NETSOL Technologies last week announced the opening of a new support and delivery center in Austin, Texas.

The global business services and enterprise application solutions provider highlighted its state-of-the-art facility will have the capacity of accommodating more than 100 employees who will facilitate the company’s growing customer base across the North American region.

“Our modern technology platform for the North American and global asset finance and leasing industry, NFS Ascent, is already live in North America and we found it necessary to expand our presence in the region to cater to the growing demand for the product in the market,” said Peter Minshall, executive vice president and head of NETSOL Technologies Americas.

“NFS Ascent is our premier product and we have a complete digital augmentation through various other finance and leasing solutions. Moreover, we have more innovative products in the pipeline,” Minshall continued in a news release. “Our new office in Austin will ensure we are able to continue meeting the demand for our products and services from customers in the United States, Canada and Mexico.

“The new facility will initially serve as our proximity delivery and customer support center for our tier one auto and equipment finance clients. Austin will house both our seasoned auto fintech domain experts as well as new hires, to provide delivery and project management oversight, including software architects, developers, business analysts, project managers, QA teams, and various other technical resources and essential pre-sales, sales and marketing personnel, among others,” Minshall added

“Austin is an ideal location as a leading technology hub in North America, to source and attract the talent we need.”

The company mentioned key executives who have been managing U.S. customers in other countries, such as Suhail Sarwar, program director for China, will also relocate to Austin.

“Austin is the perfect location for our second office in the United States,” NETSOL Technologies founder and CEO Najeeb Ghauri said. “Globally, we serve the world’s largest captive finance companies, banks and equipment finance and leasing companies, enabling them to futureproof their business operations and processes. North America is an important growth market for us, and we are strategically focused on increasing our presence and reach in this region.

“The new facility complements our Calabasas, Calif., location and enables us to offer enhanced support to NETSOL’s growing customer base in North America,” Ghauri continued.

“Our recruitment process is underway and in addition to adding new employees, certain existing employees will be offered the opportunity to relocate to Austin as well,” he added. “This is an exciting time for NETSOL Technologies Americas as we commit to further expanding our North American presence and exceeding client expectations.”

Let’s begin a new week with some upbeat projections based on the thinking from more than 300 chief financial officers and other senior finance executives.

BillingPlatform recently released its 2022 Trends in Finance Survey: Market Outlook & Strategies for Revenue Growth report. The revenue management solution provider said its findings offer an in-depth look at how the office of the CFO is adapting to macroeconomic trends, the resulting budget implications and challenges facing finance departments and what strategies they expect to drive revenue growth.

As companies across the U.S. and around the world continue to deal with the economic impact of the ongoing COVID-19 pandemic, BillingPlatform discovered that finance teams are realistic about its influence on 2022 budgets, but see signs of hope, including:

— Expecting less of an impact: 21% of respondents believe it is “likely” that economic factors will have a big impact on their budgets in 2022, down from 39% of all respondents in 2021.

— Growing budgets: Even against the pressure of the macroeconomic environment, 79% of respondents expect their 2022 budgets to grow, compared to just 61% in 2021, with 11% specifically anticipating a large increase in their 2022 budgets.

— The need for automated revenue recognition: 73% of respondents plan to invest in systems or technology to automate revenue recognition. In addition, 52% of respondents felt that they were at high or moderate risk for misstating revenue with their current revenue recognition process.

— Digital payments on the rise: When asked about the use of digital payments, 56% reported that between 50% and 89% of overall accounts receivables are received in the form of digital payments (compared to just half of respondents in 2021).

As the global economy continues to recover, BillingPlatform said it’s important for finance teams to position their companies for revenue growth.

When given a choice of seven options to rank for driving revenue, the survey revealed that the following were the top five choices:

— Launching new products and services to increase market mix (48%)

— Raising prices for existing products/services (39%)

— Offering promotional bundling and pricing incentives (38%)

— Expanding product footprint into new global regions (36%)

— Instituting new business models to combat market disruption (33%)

The survey also highlighted that underpinning the finance team’s goals and objectives for 2022 is a focus on technology and digital transformation across the entire lead-to-revenue process.

While companies are becoming more comfortable in leveraging cloud technologies (only 16% of respondents are concerned with transitioning their legacy infrastructure to the cloud versus 30% in 2021), there are new concerns for finance operations, according to the BillingPlatform survey, including:

— Top technology issues: The impact of technology on business processes looms large in 2022. Survey respondents said the top technology issues for finance operations included: automating or updating billing systems and processes (28%), using AI for predictive analytics (21%) and consolidating disparate system data for analysis (20%).

— Adopting digital payments: When asked what was preventing them from moving to digital payments, respondents listed fears of cybersecurity attacks and payment fraud (47%) as the top issues with a lack of systems and infrastructure (44%) and cost of service (40%) as additional concerns.

Conducted in December, BillingPlatform highlighted the survey included more than 300 CFOs and senior finance executives who represent a range of industries and vertical markets, with most of the companies generating $100 million or more in revenue per year.

“It’s an encouraging sign that finance executives are more optimistic about the economic outlook and budgets for 2022,” BillingPlatform chief executive officer Dennis Wall said in a news release.

“While the global pandemic, supply issues and economic instability continue to create long-term challenges, our survey shows a willingness across all industries to digitally transform revenue management processes to help businesses scale, grow and capitalize on new opportunities,” Wall went on to say.

The entire 2022 Trends in Finance Survey: Market Outlook & Strategies for Revenue Growth report can be downloaded via this website.

Solifi recently announced a collaboration with BlackBerry Limited that will integrate BlackBerry IVY with the company’s open finance platform to drive innovative, high-impact finance use cases for OEMs and automotive finance providers.

According to a news release, Solifi becames the first automotive finance technology provider to join the BlackBerry IVY Advisory Council to accelerate the development community’s focus on creating high-impact technology use cases and solutions that leverage in-vehicle data. Council members help drive the BlackBerry IVY roadmap, focusing on co-value development with a view to addressing key pain points that OEMs are looking to solve.

Experts explained BlackBerry IVY will complement Solifi’s open finance platform by providing a reliable and secure way to access a broad catalog of vehicle sensor data to enhance existing value-added services, optimize business operations, and power a new wave of innovative products and services.

“Access to rich, real-time data will accelerate the predicted once-in-a-generation shift to new financing models that are fundamentally changing the way consumers and businesses use and manage vehicle resources,” Solifi said. “This shift will drive increasing numbers to forego traditional ownership of vehicle assets in favor of pay-for-use or shared-ownership financing models.”

As the newest member of the BlackBerry IVY Advisory Council, Solifi contends that it is uniquely positioned to promote and advocate for the global automotive finance industry, which includes OEMs, banks and independent automotive financing firms.

With many parts of the broader automotive industry eager for granular real-time and near real-time data sets to determine residual value assessments, maintenance and repair costs, for example, experts went on to say that integration with BlackBerry IVY will enable Solifi to provide its customers with better fleet management services and more intelligent cost-forecasting.

“We are thrilled and honored to partner with BlackBerry and the broader IVY Advisory Council members,” Solifi chief executive officer David Hamilton said in the news release.

“By 2030, forecasts indicate 95% of all new vehicles sold globally will be connected. Experts anticipate this exponential increase in connectivity and data availability will represent $250 billion to $400 billion of incremental revenue opportunity for the automotive industry.”

Hamilton added that now is a timely opportunity to bring forward the voice of the automotive finance industry and help deliver solutions that provide real value to OEMs, finance companies, fleet managers and consumers.

“We look forward to collaborating with BlackBerry and introducing intelligent, data-driven solutions for the next generation of retail, fleet and wholesale automotive financing,” Hamilton said.

Solifi strives to deliver a global portfolio of end-to-end, integrated solutions to the automotive finance market, which are used by many of the world’s leading OEMs and financial services firms.

Solifi pointed out that its open finance platform easily can integrate with third-party partners, like BlackBerry and help secured finance companies automate their workflows, reduce risk, launch innovative product and service offerings, and make more informed decisions about their businesses.

“It’s a great pleasure to welcome Solifi as the newest member of the BlackBerry IVY Advisory Council, a select group of companies across the transportation and mobility industries who are quite literally driving and shaping the future of what it means to get from A to B,” said Peter Virk, vice president of IVY product and ecosystem at BlackBerry.

“Solifi are trusted by leading players across both the automotive and financial services value chains, and with BlackBerry IVY, together, we have the potential to turbocharge innovation and unlock new streams of revenue in an industry on the cusp of profound transformation in terms of how vehicles are valued, paid for, managed, repaired and optimized,” Virk went on to say.

Alfa, creator of the asset finance software platform Alfa Systems, has announced a successful project completion with PEAC Finance.

Completed in July, the project delivered an Alfa Systems upgrade alongside the implementation of new business for the Barclays Asset Finance operation, acquired by PEAC in June.

The company indicated that the upgrade to Alfa Systems version 5.6 gave PEAC access to a wealth of new features, including support for risk-free interest rate products and usage-based billing, alongside a comprehensive redesign of the user interface to improve user experience and increase operational efficiency.

Aligned with a move to cloud infrastructure and a change of database technology to PostgreSQL, and bringing performance benefits and room for growth, the upgrade project laid a solid foundation for future portfolio acquisitions, according to Alfa.

PEAC also transitioned new business onto Alfa Systems for its recently acquired Barclays Asset Finance portfolio. The company said this required the launch of new products and changes to operational processes for PEAC in a short timeframe.

“We were delighted at the speed with which we were able to onboard the Barclays business to Alfa Systems, and how smoothly the upgrade progressed,” PEAC Finance managing director Steve Charlton said. “The delivery from Alfa was fast and high quality, and our close working relationship enabled us to meet the project timescales.

“We were able to onboard the new portfolio without the need for system enhancements, which reinforces our decision to implement Alfa Systems originally. We continue to benefit from the wide range of products and services it supports, allowing us to grow our increasingly diverse portfolio all on a single system,” Charlton continued.

The company added that work has already started to migrate the existing contract data from the Barclays portfolio into PEAC’s Alfa Systems application.

PEAC originally implemented Alfa Systems in 2017 in a year-long project, following its acquisition by HPS Investment Partners in early 2016.

“We’re delighted to have helped PEAC achieve so much in such a short timeframe,” Alfa client account director Geoff Walters said. “This success is testament to the close working relationship between the two organizations, and we’re pleased that another client has benefitted from the flexibility and quality of the Alfa Systems product. We’re now focused on completing the successful transition of the Barclays portfolio to PEAC.”

The Clearing House (TCH) released its 2021 Consumer Survey: Data Privacy and Financial App Usage that shows consumers who are using digital banking and fintech apps on a regular basis to manage their finances want greater disclosure and control over their personal financial data,

However, the study also indicated these consumers know little about fintechs’ data collection, management and sharing practices.

In particular, 2021 survey findings show that more than three-quarters of respondents were largely unaware that fintech apps:

— Commonly use third-party providers to gather users’ financial data (80%)

— Can sell personal data to other parties for marketing, research, and other purposes (76%)

— Retain access to information even after the app is deleted (77%)

— Regularly access personal data even when the app is closed or deleted (78%)

— Typically assume no responsibility if a security breach compromises consumer data (80%)

In each of these areas, the Clearing House said a majority of consumers also expressed discomfort with fintech app data practices. In fact, majorities reported that they would prefer increased disclosure from fintech apps as well as greater control over their data, including:

— Clear disclosure of what data third parties have access to

— Clear explanations of possible risks associated with using the app

— Clear disclosure of what access is granted by apps’ terms and conditions

— Control over which financial accounts and what kind of data can be accessed by a third party

— Requiring explicit consent to every third party that seeks to access personal data

— An ability to set permissions within a fintech app

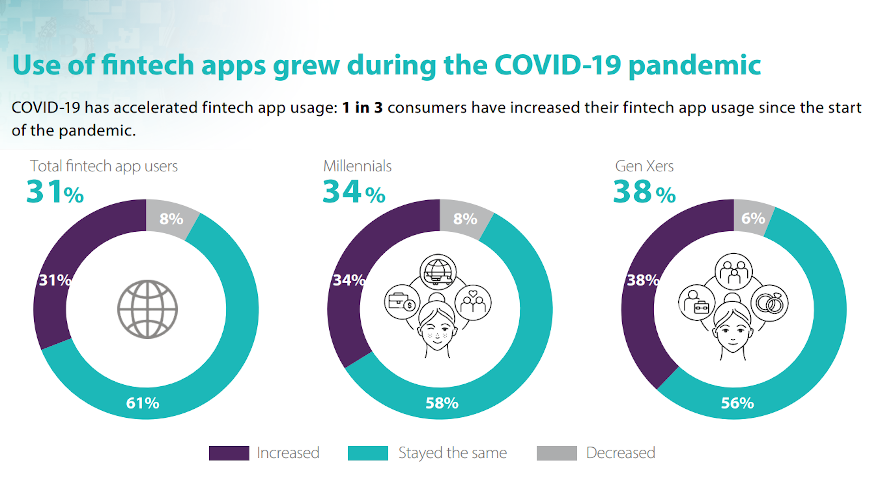

The survey also showed that one in three fintech app users have increased their usage since the start of the pandemic, with growing interest in investment services and robo-advisors. Yet, the Clearing House said 77% of consumers admit to not reading the lengthy terms and conditions and those who do read them generally report a lack confidence in their understanding.

“More consumers are using financial apps, but they’re still in the dark about how their data is used, accessed, and stored,” said Ben Isaacson, senior vice president of product strategy at TCH. “Once again, these numbers confirm that people want a better understanding about these practices and they want a greater say in how their personal and financial data are used.”

The poll was conducted as part of TCH’s Connected Banking initiative, an ongoing effort that seeks to enable transmittal of bank-held financial data to fintechs in a more secure way, while improving the customers’ control over their financial data and transparency over the permissioned use of their data.

TCH initially fielded the consumer survey in 2018 and released an update in 2019. Hall & Partners conducted the 2021 survey on behalf of TCH between Sept. 9 and Sept. 27.

“The objective was to get a fresh take on what consumers are feeling in 2021 and dive deeper into their perceptions about how fintech apps access, use, store, and share their data,” TCH said.

The full study — which can be downloaded via this website — was conducted online and consisted of a total sample of 4,019 U.S. banking consumers: 2,013 financial app users and 2,006 non-financial app users.

Solifi — which is the global fintech software combination of IDS, William Stucky & Associates and White Clarke Group — recently announced the company has secured 11 new customers and 14 go-lives to date in 2021.

With its unique open finance platform driving record-breaking growth and digital transformation, Solifi highlighted through a news release that it now serves 34 of the top 50 U.S. banks and seven of the top 10 U.S. equipment financing firms, including two of the three largest independents.

“We are thrilled to offer secured finance organizations an easier way to manage and grow their business through our open finance platform delivered via a true SaaS solution,” Solifi chief executive officer David Hamilton said in a news release.

“Access to an integrated technology ecosystem gives our customers greater economies of scale with a single strategic technology partner — everything in one place — as they pursue transformation to a digital-first business model,” Hamilton continued.

Solifi looks to deliver a global portfolio of end-to-end integrated solutions for equipment, working capital (asset-based lending, factoring, wholesale/floorplan), and automotive finance firms.

“We’ve built a market leading technology platform that enables companies to benefit from an integrated and efficient software-as-a-service (SaaS) solution. The same pay-for-what-you-use technology we deploy at large, global banks, independent, and captive finance firms is the same technology and level of service we offer to growth stage organizations who benefit from a consumption-based, not user-based, pricing structure,” Solifi officials said.

To learn how Solifi’s unified technology platform could transform a legacy system into a digital-first business model, visit www.solifi.com.

Now that MotoRefi is more than just an auto refinance platform, the company has a new name, too.

According to an announcement made on Wednesday, the company launched an expanded brand, as it’s now known as Caribou with a new company logo and new product offering.

Caribou’s technology not only can help users unlock lower rates on their auto financing, but it also can help consumers find a path to lower auto insurance payments, as well.

As a part of the new offering, Caribou said it will work directly with insurance carriers to provide a range of different insurance options to consumers. The two-for-one experience is designed to deliver unprecedented convenience and multiply savings for consumers in a single platform.

The company said it will be announcing specific details on insurance carrier plans early next year.

In the last year, Caribou has cemented itself as a leader in the auto fintech space.

The Emerging 8 honoree has experienced more than 400% revenue growth and a 300% increase in origination volume year-over-year. The company’s headcount also grew by more than 150%.

To date, executives said Caribou’s platform has facilitated the funding of more than $1 billion in refinanced contracts, saving customers more than $60 million over their lifetime.

“This is a major milestone for the company and for automotive fintech as the market continues to accelerate, presenting a unique opportunity for the Caribou brand to lead,” Caribou chief executive officer Kevin Bennett said in a news release. “The Caribou name stands for freedom, stability and trust.

“The rebrand represents an exciting next step as we work towards expanding Caribou into a full-fledged digital agency, where we can provide consumers with flexibility and additional ways to save money on their cars,” Bennett went on to say.

To learn more about Caribou, visit http://www.gocaribou.com.

More reasons why Cherokee Media Group added the National Auto Venture & Investors Conference to Used Car Week arrived on Monday from Bain & Company.

Bain’s second annual global technology report explores the impact of tech on business, consumers, economies, geopolitics and broader society.

Firm experts said technology has cemented itself at the foundation of the global economy over the past decade. Although COVID-19 remains a global threat to economic recovery, they pointed out that extraordinary growth is being fueled by increased and sustained tech-driven innovation.

“Companies that have seen their share prices rise are most often either tech firms or businesses with a tech-led strategy,” said David Crawford, leader of Bain's global technology practice.

“Over the last decade, technology has proven itself to be much more than a siloed industry. Instead, tech has become the primary force of disruption and value creation in nearly every industry around the world,” Crawford continued in a news release.

Anne Hoecker, partner at Bain and head of the firm’s Americas technology practice, added these perspectives.

“Businesses — from ‘born tech’ companies to ‘brick and mortar’ — have recognized the outsized benefits of adopting a tech-led strategy in today’s world,” Hoecker said.

“As we look across the technology landscape, the bottom line is clear: if businesses want to flourish in the current environment, executives must be comfortable with the pace and implications of tech-driven disruption,” she went on to say.

The Bain report — which can be downloaded via this website — delved into five themes, including

Venture capitalists are doubling down on technology

Technology is reshaping the economy, and it starts with venture capital.

In recent years, Bain experts have seen a clear trend toward tech companies capturing a growing share of venture funding.

In fact, Bain’s Startup Investment Cruncher database found that, from 2010 through 2020, tech start-ups took in the majority of venture funding across all deals by independent venture capital (VC) firms and corporate venture capitalists.

In the first quarter of this year, tech start-ups accounted for nearly 70% of total venture investments, according to Bain research.

Bain found that venture investments in technology initially declined by 13% between 2018 and 2020 — the first decline of its kind since 2012. But experts said tech venture investments came roaring back during the COVID-19 pandemic, with the total value of tech venture investments doubling in the first quarter of 2021 from the same period in 2020.

“This is more than twice the growth rate of investments in other sectors. The pandemic fueled this growth by accelerating the shift toward later-stage deals that had been underway for several years, increasing the total value of tech deals in the Series C stage or later by 165% year-over-year in the first quarter of 2021,” Bain said.

“Artificial intelligence (AI) and cloud technology are proving to be the primary drivers of venture investment interest,” the firm continued. “Over the past decade, these two segments of technology have grown more than twice as fast as venture investments in all other sectors, and now make up more than one third of total venture investment in technology.”

US hyperscaler M&A spending has benefited consumers and enriched market dynamics

Bain explained that hyperscalers, also known as the tech giants, are the leading cloud tools and service providers globally.

The firm said seven major hyperscalers currently dominate the tech landscape: Alphabet, Amazon, Apple, Facebook, and Microsoft in the U.S., and Alibaba and Tencent in China.

Experts acknowledged the common narrative is that hyperscalers spell the end for competition. However, Bain has found that most big tech acquisitions in the U.S. benefit consumers and do not hamper competition. Rather, over the last 15 years, hyperscaler M&A activity has proven to contribute to vibrant markets and create immense value for consumers, according to Bain’s analysis.

The firm noted that hyperscaler M&A activity represents only a small piece of the overall landscape, with hyperscaler M&A accounting for only 5% of total tech start-up exits within the last year.

But according to Bain’s research, most big tech acquisitions end up benefiting consumers in at least one of three ways: by reducing pricing, by increasing access to innovation and by improving products overall.

Bain conducted an analysis of the five U.S. hyperscalers over the last 15 years. The firm’s analysis of all $300 million-plus acquisitions, between 2005 and 2020, found that 72% of US hyperscaler M&A spending created value for consumers.

“Big tech acquisitions have not only pressured incumbents to innovate. These acquisitions have increased market fragmentation, fueled greater venture capital investments and spurred competition between the hyperscalers themselves,” experts said.

“This set of insights provides another useful perspective for both acquirers and regulators, as they work to ensure these deals continue to create — not destroy — value,” they added.

Tech decoupling will define the future: How the US and China are leading the way

Although the global technology industry will continue to be co-dependent for the foreseeable future, Bain said several major countries are now investing more than ever in technology and supply chain independence.

Experts indicated the U.S. and China’s complicated relationship over the last few years has pushed the world in this direction.

Over the last several years, Bain explained that the decoupling of the U.S. and China’s economies and technology ecosystems has gained momentum, with both countries making multi-billion-dollar investments in their domestic technological development for the future.

China, in fact, plans to spend a $1.4 trillion over the next few years in infrastructure technologies, such as artificial intelligence (AI), semiconductors and 5G networks, according to Bain.

“The two nations’ recent moves signal that decoupling will be a defining feature of the technology landscape for years to come. Recent supply chain disruptions, such as the global chip shortage, have only exacerbated these challenges and compounded the desire for self-reliance,” experts said.

According to Bain’s analysis, from 2016 to 2020, technology-related foreign direct investment between the U.S. and China dropped by 96%, “creating uncertainty for tech companies around the world and requiring tech executives to be comfortable with constant adaptation.”

The firm then added, “although decoupling appears all but inevitable, multiple chokepoints assure the global technology industry will remain co-dependent — for now.”

The semiconductor equilibrium is shifting

While there has been intense focus on the shortage of semiconductors this year, Bain determined a fundamental transformation — with even bigger implications for the future of silicon — has picked up momentum: the rise in demand for specialized processors.

Fueled by today’s computing environments, experts indicated this fast-rising demand in specialized processors is shifting an equilibrium between special- and general-purpose (GP) silicon that has existed for decades.

Bain explained that special-purpose chips, known as application-specific integrated circuits (ASICs), have historically occupied an important, yet smaller, segment in the market than general-purpose chips.

“However, as hyperscaler cloud service providers (CSPs) continue to design more custom processors in-house, the demand for specialized silicon has increased, blurring the long-standing dynamic between special- and general-purpose processors,” experts said.

“Yet, despite the growth of ASIC providers and the burst of venture funding in specialized silicon vendors, this shift in equilibrium does not spell the end of the general-purpose chip. While special-purpose processors remain difficult to program, the GP model’s flexibility allows it to be desirable in most use cases,” they continued.

“This equilibrium shift, however, opens an opportunity for companies across the semiconductor ecosystem to thrive, if they can commit to being nimble and adaptable in this changing landscape,” experts went on to say.

Welcome to the new technology economy

This year’s global technology report also detailed the cloud-based computing model’s “remarkable” impact on the technology industry over the last two decades.

Throughout the report, Bain used its analysis of the cloud technology landscape to deep dive into topics such as software-as-a-service (SaaS) subscription models, artificial intelligence and hybrid cloud adoption.

Other sections of this year’s report explore some of the tech industry’s rising challenges, including the competition for top tech talent, supply chain disruption and regulatory scrutiny across the U.S. and Europe.

The past two weeks have been quite eventful for AutoFi.

After finalizing a relationship with Santander Consumer USA, the platform for end-to-end digital automotive sales and financing announced it has teamed up with TrueCar to provide customers with an “easy and seamless” process to explore auto financing directly from the TrueCar marketplace.

According to a news release, this new experience will allow consumers who have configured payments on TrueCar and are ready to make a vehicle purchase to apply for financing through their chosen dealer, powered by AutoFi’s Lending as a Service.

The firms explained that consumers are then able to see the offers from a variety of finance companies, compare them and decide what’s right for their needs. Once they’ve selected their financing options — including chosen protection products — they can quickly complete the transaction with their dealer, AutoFi and TrueCar said.

“AutoFi is a fintech pioneer in the automotive segment and a proven digital retailing solution used by thousands of dealers,” TrueCar chief executive officer and president Mike Darrow said in the news release. “We’re excited to partner with them to enable the discovery of auto finance options for our customers.

“It is yet another way we want to give TrueCar shoppers the best experience possible while making a car purchase,” Darrow continued.

TrueCar highlighted these new capabilities are a key step in its path toward enabling a marketplace-based end-to-end auto buying experience. Consumers can explore pricing, a value for their trade-in, accurate monthly payments and soon auto financing offers and protection products all on the TrueCar platform.

“TrueCar is laser focused on using leading technology to enhance the consumer experience,” AutoFi CEO and co-founder Kevin Singerman said in the news release.

“AutoFi is excited to partner with TrueCar to extend our digital sales and financing solutions, beyond just the dealership’s website, but to TrueCar’s vast audience of millions of car shoppers,” Singerman went on to say.

Charlotte Principato is a financial services analyst at research firm Morning Consult, which recently released a study that examined consumers’ trust in fintech, considering both start-ups and well-established players in financial services.

In fact, a segment of the report said, “Jamie Dimon is right to be scared.”

To explain what she meant by the reference to the top boss at J.P. Morgan Chase and more, Principato discussed the report and more during this episode of the Auto Remarketing Podcast.

To hear the conversation, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.