used luxury SUVs fell by just a little more than $325 in September.

—The average price of used vans and minivans on Carfax fell by more than $270.

“Consumers are showing growing signs of hesitation about making big purchases right now because of higher than normal interest rates, creeping inflation, and concerns about a potential economic turndown,” Carfax editor in chief Patrick Olsen wrote in an analysis.

“The prices did not drop for all categories, though. The average price of used luxury cars on Carfax climbed for the sixth straight month and are up 5.8% year-over-year. They’re on the verge of breaking through the $32,000 level,” Olsen continued.

“Still, for most of the other categories, prices remain much more consistent. That may be because dealers — along with consumers — are trying to get a handle on where the economy is going in the next few months,” Olsen added.

The Carfax Used Car Index also broke down price trends by region, including:

Mid-Atlantic (PA, NJ, MD, DE)

Segment with the highest increase in price: Used vans and minivans, up nearly $550 over last month.

Segment with biggest drop in price: Used hybrids and EVs, down roughly $150 on average.

Midwest (OH, IN, MI, IL, WI, MN, IA, MO)

Segment with the highest increase: Used luxury cars, up more than $250.

Segment with biggest drop: Used luxury SUVs, down more than $260.

Northeast (NY, CT, VT, NH, ME, RI, MA)

Segment with the highest increase: Used cars, up about $260.

Segment with biggest drop: Used vans and minivans, down about $300.

Plains (OK, ND, SD, NE, KS, ID, WY, MT)

Segments with the highest increases: Used Cars, up more than $450; and hybrids & EVs, up more than $440.

Segment with biggest drop: Used luxury SUVs, down more than $400.

South (GA, FL, AL, MS, LA, AR)

Segment with the highest increase: Used luxury cars, up a whopping $700.

Segment with biggest drop in price: Used vans and minivans, down by more than $300.

Southeast (VA, WV, NC, SC, KY, TN)

Segment with the highest increase: Used luxury cars, up by more than $300.

Segment with biggest drop: Used pickup trucks, down nearly $300.

Southwest (UT, CO, AZ, NM, TX)

Segment with the highest increase: Used luxury cars, up more than $250.

Segment with biggest drop: Used vans and minivans, down a whopping $660.

West (WA, CA, OR, NV, HI, AK)

Segment with the highest increase: Used luxury cars, up sharply at nearly $800.

Segment with biggest drop: Used luxury SUVs, down by more than $700.