Middle-income consumers turning more toward used cars, survey finds

Image courtesy of Santander Holdings USA.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The American Dream used to include owning a home and buying a new car.

But according to a survey conducted in September by banking and financial services provider Santander US, that dream has shifted for middle-class Americans, who now see renting and used cars as their path to financial security.

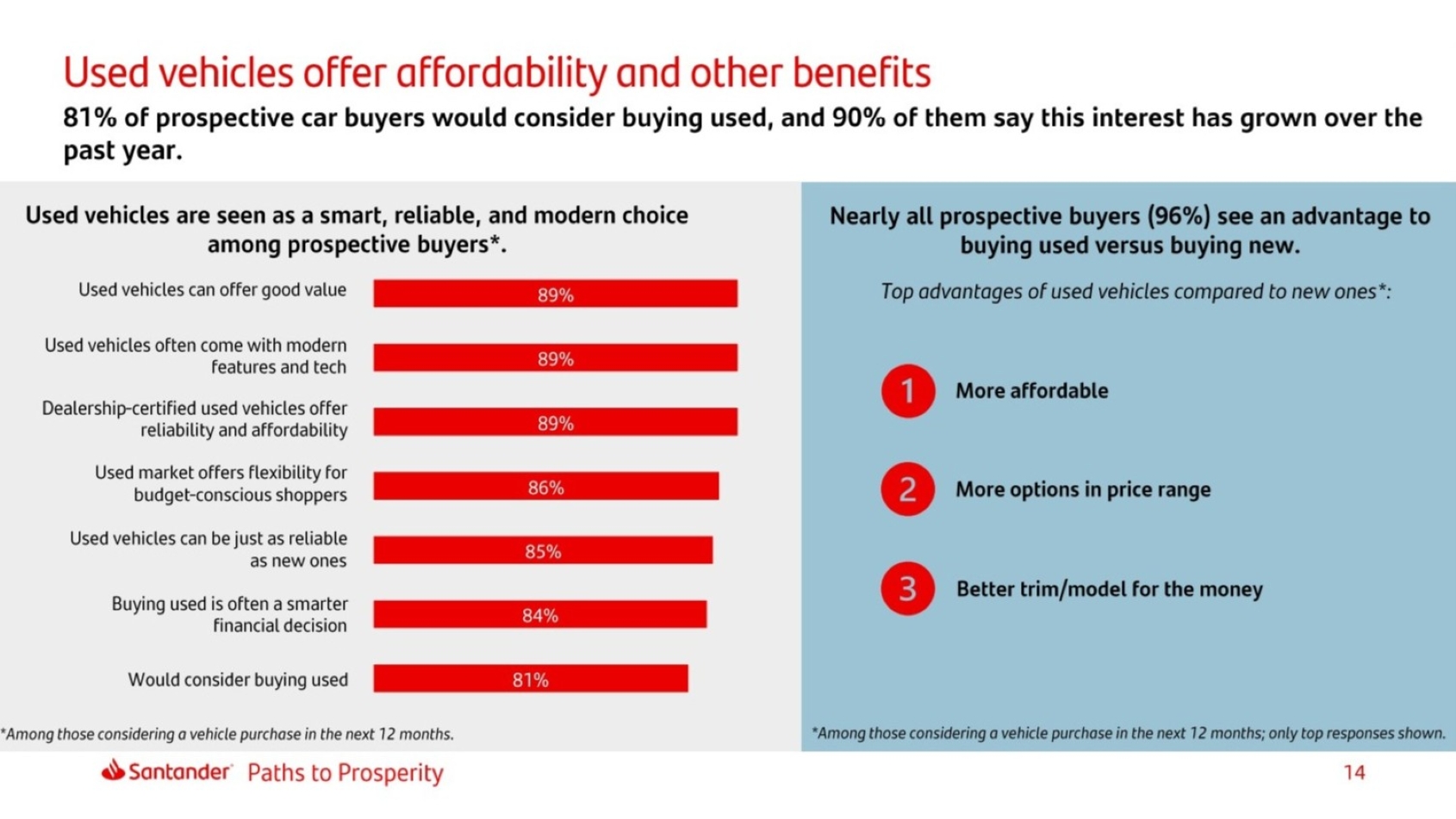

The quarterly survey of 2,216 adults in the middle-income range — $53,000-$161,000 annually — found the majority of those in rental housing feel owning a home is not a necessity, while 81% of respondents in the market for a vehicle are considering a used car and 90% said their interest in used has grown over the past year.

Santander said the increasing interest in used cars is part of a broader focus on affordability among middle-income consumers, which is why price ranked as the top influencing factor among those who purchased vehicles in 2025.

The survey found 79% of those car buyers made some sacrifices, such as giving up technology features or buying an older vehicle, but 88% were able to find a vehicle in their price range and 90% said they’re satisfied with their choice.

“Affordability continues to be a driving factor for today’s buyers, and it’s encouraging to see that so many of them are finding vehicles that fit within their budget,” Santander Consumer USA president of auto relationships Betty Jotanovic said. “The increased openness to used cars reflects both practicality and resilience — buyers know they can get value, modern features and reliability while maintaining financial flexibility.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“At Santander, we see this as a positive sign of consumers adapting to today’s market while staying focused on what matters most: access to safe, dependable transportation.”

Middle-income car shoppers overwhelmingly see advantages in buying used, with 96% of potential buyers citing benefits such as affordability, more available options in their price range and getting a better model or trim level for the money.

Nearly nine in 10 prospective buyers (89%) agreed used vehicles provide good value and offer modern features and technology, while 84% believe buying used is often the smarter choice.

According to the survey, which also covered topics such as housing, savings and general finances, overall demand is rising in the auto market. More than half of the middle-income consumers surveyed (54%) said they’re considering buying a vehicle in the next 12 months, up from 43% a year ago.

Meanwhile, 50% said they had delayed a purchase in the past year, tying for the lowest total since the survey began in early 2023. That marks the second consecutive quarter in which purchase considerations outnumbered delays, which Santander said indicates stronger buying momentum as sales overtake pent-up demand.

The survey showed 66% of prospective buyers are already researching options and 49% are visiting dealerships, both increases from previous surveys. And 72% said they’re willing to sacrifice other items in their budget for a vehicle, a rising trend since the end of 2024.

The full report is available here.