Lane watch: Wondering what’s next with EVs

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Black Book is asking the same question you and your colleagues at your dealership or finance company might be considering.

How much industry juice are electric vehicles going to lose now that the federal tax credits have expired?

Those federal EV incentives hit their sunset last week when Black Book watched overall wholesale values drop by 0.49%.

“After a brief pause in depreciation early last month, the market has returned to its typical seasonal declines,” Black Book said in its newest installment of Market Insights released on Tuesday. “This trend aligns with an increase in days-to-turn and a recent decrease in auction conversion rates.

“As we enter the first full week of October and the start of the fourth quarter, the team is also closely monitoring the performance of electric vehicles following last week’s expiration of the federal tax credit,” Black Book added in the report.

As analysts noted, their estimation of used retail days to turn is now at roughly 36 days.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

And last week’s auction conversion rate settled at 55%, which was the lowest level recorded since the second week of January, according to Black Book tracking.

“Auction activity remained steady yet selective across lanes,” Black Book said. “Solid digital turnout and competitive in-lane bidding supported healthy buyer engagement.

“Clean, low-mileage vehicles continued to deliver the strongest results, while units with condition disclosures or niche trims experienced modest pullbacks. Crossovers and midsize SUVs were core performers, maintaining values between clean and average,” Black Book continued.

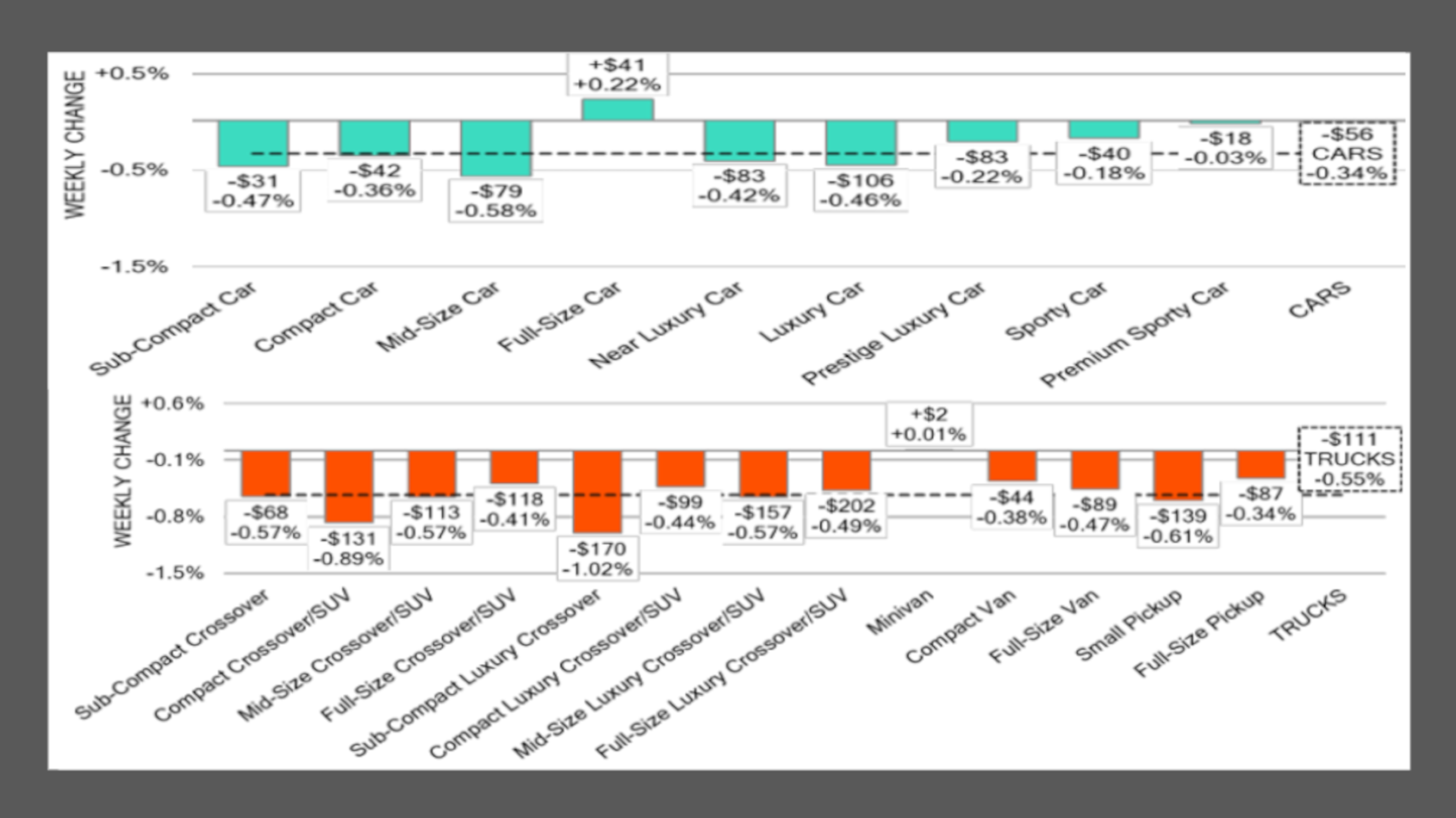

Delving deeper into its price data, Black Book noticed midsize cars experienced the steepest value decline among cars last week, falling by 0.58%.

Among trucks and SUVs, analysts said values for compact crossovers recorded their sharpest drop since January, falling by 0.89%.

Prices for subcompact luxury crossovers slid even more, dropping by 1.02%. Black Book said it’s the first time since July 2024 that the segment has recorded a weekly drop of more than 1% in a single week.

And what’s been watched a bit closer in recent weeks, Black Book reported prices for the oldest vehicles at auction dropped again. Values for cars between 8 and 16 years old softened by 0.48%, while prices for trucks in that age range decreased by 0.39%.

All told, eight of nine car segments and 12 of 13 truck segments in Black Book’s data set posted price declines a week ago.

“Overall, the market remains stable, characterized by disciplined bidding, consistent buyer participation, and gradual price normalization across most vehicle classes,” Black Book said.

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book went on to say.