Capital One discovered that perhaps not everything about the financing and retailing of vehicles changed because of the pandemic.

While buyers are increasingly using digital tools to shop for a vehicle, Capital One compiled data that shows U.S. consumers say they still value the in-person experience at dealerships. That assertion came via Capital One’s inaugural Car Buying Outlook, what the bank called the first-ever survey of both consumer and dealer preferences, attitudes and behaviors around auto financing.

Capital One said 77% of respondents reported they will research financing options and pre-qualification online more than before as a result of COVID-19.

At the same time, Capital One indicated in-person dealer experiences like test driving and negotiations are still important, with 82% of respondents saying they will visit more than one dealership.

“For most Americans, buying a car is one of the biggest purchases they’ll ever make, so it’s not surprising that they want to see, feel and experience this investment for themselves in person, alongside a trusted dealer advisor,” said Sanjiv Yajnik, president of financial services at Capital One.

“The future of car buying requires embracing a model that marries digital tools with physical experience, empowering customers to have the car buying journey they want,” Yajnik continued in a news release.

Additional survey findings delved into three crucial topics.

Value of the in-person experience

Capital One discovered consumers value in-person elements of the vehicle-buying experience and visited the dealership even in the midst of COVID-19, reinforced by these data points:

— 94% of buyers are most comfortable purchasing a vehicle from a dealership.

— 92% of buyers say the test drive is an important part of the buying process.

— 82% of future buyers say they plan to visit more than one dealership.

— 43% of future buyers plan to have financing discussions at the dealership.

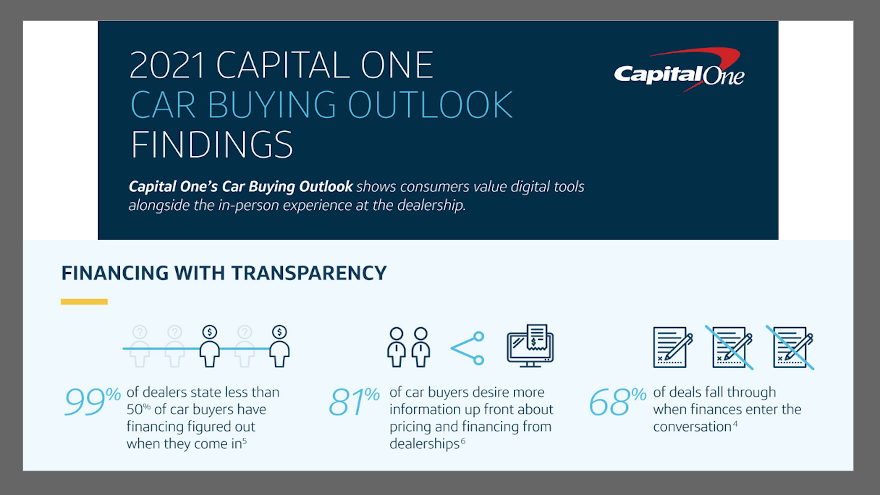

Financing with transparency

Capital One emphasized that dealers play an important role in how vehicle buyers understand their financing options as shown by:

— 68% of deals fall through when finances enter the conversation, according to both dealers and buyers.

— 99% of dealers state less than half of their consumers have their financing figured out when they arrive.

— 54% of buyers state they think about financing after settling on a vehicle, an increase from 43% in 2019.

— 81% of buyers say dealerships should provide more information up front about pricing and financing.

Dealers digitize to meet customer demands

Dealers are adopting digital tools to enhance customer engagement as more consumers turn online for shopping.

— 69% of dealers say the role of technology and digitization in dealer operations will be more important post-COVID-19.

— 56% of dealers have permanently increased their use of digital tools to combat business challenges brought on by COVID-19.

— 38% of dealers agree that the need to improve customers’ experience with technology has been accelerated by COVID-19.

Capital One’s Car Buying Outlook was compiled from findings from two surveys targeted to consumers and dealers.

The consumer survey of 1,000 U.S. adults ages 18 and older was conducted on behalf of Capital One Auto Finance using Ipsos. Of the 1,000, 348 have bought or leased a vehicle in the past 6 months and 652 self-reported that they’re planning to buy or lease a vehicle within the next two years.

The dealer survey of 401 current dealers was conducted on behalf of Capital One Auto Finance using Beresford. Of the 401 respondents, 132 were self-reported as owners, 133 as general managers, 30 as F&I directors, 83 as sales managers and 23 as internet managers.

One of the scenes in the 1967 film “Cool Hand Luke” includes a famous line that’s likely been turned into an array of social media content nowadays. It’s when Paul Newman is told, “What we’ve got here is a failure to communicate.”

Evidently, that’s also what’s happening to the interaction of dealerships and auto-finance companies as a result of the COVID-19 pandemic.

According to the J.D. Power 2020 U.S. Dealer Financing Satisfaction Study, disruption has been the name of the game in the automotive finance industry that has simultaneously been strained with day-to-day operations while being pushed to complete more transactions than ever digitally.

J.D. Power asserted that these changes — many of which dealers expect to be long-term — are forcing finance companies to evolve quickly in an increasingly digital environment.

“The pandemic has severely disrupted dealer-lender communication, with many dealers reporting that lenders were delayed or not available when they needed them, or not able to assist in a timely manner,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power.

“While the effect of the pandemic has pushed more sales to digital channels, 55% of dealers are saying they expect at least one in five of their sales to be digital in the next year,” Roosenberg continued in a news release. “With lenders’ sales reps forgoing on-site dealer visits and the credit staff and funders working remotely, the need for consistent and reliable communication is paramount to dealer satisfaction.

“Lenders will need to step up their efforts to deliver high levels of service to help facilitate sales, whether those transactions are happening virtually or in the dealership. Knowledgeable, helpful and available sales reps, credit analysts and funders can help drive incremental business,” Roosenberg went on to say.

The 2020 U.S. Dealer Financing Satisfaction Study is based on responses from 3,960 dealer financial professionals. The study, which was fielded in August-September, measures dealer satisfaction in six segments, including

— Captive luxury – Prime

— Captive mass market – Prime

— Lease

— Non-captive national – Prime

— Non-captive regional – Prime

— Non-captive subprime

In the captive mass market segment, the study showed Volkswagen Credit ranked highest in overall dealer satisfaction with a score of 939 (on a 1,000-point scale), followed by Subaru Motors Finance (934) and Honda Financial Services (902).

In the national banking ranking, TD Auto Finance came in highest in overall dealer satisfaction with a score of 931, followed by Ally Financial (922) and Chase Automotive Finance (872).

In the regional banking listing, Citizens One Auto Finance ranked highest in overall dealer satisfaction with a score of 954, followed by Huntington National Bank (910) and Fifth Third Bank (879).

In the subprime space, the study placed Ally Financial highest in overall dealer satisfaction with a score of 913, followed by Chase Automotive Finance (878) and Capital One Auto Finance (820).

And in the lease category, Audi Financial Services topped the overall dealer satisfaction ranking with a score of 970, followed by Subaru Motors Finance (946) and Volkswagen Credit (941).

If 2020 has proven anything, it’s that drastic changes can arrive that no one anticipated.

With that thought in mind, Swapalease.com wants to bring automakers and dealerships together with vehicle-lease holders who want out of their contract or to switch vehicles before the term has fully expired.

On Wednesday, the site launched new program called Mobility Leasing by Swapalease that’s designed to create a unique marketplace infrastructure dealers and OEM partners can utilize to help customers add more flexibility into their lease contracts.

For a variety of financial or life event reasons, Swapalease estimated that nearly eight out of every 10 lease drivers want to exit their lease contract before it is completed. However, site officials acknowledged buying out a lease contract to change vehicles is “a serious headache” that comes with considerable financial consequences.

“Life events like marriage, a new child, job transfer and income changes have all prompted consumers to change into a new or different vehicle,” Swapalease said.

A recent Swapalease.com industry report also found that dealers turn away roughly 38% of the customers who are interested in getting a new vehicle simply because they have more than a few months remaining on their lease contract. The new Mobility Leasing by Swapalease program is designed to immediately help dealers help these customers into a new vehicle.

Here’s how the program is geared to work.

Officials explained that when a customer walks into a Swapalease-participating dealership and leases a new vehicle, their salesperson informs them they can return the lease after satisfying an initial grace period (usually 12 months).

When the customer returns to exercise their option, the dealer immediately can begin the process of helping them out of their lease by listing the vehicle on the Swapalease.com lease transfer marketplace, where there is historically more buyers looking for gently-used leases to take over.

When a match is found, Swapalease indicated the customer is free to work out a deal on their next vehicle with the salesperson.

The site emphasized this process can eliminate the frustration and expensive penalty consumers face when they want to buy out their lease early, and it can help dealers offer immediate assistance to those customers hoping to exit their lease because a life event has changed their automotive vehicle preference.

“Auto dealers have had several years of solid sales performance, including 2020 when the pandemic was believed to be far more destructive earlier in the year,” Swapalease.com executive vice president Scot Hall said in a news release. “Despite all of this, many dealers are still missing out on millions in additional or lost revenue by having to turn away customers who want to shop for a new vehicle but feel stuck in their lease contract.

“Our new program eliminates all of this friction on both sides and enables dealers to immediately help their customers add more flexibility into their driving needs,” Hall went on to say.

Dealers interested in participating in the Mobility Leasing by Swapalease program may call (866) 792-7669, ext. 1000 for more details.

Drivers interested in exiting their lease even if their local dealer is not a participant may utilize the Swapalease.com direct-consumer marketplace located at www.Swapalease.com.

JM&A Group and MileOne Autogroup first began a relationship back in 2005; two years before Apple introduced the iPhone.

Now with smartphones prevalent and online activities commonplace, the independent provider of F&I products and the dealer group recently expanded their 15-year partnership to include the retailer’s new virtual F&I model.

Describing itself as “pioneers” in the virtual F&I space, JM&A Group highlighted that it is significantly expanding its footprint by delivering the process within the MileOne infrastructure.

During the initial phase of the partnership, which is expected to last approximately 90 days, JM&A Group said it will manage and conduct MileOne's Virtual F&I operations while training the dealer group's internal team on how to sustain a successful Virtual F&I program, before turning the reins over to the MileOne F&I manager and providing continued support.

As one of the largest automotive sales and service delivery networks in the Mid-Atlantic region, MileOne represents 27 automobile brands with 80 dealership locations throughout Maryland, Pennsylvania, Virginia and North Carolina.

The partnership with JM&A Group will initially go live at 15 to 18 dealerships with the possibility of future expansion, according to the company.

“The potential for time savings and new revenue streams through Virtual F&I is an exciting proposition for our industry as consumer preferences and buying habits shift,” said Scott Gunnell, group vice president for business strategy and operational excellence at JM&A Group.

“Virtual F&I has been proven to increase customer satisfaction by creating a seamless and modern way to conduct F&I at a time and place that’s convenient for them,” Gunnell continued in a news release.

While this new service model is an evolution and a learning process, JM&A Group indicatated that dealers utilizing virtual F&I have reported great gains both from a business profitability standpoint and in customer satisfaction.

The company’s initial testing of its virtual F&I service with various dealership partners began in October 2018, and has delivered more than 5,500 deals since that time.

JM&A Group said the collaboration with MileOne will be the first mass roll-out of its kind, providing valuable learning opportunities about the viability and scalability of this service going forward.

“We, along with JM&A Group, are being very strategic and intentional in how we have been implementing this offering during its pilot phase, which is critical to the process of launching something new in the automotive industry,” MileOne Autogroup division president Bill Baker said.

“Together we continue to refine the approach to deliver an efficient, customer-centric experience,” Baker went on to say.

Dealers who want to learn more about this product can go to info.jmagroup.com/virtual-fi.

Inovatec Systems Corp. asked dealerships to complete a survey to learn more details about how stores are completing their vehicle financing during the coronavirus pandemic.

While COVID-19 has impacted many components of dealership operations, the provider of cloud-based software solutions for financial institutions learned that one of the key elements of auto financing — time — remains paramount.

This week, Inovatec announced the results of its latest survey as dealers reported partnering with fewer than 20 finance companies to book installment contracts and leases, highlighting a competitive financial marketplace for providers.

Inovatec explained that its data sheds light on the importance of accurate and efficient financing processes in an environment where dealers can be selective about their provider partnerships.

When asked about their current dealership financing options, 58% of dealers reported relying completely on third-party financing, while 42% said they offer in-house financing. When asked about their finance preferences, 40% stated that they prefer to use their own in-house financing options over the help of a third-party financial institution.

Inovatec shared that respondents were further asked about their credit application procedures, transaction times and COVID-19 related changes in sales and processing time.

Of those stores surveyed, 75% said that customer credit application forms could take up to one hour to complete. When asked about the average transaction time, 39% of dealers reported their transactions take between one to two hours.

An additional 21% said a transaction takes between two to three hours, 12% said between three to four hours, and only 28% said it takes less than one hour.

When dealers were asked how long the average lender transaction processing time has increased during COVID-19, Inovatec learned that 62% said it has increased by approximately one hour.

“The results of the survey indicate a clear need for quicker, more effective lending technology processes that can increase the efficiency of existing systems that require ample amount of processing time,” Inovatec U.S. director of sales Brendon Aleski said in a news release

“It’s evident the financial marketplace is competitive and robust, and many lenders have struggled to adjust to the changing landscape during the pandemic.”

For more information, visit https://www.inovatec.com.

A Midwest franchised dealer group with its own finance company finalized a partnership with Inovatec Systems Corp. on Wednesday.

The provider of cloud-based software solutions for all financial institutions now has a relationship with Wisconsin Consumer Credit, the financial arm of the Van Horn Automotive Group with 16 dealership locations throughout Wisconsin and Iowa.

According to a news release, Wisconsin Consumer Credit will integrate Inovatec’s end-to-end solution into its lending services, rental payments and debt collection systems.

Executives explained Inovatec will partner with Wisconsin Consumer Credit to increase the speed and accuracy of lending decisions for the company’s current automotive and rental payments portal that are accessible through online and mobile phone applications.

Inovatec emphasized that its technology can provide a solution that is scalable and data-driven, allowing for more strategic and confident lending decisions to be made.

“At Wisconsin Consumer Credit we have a strong appetite for growth, and it is critical that we implemented the tools necessary to make that happen,” Wisconsin Consumer Credit vice president of operations Amanda Kroener said.

“We are excited for what the future holds now that the ground-work is completed for a successful loan origination and management system,” Kroener continued.

Inovatec highlighted that its agile process builder will allow Wisconsin Consumer Credit to create processes and workflows that can be seamlessly and almost immediately implemented with minimal training.

“The integration of lending technology and automation is allowing for seamless digital finance options for automotive shoppers,” said Bryan Smith, head of customer growth and strategic partnerships at Inovatec. “By implementing sophisticated systems, the speed of buying and lending process is significantly increased.”