Fraud and its prevention are gaining more attention, especially since the pandemic arrived.

LexisNexis Risk Solutions unveiled findings about what it classified as the current state of fraud, detailing key fraud trends occurring in 2020 for organizations in the United States and Canada while also looking ahead at what to expect in 2021.

LexisNexis Risk Solutions compiled these findings from a review of multiple studies it conducted last year. The consolidation of the report findings showed what it called a “perfect storm” of trends that have impacted fraud throughout the past year and those that may linger into 2021.

Experts said the COVID-19 pandemic caused 2020 to be a year of unique circumstances and disruption to the global economy. One thing that has stayed the same is fraudsters’ willpower to gain access to money and confidential information.

While many believe that fraud victims are mostly the technologically naïve, experts also said 2020 validated that anyone can be a victim. LexisNexis Risk Solutions examined consumer behavior, popular fraud methods, social uncertainty due to the pandemic when compiling this data and suggests what organizations of all shapes and sizes can do to protect their business.

The shift of consumer behavior towards digital transactions

LexisNexis Risk Solutions acknowledged that 2020 saw major changes in the ways in which consumers behave.

The firm’s data showed digital transaction in the U.S. and Canada increased 42% year-over-year leading up to June, with 60% representing mobile transactions; 67% made via a mobile app and 33% made by a mobile browser.

LexisNexis Risk Solutions explained consumers now engage in more digital transactions and use different payment methods that fraudsters leverage to target a broader set of businesses through more sophisticated and complex fraud methods. These actions often involve the mobile channel and the purchase of digital goods and services, according to experts

“Difficult to detect fraud methods like synthetic identities, identity fraud rings, multiple device linkages and bot attacks create identity proofing challenges for businesses,” LexisNexis Risk Solutions said.

“Identity proofing could prove to be a significant challenge for organizations in 2021, as fraudsters leverage digital channels to launch more sophisticated and complex types of fraud,” the firm continued.

According to the Federal Reserve, 86%-95% of applicants identified as potential synthetic identities escape flagging by traditional fraud models.

“This is something every organization should be on the lookout for particularly with the rise in digital transacting,” LexisNexis Risk Solutions said.

Breached consumer data fuels sophisticated fraud methods

LexisNexis Risk Solutions explained this category is more than just about PINs and passwords as this data is valued for both the physical and digital identity attributes linked to transactions and devices, such as email addresses, billing addresses and phone numbers.

The LexisNexis Digital Identity Network indicated a risk in fraudulent events through emails are likely from data breaches and are used by multiple fraudsters.

“Fraudsters are no longer always hidden — they can take the form of a visible business or a network of businesses or devices,” LexisNexis Risk Solutions said. “Physical and digital consumer data is fuel for fraudsters.”

According to analysis from LexisNexis Risk Solutions, 45% of people in the United States having had their personal information compromised by a data breach in the last five years.

“Fraudsters have a trove of personally identifiable information that enables them to use this sensitive information to launch account takeovers and new account creation attacks,” the firm said.

Meanwhile, Javelin estimated that account takeover attacks are up 72% year-over-year while the LexisNexis Risk Solutions Cybercrime Report from January to June found that that one in seven new account creations are likely fraudulent.

Bad actors exploit weaknesses as economic uncertainty continues

Last year, LexisNexis Risk Solutions pointed out overall market and economic uncertainty due to COVID-19 significantly increased successful fraud attempts. Expert said this spike is especially true for the e-commerce, retail, financial services and lending sectors.

“We expect the trend will continue in 2021,” experts said. “While professional fraudsters are always ready to attack, economic hardships can also induce others to engage in fraudulent activities. These can be individuals with no criminal behavior history.”

Typically, LexisNexis Risk Solutions acknowledged, organizations are more sensitive to customer friction during slower economic periods and more concerned about lost opportunities.

“That does not mean they can let their guard down,” experts said. “In addition to those who attack with intent, consumer stress and fear can lead consumers to riskier transaction behaviors, which may increase successful tactics for malware infection on devices and theft of personal identification information.

“This presents more opportunities for fraudsters leading to more attacks,” experts went on to say.

Suggestions of what service providers can do to curb fraud

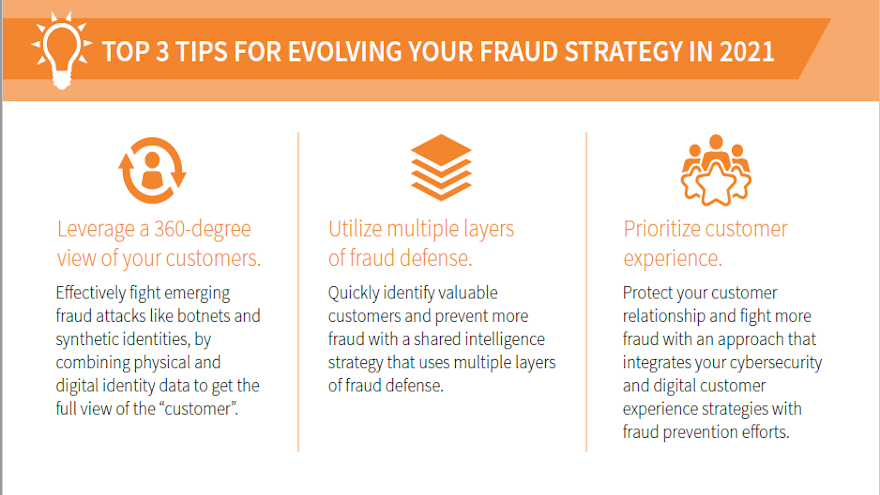

LexisNexis Risk Solutions recommended that businesses must use both physical and digital identity data to get a full view of their customers to effectively fight emerging fraud attacks.

Experts added that businesses should also utilize multiple layers of fraud defense like actionable decision analytics and investigation tools. This strategy, coupled with integrating their digital customer experience and cybersecurity strategies, will protect the relationships that businesses have with their customers and their information, according to LexisNexis Risk Solutions.

“Businesses can no longer use a check-the-box, incremental approach towards addressing these challenges and trends one at a time because fraud always evolves,” said Kimberly Sutherland, vice president of fraud and identity management strategy at LexisNexis Risk Solutions.

“These factors feed on each other and require an integrated and holistic approach to detecting, assessing and mitigating fraud risks moving forward. 2021 will likely be another challenging year for the world in many ways, but organizations can and should make sure they take a comprehensive view of their customers so that they can effectively fight fraud,” Sutherland went on to say.

With a dealership offering tools for online payments, trade-in and financing still being greatly wanted by consumers, TrueCar’s latest shopper study also growing concern about individuals being able to afford their purchase.

On Monday, TrueCar released the fifth wave of its study into the impact of the pandemic on vehicle shopping and vehicle shoppers’ needs, six months into the COVID-19 pandemic.

“At the six-month marker, it’s encouraging to see that fewer shoppers now report being less likely to purchase a vehicle due to the pandemic than at any point during our research series,” TrueCar head of research Wendy McMullin said in a news release.

“Shopper concerns over vehicle affordability stood out, however, and we expect that trend to continue while inventory remains limited,” McMullin continued.

In TrueCar and ALG’s latest automotive industry forecast, average new-vehicle transaction prices are projected to have increased by 3.5% year-over-year for September, reaching $36,541 while automaker incentive spending is projected to be up 5.3% year-over-year for September, climbing to $4,001.

“As affordability concerns rise and new car inventory shortages continue, we can expect to see more consumers gravitating toward the used market where strong sales the past three to five years as well as high leasing adoption have resulted in a strong supply of late model used vehicles” said Nick Woolard, who is director of OEM analytics.

“We also foresee new-car shoppers expanding their consideration set to brands with lower cost entry level models in the popular utility and CUV segments to help drive down vehicle costs.”

TrueCar conducted its latest survey on Sept. 23 with 1,200 participants as confirmed cases of COVID-19 surpassed 7.1 million in the U.S. The major highlights from the study included:

• Shoppers’ concerns about being exposed to COVID-19 during their shopping process fell to the lowest point since March when widespread shutdowns began. While the 50% who state they’re very or extremely concerned about being exposed to COVID-19 is still a sizeable number, TrueCar pointed out that it’s down significantly from 56% in July and 62% in April.

• Although concern over virus exposure is ebbing, TrueCar discovered shoppers still desire a comprehensive online shopping experience as 41% state they would be encouraged to work with a dealer that allows them to configure their deal online. And the findings showed more shoppers than ever state they are doing more of their shopping online (35%) and visiting fewer dealerships (33%).

• Two-thirds (68%) of shoppers say they would be more likely to shop with a dealership offering online payments, trade-in and financing.

• Vehicle affordability concerns are at their highest levels across five waves of the study. TrueCar indicated that 51% of participants said they’re very or extremely concerned about being able to afford the vehicle they plan on purchasing or leasing.

• Consumer desire for lower interest rates and incentives as a factor to encourage vehicle purchasing are at their highest point (61%), across study waves.

• TrueCar noted that 29% of consumers surveyed said inventory availability is a factor that might deter a purchase.

• Fewer shoppers than at any other point during the study say the pandemic makes them less likely to purchase with the reading now at 20% versus a peak of 36% in April.

• Since wave No. 4 of the survey was fielded two months ago, TrueCar indicated shoppers’ need for a vehicle stayed consistent with 82% of shoppers stating their need for a vehicle remains the same or has increased despite the pandemic.

“Fewer car shoppers are now expressing concern over being exposed or exposing others in their vehicle shopping than at any other point in our COVID-19 research series,” McMullin said.

“Despite this, consumers’ desire to do more online and visit fewer dealerships is at its highest point now, hinting at a longer-term trend beyond the pandemic,” McMullin went on to say.

A New Jersey Volvo dealership reaped the benefits of when fintech firms collaborate with the goal of making digital retailing more efficient for both stores and their customers.

When COVID-19 hit back in March, New Jersey was shut down and Prestige Volvo principal Matthew Haiken was forced to lay off the dealership’s sales department.

At that time, Haiken had an online presence mostly designed to create interest and inquiries.

However, Haiken realized that he had an opportunity to continue to operate by transforming his business into “an internet dealership,” fully set up to accommodate sales transactions.

That’s when FRIKINtech and Market Scan entered the situation.

Prestige Volvo turned to FRIKINtech to help him in this endeavor. FRIKINtech’s lead-generation service, coupled with its illumiQUOTE technology, enabled Haiken’s trained customer service staff to move a consumer through the online process and provide penny-certain accurate payment quotes, that were VIN-specific and transaction-able.

“COVID-19 presented a challenge for every dealer in automotive retailing,” Haiken said in a news release. “When your sales showroom and the manner in which you do almost all of your sales get shut down, you can feel sorry for yourself or realize this is a massive opportunity.

“Being a small but nimble business, driven by creativity and a willingness to reinvent our business model — and how we actually accommodate clients — were key drivers. Couple that with the cutting edge technology and solutions that FRIKINtech and Market Scan offer and you have a powerful recipe,” he continued.

“Objectively, we’re simply providing the consumers with the experience they have been looking for all along. Being the No. 1 volume dealer in the country, with 100% of deliveries taking place at the customers’ homes, would have been an absurd notion a year ago — but that’s the new normal for us,” Haiken went on to say.

FRIKINtech co-founder and chief executive officer Alex Snyder elaborated about how Prestige Volvo is a sterling example of dealers realizing that consumers have a significant interest in being able to shop, purchase, and even take delivery, without setting foot in a dealership.

“Matthew makes technology work for him. By centralizing the conversation on payments, and working with the customer in the same tool, Matthew’s team grew engagement beyond everyone’s wildest expectations,” Snyder said.

“Moving deals from the illumiQUOTE experience into Market Scan’s mDesking is totally seamless and empowers Prestige Volvo to be far more creative in making deals happen whether the customer is in the showroom or when they were forced to buy from home,” Snyder went on to say.

Finally, Market Scan co-founder and president Rusty West described how the coronavirus pandemic accelerated development for stores like Prestige Volvo to continue on a path that other stores have been navigating for a much longer time.

“We are excited to see how Market Scan’s mScanAPI technology and mDesking solution work in tandem with what FRIKINtech offers,” West said. “We have seen a gradual, but slow change in retailing over the past two decades. COVID-19 has changed everything overnight.

“With consumers’ expectations much higher than ever before, they are driving the necessary changes in digital, modern retailing to create a new normal,” West continued. “This change presents a paradigm challenge for dealers who embrace or resist digital retailing: they will fail, survive or thrive.

“It is obvious that Matthew and Prestige are fully committed to digital retailing, and it’s great to see them thrive in doing so,” West went on to say.

To learn more about FRIKINtech, visit www.frikintech.com. To learn more about Market Scan, visit www.marketscan.com.

This summer, DigniFi gained nearly $300 million in resources to boost its vehicle-repair financing platform and landed a relationship Cox Automotive to launch FlexPay, an easy-to-use payment option offered directly through the Xtime platform.

On Thursday, DigniFi’s momentum continued with an endorsement from Volkswagen of America as a preferred vendor in its eConnect Flexible Payment Program.

Volkswagen’s 636 U.S. dealerships now can partner with DigniFi to offer service center customers access to financial flexibility in these trying times. DigniFi can enable customers to apply for short-term financing on their smartphone and receive an instant decision.

On average, dealerships that offer DigniFi increase service revenue by 20% annually, according to the company.

Today amidst the COVID-19 pandemic, DigniFi acknowledged that young working Americans increasingly depend on their vehicles for safe mobility. More driving entails more maintenance, and a recent LendingTree study found that 43% of all U.S. drivers, and 58% of millennials, have gone into debt as a result of vehicle trouble.

Furthermore, that survey showed 21% of these drivers accumulated this debt after the pandemic began. Nearly six out of 10 Americans, including 71% of millennials, have skipped necessary repairs because they cannot afford them, according to that survey.

Perhaps if these individuals seek repair assistance at Volkswagen dealership, they might be able to get assistance through DigniFi’s platform.

“COVID-19 has left young people in such a state of financial insecurity that many are choosing to skip repairs that are vital to the longevity and safety of their vehicle,” DigniFi chief executive officer Richard Counihan said in a news release. “In partnership with Volkswagen, we are changing that.

“We applaud Volkswagen for supporting flexible payment options that serve customers in their time of need,” Counihan continued.

DigniFi’s financing platform can help drivers afford repairs by providing access to flexible payment options and 0% financing for those who qualify. Customers complete the financing application on their personal smartphone in just a few minutes, ensuring a safe, contactless process for dealership staff and customers.

The company said approval rates on DigniFi’s platform are two times higher than the average credit card, serving customers across a wide range of FICO scores.

To date, more than 5,000 dealerships and auto service centers in the U.S. have used DigniFi to increase profitability and customer retention.

“Volkswagen owners should never have to choose between fixing their car and affording other basic necessities,” said Julia Howard, service lane technology business development specialist at Volkswagen of America.

“We are committed to offering the flexibility and understanding our customers need in these trying times. With the help of DigniFi, we will get our customers back on the road,” Howard went on to say.

Volkswagen dealers can visit dignifi.com/partners to get started with DigniFi.

The interaction with dealerships and finance companies is likely intense as ever, especially considering how much happens online nowadays because of the coronavirus pandemic.

How have dealership needs of finance companies adjusted? How have what finance companies need from dealers changed? Dealertrack lender solutions strategist Andy Mayers addressed those topics and more during this episode of the Auto Remarketing Podcast.

To listen to the entire conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Inovatec Systems Corp. asked dealerships to complete a survey to learn more details about how stores are completing their vehicle financing during the coronavirus pandemic.

While COVID-19 has impacted many components of dealership operations, the provider of cloud-based software solutions for financial institutions learned that one of the key elements of auto financing — time — remains paramount.

This week, Inovatec announced the results of its latest survey as dealers reported partnering with fewer than 20 finance companies to book installment contracts and leases, highlighting a competitive financial marketplace for providers.

Inovatec explained that its data sheds light on the importance of accurate and efficient financing processes in an environment where dealers can be selective about their provider partnerships.

When asked about their current dealership financing options, 58% of dealers reported relying completely on third-party financing, while 42% said they offer in-house financing. When asked about their finance preferences, 40% stated that they prefer to use their own in-house financing options over the help of a third-party financial institution.

Inovatec shared that respondents were further asked about their credit application procedures, transaction times and COVID-19 related changes in sales and processing time.

Of those stores surveyed, 75% said that customer credit application forms could take up to one hour to complete. When asked about the average transaction time, 39% of dealers reported their transactions take between one to two hours.

An additional 21% said a transaction takes between two to three hours, 12% said between three to four hours, and only 28% said it takes less than one hour.

When dealers were asked how long the average lender transaction processing time has increased during COVID-19, Inovatec learned that 62% said it has increased by approximately one hour.

“The results of the survey indicate a clear need for quicker, more effective lending technology processes that can increase the efficiency of existing systems that require ample amount of processing time,” Inovatec U.S. director of sales Brendon Aleski said in a news release

“It’s evident the financial marketplace is competitive and robust, and many lenders have struggled to adjust to the changing landscape during the pandemic.”

For more information, visit https://www.inovatec.com.

This episode of the Auto Remarketing Podcast features Wayne Miller, executive director of The Venture Center, which collaborates with the FIS Fintech Accelerator program to identify and help startup firms accelerate the development of innovative solutions that bring new capabilities to the financial-services community.

Miller explained why this fintech research and development initiative is even more crucial as the industry navigates the challenges triggered by COVID-19.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Back in May, Michael Sogomonian, the director of decision science at Digital Matrix Systems, suggested a series of actions finance companies could take to protect their portfolios during the coronavirus pandemic.

For this installment of the Auto Remarketing Podcast, Sogomonian revisited those recommendations in light of how risk factors have changed during the past couple of months.

To listen to this episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

Business leaders have largely embraced the rapid introduction of home working and digital processes as an inevitable necessity. Though the global lockdown has rapidly accelerated trends in digitalization, seeing many asset finance businesses moving their operations entirely online in a contracted timescale, the direction of these developments is not a new concept for the industry.

As a result, the past three months of Zoom, Teams and Slack meetings, shopping exclusively online, and a new appreciation for IT infrastructure staff, have defined a new — though not unexpected — future for how businesses will operate, long after office doors reopen.

In many cases, the enablement of remote working has required extensive staff support and guidance, the implementation of a range of new tools, and the assessment of policies and procedures for managing sensitive customer data. Despite this, digitalization was becoming increasingly essential to maintaining the flow of finance prior to the coronavirus outbreak, with its role already crucial in various aspects of everyday business, from customer communications to fast finance decisions.

With acceleration, however, asset finance businesses are experiencing a more prevalent focus on developing or enhancing self-service options to meet customer expectations. Both internally and externally, the disruption of business has prompted a tidal wave of enquiries, with asset finance in particular dealing with new customer requests to postpone payments, discuss arrears or resolve issues in sourcing new funds under government-backed schemes.

To expedite responsiveness to these queries, chatbots and artificial intelligence-driven services are seeing greater interest as a means of fast, convenient support. Meanwhile, other technologies such as e-Signing, e-Identification and document imaging services with built-in consumer notifications have seen a surge in uptake as a secure, straightforward means of speeding up administrative processes.

Where there are challenges in using digital methods or AI to handle customer service, complex queries can now be transferred to a workforce less burdened by everyday administration and paperwork. Though the immediate effect of such technology is to resolve straightforward issues swiftly, it also allows companies to provide high-level personnel support to customers who prefer not to use digital channels or where automated services aren’t appropriate for the complexity of the query.

On the other hand, the coronavirus outbreak has also prompted the need to assess potential compromises to traditional business strategies, particularly when it comes to risk.

For example, customers that entered the pandemic with a strong credit record may be in a very different position now, after three months of lockdown, as pay cuts and the looming threat of sudden redundancy remains a real concern for many. The risk of fraud in requests for forbearance or new finance is something to consider alongside helping customers who are experiencing genuine financial struggles. Payment deferrals have become standard across several industries in recent weeks; it remains to be seen what impact this will have on the market and consumer expectations in the months ahead.

In a recent seminar on the topic of operations and forbearance held by the International Asset Finance Network, Mel Chell, partner at Shoosmiths LLP, commented that ongoing communication with consumers would be a vital element of lenders’ survival through this period.

Chell explains that without this vital contact, businesses may have trouble getting in touch with consumers after payment deferrals and will need a strategy in place to communicate how and when payments are to be resumed. Lenders will have to consider a “long game” of wider mandates, concessionary options and communication strategies to offer their customers sensible decisions regarding contracts — particularly regarding options around contract termination, such as voluntary recovery, and the effect of payment deferral on future payments.

Furthermore, the ability to use data and analytics within the lending industry is increasingly under the microscope; the way lenders use this information on a real-time basis in response to these new issues will be critical to success. Embracing new technology services, such as open banking, enables a constant assessment of risk and, crucially, can facilitate anticipating customer needs proactively rather than reactively as they arise.

With the current situation remaining so dynamic, technology that provides a comprehensive means of gathering and managing data will be vital to obtaining the insights needed to adapt. Lenders must ensure they have measures in place to pre-empt evolving customer requirements, and both the technical and operational flexibility to accept a compromise of current standards if business is to remain sustainable and profitable.

Although much of the focus of a data-centric outlook is on achieving enhanced levels of customer service to retain business and minimize risks, the success of digitalization projects and technology investments often reduces costs in the long run – a bonus at present given the precarious position of the global economy.

To conclude, customer concerns over the loss of jobs and public health, as well as the forecasted imminent global recession, are likely to cull the number of new deals made throughout the remainder of 2020 and in the months to come. Competition will be fierce and, from a consumer perspective, decisions are more likely to be cost-led, particularly in the subprime space.

The ability to marry historical data with new factors will be a critical element of strategies for reaching out to customers that are currently struggling before they become delinquent. New technologies and robust contract management systems in place will mark the businesses best equipped to navigate the crisis.

Brendan Gleeson is group CEO at White Clarke Group.

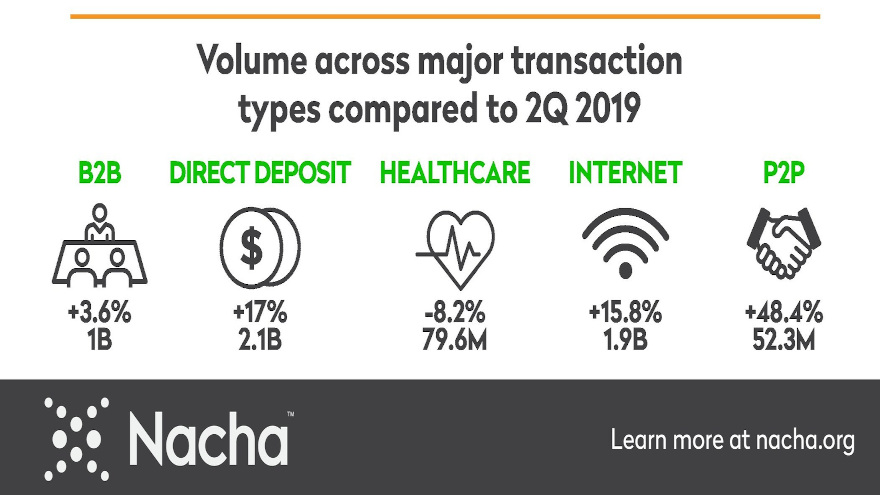

Last week, Nacha highlighted how much electronic financial transactions jumped year-over-year during the second quarter, triggered in part by the coronavirus pandemic.

The steward of the ACH Network, a payment system that universally connects all U.S. bank accounts and facilitates the movement of money and information, reported that Q2 ACH payment volume grew 7.9% compared to the same period a year earlier, reflecting the use of the ACH Network to deliver economic assistance to individuals and businesses, as well as an acceleration in the shift from paying by paper check to paying electronically.

Officials determined there were 6.6 billion payments made on the ACH Network during the quarter, representing a value of $14.7 trillion. Nacha indicated direct deposit payments rose 17%, due in part to federal and state assistance payments made to Americans in need.

“Direct deposit is the best way to reliably deliver pay and assistance to the vast majority of Americans,” Nacha president and chief executive officer Jane Larimer said in a news release. “All Direct Deposits are delivered on time and paid on the intended date. With same day ACH, urgent direct deposit payments can be initiated, and funds made available all within a single day.”

Nacha also noted Internet-initiated payments, which include primarily online bill payments and account-to-account transfers, increased by nearly 16%. Person-to-person transfers rose 48%. Officials explained both results are consistent with people making more payments remotely and shifting from paper checks to electronic payments.

Nacha went on to mention the pandemic’s impact was also apparent in some payment volume declines. Most dramatically, check conversion payments — in which a consumer’s paper check is processed electronically as an ACH payment — declined by 24%. At the point-of-sale, check conversion volume declined by approximately 45%.

Furthermore, officials pointed out a 4% decline in a recurring bill payment category is reflective of some disruption to certain types of monthly bills, such as mortgages, rent and loans, as well as the deferral of the federal tax payment deadline. Healthcare claim payments to medical and dental providers fell 8% from the second quarter of last year as many practices were shut.

Nacha closed its update by indicating same day ACH volume climbed 37% over a year earlier, with 81.6 million payments. The average dollar amount of a same day ACH payment increased by 33% in the second quarter, compared to the first quarter of 2020, as Nacha increased the allowable same day ACH transaction size to $100,000.

“ACH payments are for every day. As people, businesses and governments adapt to new conditions, they can rely on the ACH Network to deliver pay and benefits on time, to pay their bills, and so much more,” Larimer said.