Lane watch: Seeing stability as industry ramps up for tax season

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The newest installment of Market Insights from Black Book covered the week when the calendar rolled from 2025 to 2026, as auctions, consignors, dealers, transporters and other service providers began to deploy plans for tax season.

Black Book reported that during that timeframe, wholesale prices softened by 0.38%, the auction conversion rate held at 59%, and the estimated used retail days to turn sat at roughly 38 days.

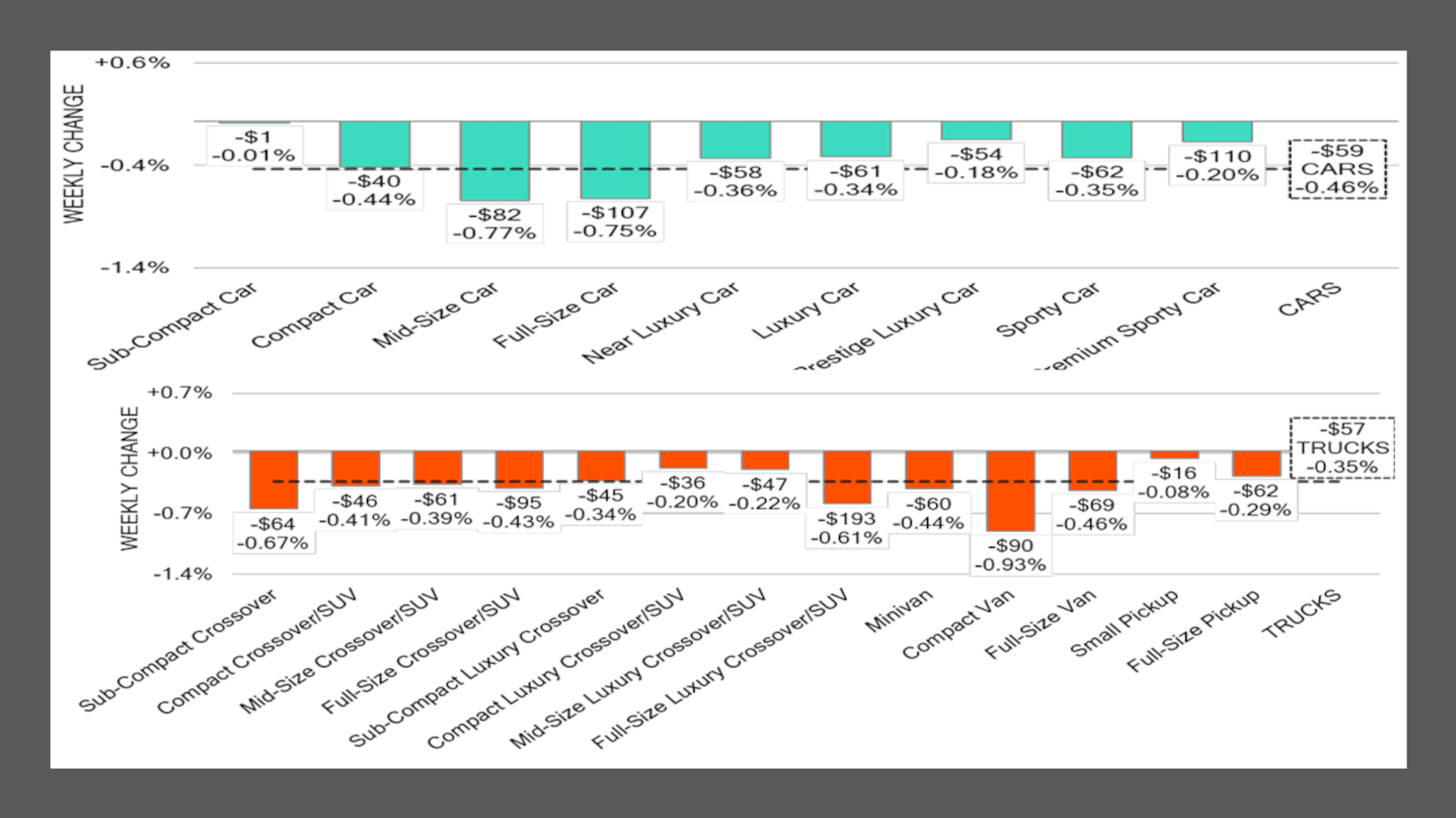

“As 2025 ended, prices remained mostly stable, with typical year-end trends keeping movement modest across both the car and truck segments,” Black Book said in its report released Tuesday. “Car values declined by an average of 0.46%, while trucks and SUVs softened 0.35%, signaling a continuation of the market’s gradual seasonal depreciation.

“Overall, price changes stayed within historical norms, reflecting a balanced supply-and-demand environment heading into the new year. Wholesale activity slowed through the holidays, but buyer confidence and floor prices held firm across most lanes,” analysts continued.

Black Book noted a few specific vehicle segments in its first edition of Market Insights for the year beginning with values for sub-compact cars.

Prices for those units ticked just 0.01% lower last week after falling 0.44% during the prior week and averaging a drop of 1.02% weekly over the past 10 weeks.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“This marked the slowest pace of decline in recent months, suggesting potential stabilization,” Black Book said. “It remains to be seen whether this pause reflects a brief seasonal fluctuation or a shift toward renewed demand as buyers begin positioning for tax season, given the relative affordability within this segment.”

Analysts added values for compact vans sunk by 0.93% last week. And prices for compact vans less than 2 years old decreased by 0.26%, the steepest single week drop for the segment since December 2024, according to Black Book tracking.

Black Book also pointed out values for all 22 vehicle segments declined last week.

“Looking ahead, market conditions are expected to stabilize or show modest gains in early 2026 as dealer activity ramps up and tax refund season supports retail demand —particularly in affordable and high-demand segments such as compact cars and pickups,” analysts said. “Auction conversion rates remained elevated throughout much of the year, averaging 59% as 2025 ended, underscoring consistent buyer engagement even amid seasonal softening.

“The year closed with solid conversion rates and typical seasonal declines, accompanied by encouraging signs for a strong 2026 as large independents remained active in both bidding and purchasing,” analysts continued. “Black Book will be finalizing official projections for the year in the coming weeks and looks forward to sharing them with the industry. We hope everyone enjoyed the holidays and that the new year is off to a great start.

“As always, our team of analysts are focused on keeping their eyes on the market for developing trends and gathering insights,” Black Book went on to say.