Point Predictive highlighted this week that another finance company has successfully completed its Auto Fraud Manager implementation.

Not long after Lobel Financial finished the journey, CIG Financial now has, too, leveraging real-time consortium fraud alerts and sophisticated artificial and natural intelligence-powered fraud scores to substantially enhance its own predictive models to help determine the most appropriate stipulations or waivers and improve the speed and quality of funding decisions.

Sona Shakoory, risk operations manager at CIG and one of this year’s Women in Auto Finance honorees, described the benefits she observed during the Auto Fraud Manager implementation.

“CIG Financial’s fraud prevention efforts are already world-class, but we are always searching for tools and technology to help us improve,” Shakoory said. “We found such a tool with the Auto Fraud Manager, and we were incredibly impressed by the results from a retrospective analysis and pilot.”

“CIG is a proud member of Point Predictive’s anti-fraud consortium since fraud risks are best managed through a collaborative, cross-industry approach,” she continued.

Jeff Butler, president of the Irvine, Calif.-based full-spectrum auto finance company, added, “a major aspect of delivering consistent performance is flushing out fraud, and that is inherently more prevalent in the subprime space. Point Predictive, we believe, significantly enhances our ability to do that.”

Point Predictive senior fraud consultant Justin Davis also pointed out that an enhanced applicant experience originated from CIG’s focused results.

“Auto Fraud Manager will greatly increase its operational efficiency, allowing its underwriting and fraud analysis teams to zero in on where the fraud typically resides,” Davis said.

Point Predictive co-founder and chief executive officer Tim Grace described how his company’s advanced data science can improve on an established and effective model.

“Even the most rigorous of lenders can benefit from Auto Fraud Manager, which is powered by a vast, unique dataset consisting of billions of risk elements gleaned from over 100 million historical auto loan applications,” Grace said.

“By intelligently automating aspects of the lending decision, CIG is able to get a 25x separation in their risk analysis, one of the best results we have seen in our experience,” he continued.

“CIG was one of the earliest lenders to realize Point Predictive’s vision of reduced losses, increased revenue and a more automated process that protects against the widest range of first- and third-party fraud risks,” Grace went on to say.

Finance companies interested in more information about Auto Fraud Manager or Point Predictive’s consortium data can send a message to [email protected].

Point Predictive announced this week that Lobel Financial has successfully completed its Auto Fraud Manager implementation.

With Auto Fraud Manager now in place, Lobel Financial will use Point Predictive’s fraud alerts and scores in real-time within the finance company’s native origination environment across its entire application volume.

In feedback delivered to Point Predictive, the risk management department at Lobel Financial described the benefits of enhancing its in-house models through its consortium approach. According to a news release, Auto Fraud Manager “makes our operation better at reducing loss while eliminating unnecessary friction for trustworthy borrowers.” Also, the unique scores and alerts “give us data that we’d never see in our own silo.”

Point Predictive explained that the Anaheim, Calif.-based finance company’s enthusiasm stems from key features of the consortium-based solution that can address elevated risks of fraud. Such predictive features include geographic proximity to prior fraud, repetition or manipulation of Social Security Numbers, income misrepresentation, synthetic identity fraud and suspicious claims of employment or sources of income.

Point Predictive co-founder and chief executive officer Tim Grace added that Lobel Financial’s experience provides more evidence that Point Predictive’s cross-industry fraud consortium, combined with its patented Artificial + Natural Intelligence, can deliver a real-time, automated financing experience that is both consumer- and dealer-friendly.

“Auto Fraud Manager is a solution powered by unique automotive finance data that reduces or eliminates a wide range of fraud and misrepresentation risks,” Grace said about the company’s advanced data science that can modernize operations.

“By intelligently automating aspects of the lending decision, lenders can confidently grow their portfolios and deliver a modern borrower experience that gets more trustworthy people into the cars they need,” Grace continued.

“Collaboration and innovative data science are principles that we share with Lobel and we’re thrilled to work with their team,” he went on to say.

Finance companies interested in more information about Auto Fraud Manager or Synthetic ID Alert can send a message to [email protected].

Point Predictive chief fraud strategist Frank McKenna made his first appearance on the Auto Remarketing Podcast since this spring’s Automotive Intelligence Summit to discuss fraud trends that have surfaced recently.

McKenna also gauged the current mood of finance companies; whether they feel they’re making strides in the fight against fraud or if they’re as frustrated as ever.

To listen to the episode, click on the link available below, or visit the Auto Remarketing Podcast page.

Download and subscribe to the Auto Remarketing Podcast on iTunes or on Google Play.

TransUnion is making another significant investment in helping finance companies and other clients keep fraud out of their book of business.

On Monday, TransUnion said it has signed a definitive agreement to acquire Neustar, an identity resolution company with leading solutions in marketing, fraud and communications, from a private investment group led by Golden Gate Capital and with minority participation by GIC.

According to a news release, the acquisition is for $3.1 billion in cash and is expected to close during the fourth quarter. It expands TransUnion’s digital identity capabilities through the addition of Neustar’s distinctive data and analytics, enabling consumers and businesses to transact online with greater confidence.

“The credit information and analytics that TransUnion provides make trust possible between consumers and businesses. As digital commerce continues to grow globally, TransUnion’s powerful digital identity assets, enhanced by Neustar’s distinctive data and digital resolution capabilities, will enable safer and more personalized online experiences for consumers and businesses,” TransUnion president and chief executive officer Chris Cartwright said in the news release.

The company highlighted that the acquisition advances TransUnion’s strategy to diversify from its core credit solutions with complementary digital marketing and fraud mitigation capabilities.

Executives added that Neustar’s OneID platform will help to unify the digital identity capability TransUnion has built and acquired in recent years including the TLO data assets and fusion platform, the iovation device reputation network and the digital marketing capabilities of Tru Optik, among others.

“TransUnion and Neustar share a similar strategic vision, culture and focus on building innovative identity-based solutions which enable trusted connections between companies and people,” said Charlie Gottdiener, president and CEO of Neustar. “The two companies’ complementary businesses, products and relationships will offer benefits for our combined customers, employees and other stakeholders across a diverse set of markets.”

TransUnion mentioned other key benefits of the proposed transaction, including:

• The addition of Neustar’s talent, data and products will enhance TransUnion’s position as a global information and insights company providing diverse, high-growth credit and non-credit solutions at scale.

• Neustar’s OneID identity resolution platform will increase the speed and sophistication of TransUnion’s identity-based solutions, strengthening TransUnion’s offers across industry verticals in the U.S., as well as global markets in the longer term.

• The combined company will be well positioned to solve customer and consumer challenges related to identity

• Neustar’s broad customer base advances TransUnion's diversification into new markets and verticals and presents significant opportunities for cross-selling and innovation.

Executives pointed out that Neustar’s security business, which is excluded from the transaction, will become a Golden Gate Capital and GIC portfolio company following close.

“Over the last four years, Neustar has meaningfully scaled its core portfolio of solutions, completed strategic investments in its growth platforms and technology, and enhanced its winning culture,” Golden Gate Capital managing director Rishi Chandna said. “We are proud to have partnered with management and the talented Neustar team to execute this successful transformation into a leading provider of identity-driven solutions which leading brands rely on every day to connect with their prospects and customers.

“We have great respect for TransUnion and are confident they are the right partner for Neustar in its next chapter,” Chandna added.

It’s not quite RoboCop policing your flow of financing applications, but Point Predictive certainly is leveraging new technology to help finance companies from becoming fraud victims.

The San Diego-based company that provides machine learning solutions and was one of the first Emerging 8 honorees has unveiled its Fraudbot technology to protect finance companies against systematic fraud so they can safely and dramatically automate and accelerate originations.

The company highlighted Fraudbot is Point Predictive’s purpose-built, artificial intelligence technology that continuously digs through more than 100 million loan applications and more than 10 billion risk attributes to detect the hidden links across a vast data set.

Point Predictive said a Fraudbot can emulate the actions of human fraud analysts as they forensically search for suspicious data anomalies and connections across applications that are often invisible to the human eye.

The Fraudbots deployed earlier this year to Point Predictive consortium members, who have already received 2,000 fraud ring alerts, accounting for $351 million in suspected fraud so far in 2021.

With Fraudbots working around the clock, the company indicated even finance companies without a large in-house fraud analyst team can now receive fraud alerts directly through Point Predictive’s outsourced fraud mitigation service.

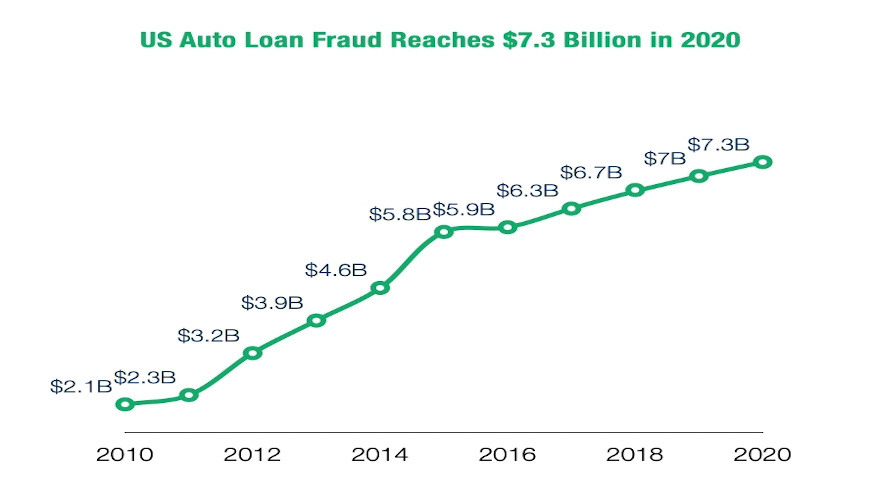

According to Point Predictive’s recent research, the top U.S. auto finance companies are exposed to more than $7.3 billion in auto fraud, and mortgage lenders faced a shocking $20 billion in mortgage lending fraud exposure last year.

The company explained that providers endure this level of risk because it can be difficult to trust information presented on loan applications from consumers, correspondents and dealers.

“Underwriters routinely grapple with synthetic identities, income and employment misrepresentation, document forgeries, straw borrowing schemes, and collateral fraud. Each of these unique schemes exhibits very different signals in the data they receive through digital loan applications. The only way to keep up while still connecting the dots is by automating fraud detection,” Point Predictive said.

Point Predictive co-founder and chief executive officer Tim Grace looked to put this innovation milestone into perspective.

“The consortium approach gives lenders a cross-industry perspective on the trustworthiness of the information they receive on credit applications,” Grace said in a news release.

“Innovations like Fraudbot provide one of the earliest indicators of a fraud threat,” he continued. “Lenders who can automatically clear truthful applications are in the best position to quickly fund more performing loans.”

Point Predictive developed Fraudbot as a purpose-built automation to uncover suspicious patterns across successive loan applications that are submitted to U.S. finance companies that individual operations may not be able to see.

Fraudbots were initially deployed to find clustered fraud activity concentrated in high-risk locations across the U.S. In its first week on the job, Point Predictive said Fraudbot identified a cluster of 600 separate applications around the Houston area that were connected by only a single hidden link.

The company mentioned another Fraudbot was used to root out fake employer names by linking phone numbers associated with prior instances of synthetic identity fraud and similarly forged income documentation.

Point Predictive went on to say the synthetic identity Fraudbot can reduce origination friction by 90% on tasks involving discrepancies across Social Security numbers, dates of birth, names and tumbled data.

“Some lenders are moving forward with digital automation more slowly than possible because of the massive fraud risks that they could face without adequate defenses. Point Predictive is in the absolute best position to help lenders better identify concentrated fraud activity by fraudsters operating in the shadows, as well as fraud perpetrated by trusted third parties like rogue mortgage brokers and a few shady car dealerships,” said Frank McKenna, co-founder and chief fraud strategist at Point Predictive.

“The consortium provides a bird’s eye view across lenders and loan types, so member organizations can see those fraud patterns forming weeks or even months before the first early payment default occurs,” he continued. “We’re excited to launch this service to lenders to expose these patterns as they happen.”

Due to the autonomous nature of Fraudbot, Point Predictive emphasized that all consortium members benefit from its output.

Fraudbots can generate consortium-wide or finance company-specific alerts.

Grace added that there is no practical limit to how many Fraudbots that Point Predictive’s data scientists and fraud experts can deploy, remaining committed to directing attention where the friction is the greatest.

“Because fraud is historically difficult to classify, it makes more sense to unclog the pipeline by telling lenders which data they can trust,” Grace said.

Point Predictive invites any finance companies that wish to explore Fraudbot and other benefits of consortium membership to contact the company by sending a message to [email protected].

FICO recently made moves to enhance its solution aimed at curtailing a growing fraud trend that’s caught the attention of the Federal Trade Commission (FTC) as well as authorities in the United Kingdom.

FICO announced the latest release of the FICO Falcon Fraud Manager model for retail banking, which leverages machine learning to enhance scam detection in tandem with Falcon Fraud Manager’s existing third-party fraud detection score.

According to a news release, it’s all geared to provide banks with improved detection and prevention of authorized push payment (APP) scams.

FICO highlighted the new Scam Detection Score leverages targeted profiling of customer behavior to help FICO Falcon Fraud Manager clients detect 50% more scam transactions.

Powered by more than 120 patents in fraud-specific machine learning and AI, the FICO Falcon Platform can help financial institutions detect and prevent fraud seamlessly, in real-time. More than 2.6 billion payment accounts worldwide are protected by Falcon.

FICO explained APP scams manipulate customers into sending money to an account controlled by scammers. They can take multiple forms, including mobile game payments, online purchases that never arrive, or text messages from someone the victim mistakenly believes is a friend, business partner or bank official.

According to the FTC, more than 350,000 Americans reported losing a total of more than $245 million to fraudulent online purchases in 2020, including a record high to scams that started on social media.

In the U.K., FICO mentioned that UK Finance reported a 5% increase in losses to such fraud in 2020 with reported losses of £479 million.

FICO emphasized these scams have proved particularly difficult to detect as the person initiating the payment is the legitimate account holder — who has been tricked into making the payment.

FICO noted that the new Scam Detection Score can help Falcon customers overcome the challenge of detecting APP scams, using the distinguishing characteristics revealed by the FICO Falcon Fraud Manager model for retail banking to identify 24 times the number of fraudulent transactions on favorite devices.

“The proliferation of mobile payment apps and new open banking standards in the wake of the pandemic have caused authorized push payment (APP) scams to grow,” FICO chief analytics officer Scott Zoldi said in the news release.

“FICO has been following how the sophistication of scams are evolving at breakneck speed and we are strategically innovating to offer our clients in retail banking the cutting-edge scam detection analytics needed to combat today’s criminals,” Zoldi added.

Fraudsters seem to be following the old cliché of “follow the money.”

As more consumers go online for banking and other financial transactions, new research from TransUnion found that fraudsters are ramping up their efforts in the financial services industry.

When comparing the last four months of 2020 and the first four months of 2021, TransUnion discovered the percentage of suspected global digital fraud attempts in financial services increased 149%.

In the U.S., TransUnion indicated financial services fraud attempts increased 109%.

Across industries, analysts said the rate of suspected digital fraud attempts globally rose 24% when comparing the first four months of 2021 with the last four months of 2020. In the U.S., the percentage of fraud attempts increased at a similar rate (25%) during the same time period.

TransUnion monitors digital fraud attempts reported by businesses in varied industries such as gambling, gaming, financial services, healthcare, insurance, retail and telecommunications, among others.

The conclusions are based on intelligence from billions of transactions and more than 40,000 websites and apps contained in its flagship identity proofing, risk-based authentication and fraud analytics solution suite — TransUnion TruValidate.

“The rate of fraud attempts are up globally and especially in the financial services industry because fraudsters understand this is where the most high value transactions are taking place,” said Shai Cohen, senior vice president of global fraud solutions at TransUnion. “We are seeing more financial services organizations implement fraud prevention solutions with some success, though our findings make it clear that this is not the time to relax.

“As lenders increase their customer acquisition efforts in an increasingly digital environment, fraud mitigation needs to be a part of every marketing campaign,” Cohen continued in a news release. “Financial institutions also need to do even better to ensure they are providing a secure marketplace that offers friction-right experiences to consumers.”

A secure marketplace is of special importance as COVID-19 accelerated the shift to digital financial transactions, according to TransUnion.

In late September, 40% of consumers with a financial account said in a TransUnion commissioned survey that they are using digital platforms more frequently since the onset of the pandemic.

The same survey also determined 60% of consumers said that the majority of their financial transactions are conducted via mobile applications.

TransUnion defines true identity theft — the top type of digital fraud in financial services — as the consumer using a stolen identity to commit fraud with the victim being a real person. The second and third most reported type of digital fraud by TransUnion financial services customers are first party application fraud and account takeover, respectively.

Analysts explained first-party application fraud is when a consumer refuses to repay legitimately incurred debts and/or falsely claims to be a victim of identity fraud to evade debt. Analysts added account takeover is when someone other than the owner of an account uses the account without permission, indicating that the account has been maliciously compromised.

“An interesting dynamic is playing out where we are seeing other industries facing far fewer suspected fraud attempts than what has been observed in financial services. In some cases, we are seeing a decline in such fraud attempts,” said Melissa Gaddis, senior director of customer success with global fraud solutions at TransUnion.

“The key takeaway for businesses is that fraudsters do not treat every industry equally,” Gaddis added. “They often pick and choose an industry to focus on based on the time of year or what businesses are seeing more transactional activity. At times, fraud attempts are simply conducted at random simply to determine if businesses are prepared to meet their challenges.”

Fresh off finalizing two more integrations with outside firms that will be leveraging its providing of credit reports, compliance solutions and soft-pull products and services, 700Credit is set to host an online event focused on a costly topic: synthetic identity fraud.

Featuring experts from Equifax, Experian and TransUnion, 700Credit is hosting this event on June 15 and June 17 for dealerships and finance companies because the firm said synthetic identity fraud was reported to cost businesses $1.3 billion in 2020 and is projected to grow to $1.8 billion in 2021.

Topics on the session agenda include:

— Define a synthetic identity and how it is created

— Quantify how the problem is today in automotive retail

— Discuss trends in synthetic incident rates and the effect of COVID on this type of fraud

— Perform a crime scene analysis: what does a synthetic fraud attack look like and how to recognize and detect it

— Review models that are addressing synthetic ID Fraud and how to put them to work for your store today

— Discuss frequent misconceptions on whose responsibility it is to detect and prevent Synthetic ID Fraud

— Introduce future predictions and what the future holds for the industry

The experts who are scheduled to discuss these topics and more include:

— Lloyd Laudorn, senior solutions engineer at Experian

— Mike Urban, vice president of trusted identity services consulting at Equifax

— Chad Gluff, director of identity and fraud solutions at TransUnion

“Our goal with this free webinar is to inform, educate and equip our automotive, power sports, RV and marine dealer communities with information about this alarming and costly fraud that is now occurring in our industry, and discuss tools and techniques to keep their dealerships — and their customers — safe,” said 700Credit managing director Ken Hill, who will be the event orchestrator.

“This is a global issue where no one is immune, which is why we asked our partner experts from Equifax, Experian and TransUnion to bring this important message to the market. The credit bureaus have each been working diligently to study the issues and bring solutions to market that help dealers detect and protect their business and customers to minimize loss,” Hill went on to say.

Registration for the sessions can be completed on this website.

2 new integrations

In other company developments mentioned in separate news releases, 700Credit also recently finalized a pair of integrations; one with 321 Ignition and another with Astute RM

Dealers who use the 321 Ignition platform to build and manage their websites now can easily enable 700Credit soft pull technology to gain visibility into their customer’s FICO Score, full credit profile and receive accurate payments for vehicles of interest.

“321 Ignition is proud to integrate with 700Credit to allow car dealerships to seamlessly receive credit applications and sensitive personal information with industry-leading encryption,” said Lyamen Savy, chief executive officer and co-founder of 321 Ignition. “This integration allows car dealers using 700Credit, Dealertrack, RouteOne, or CUDL to offer free credit score lookup services and easy online car loan financing applications in a mobile-first manner to generate additional leads using credit hard pulls and soft pulls.

“Our mobile-first credit application process has an average of 55% completion rate with features that make it easy for users to complete the application including a responsive keypad for easy text/number inputs, Google Maps integration for predictive address entry, and adaptive information boxes that appear or disappear based on previous responses,” Savy continued.

And 700Credit’s product alliance with Astute RM, a cloud-based CRM and communication platform, can enable dealers and consumers to communicate and collaborate seamlessly across desktop and mobile devices. This friction-free platform is designed to simplify the sales process and provide a smooth workflow so dealers can complete sales quicker.

“Our integration with 700Credit makes desking customer deals a quick and easy process. Customers expect efficiency and the seamless integration with 700Credit in Astute RM achieves that goal,” said Brendan Hurley, managing partner of Astute RM.

“Our 20-year relationship with 700Credit gave both development teams a unique ability to create an industry leading integration,” Hurley continued. Using the 700Credit QuickScreen solution saves precious time by giving great insights into the customer’s credit profile right inside Astute RM as you craft the perfect deal.”

Hill described the value 700Credit is bringing to clients through each of these integrations.

“The addition of soft pull credit reports to 321 Ignition’s lead generation tools benefits both the consumer and the dealer. Consumers can shop for vehicles and receive accurate payment quotes without impacting their credit score” Hill said. “An accurate Payment quote removes the friction when transitioning to closing the deal. Dealers also benefit by receiving insight into the consumers credit position at the top of the sales funnel allowing the Dealer to set consumers expectation right from the start.”

Hill then added, “We are pleased to welcome Astute RM to the 700Credit family. Their innovative CRM and communication platform enables dealers to prescreen their customers and access their credit report information easily.

“The integration of our prescreen solution will give dealers a unique insight into their customer’s credit profile and estimated monthly payments on prospective vehicles before posting a hard inquiry,” he went on to say. “With the consumer’s FICO score and equity on trade-in, dealers can work the right deal, right away, putting the consumer in a vehicle they want with payments they can afford.”

Point Predictive pinpointed a number in connection with one of the important topics being discussed this week during the Auto Intel Summit.

According to the company’s Auto Fraud Report, Point Predictive said fraud reaching $7.3 billion of originations last year, with chief fraud strategist Frank McKenna calling 2020 “a pivotal year for fraud risk.”

The San Diego-based artificial intelligence and data science company that helps finance companies and other lenders predict the trustworthiness of application information highlighted that its 2020 fraud report includes unique insights about income and employment misrepresentation, identity fraud, and collateral fraud for U.S. auto finance companies, as well as the impacts of the pandemic on this important sector of the economy.

“The pandemic heightened fear and anxiety and likely made consumers more vulnerable to scams and frauds,” said McKenna, who will be one of the experts appearing on Wednesday during the Auto Intel Summit.

“The ensuing economic turmoil caused an immediate and dramatic rise in unemployment, increasing some people’s willingness to engage in loan fraud,” McKenna continued in a news release. “Furthermore, a flood of stimulus money and generous lender forbearance programs simultaneously increased the level of fraud while delaying lenders’ ability to recognize it.”

The latest analysis came from the Point Predictive Anti-Fraud Consortium dataset, a secure and private data science collaboration among dozens of U.S. finance companies.

The consortium now includes more than 94 million applications, containing 85 individual fields of data on each application.

Every month, activity from 45,000 dealerships contributes to a view of vehicle financing that spans nearly all 157,000 U.S. dealers. This data set tracks more than $2.7 billion in known early payment default and the company’s machine learning techniques have generated more than 10 billion risk attributes.

“Consortium data is deeper and more predictive of risk than any credit bureau or public records source,” McKenna said. “This vast and deeply specific data on each loan application gave us incredible clarity into fraud risk that lenders are exposed to.

“And one thing is for sure: The risk of fraud to auto lenders rose dramatically as the pandemic unfolded,” he went on to say.

One of the most significant trends addressed by the analysis was the marked uptick in income and employment misrepresentation.

As the lockdowns began, Consortium members were suddenly impacted by a 100% year-over-year increase of falsified income and employment claims on auto-finance applications, a level of risk which continued throughout the year.

Detected among the trend was the use of more than 300 new, but bogus employers each month, used by applicants to fraudulently convince lenders of steady sources of income.

Completing a complex risk picture for fraud managers, the report noted that scams like synthetic identity creation, credit washing, and even lawful impacts of credit repair efforts complicate efforts by lenders to guard against fraud in order to more quickly serve trustworthy borrowers.

“As a lender, you have to keep your guard up at all times. No assumptions can be made about any loan application until every single one clears a satisfactory fraud review,” Elite Acceptance Corp. executive vice president Steve Christensen said in the news release. “The analysis and outlook from Point Predictive is essential reading in order to be prepared.

For Elite Acceptance, the crucial trends to get ahead of are the dealer implications, such as a sale price inflation of over 10% on the top 10 models,” Christensen continued. “I credit Point Predictive for exposing the truth behind what is presented to lenders by dealers and borrowers.”

Additionally, the analysis of auto-finance fraud in 2020 covers other concerning trends, including clusters of fraud in certain states and metropolitan statistical areas (MSAs), new tactics used by self-employed borrowers, patterns of suspicious and ambiguous naming conventions for fake employers, synthetic identity centers, Social Security number manipulation tactics, vehicles subjected to inflated pricing, and the systematic disputing of multiple negative tradelines on a credit report in order to make the borrower appear to be more creditworthy.

Point Predictive added that power booking is also on the rise, wherein dealers inflate sale prices and falsify down payments to increase the chances of loan approval.

The Auto Fraud Report concludes with recommendations from Point Predictive’s fraud experts for staying ahead of fraud in 2021.

Point Predictive chairman and chief executive officer Tim Grace encouraged finance companies to bolster fraud defenses and staff.

“In times of crisis, there is often a need to reduce costs to stay profitable amidst decreasing volumes. But this is a mistake,” Grace said. “The rate of fraud and risk will increase over the next 18 months, making fraud prevention and staffing one of the most important investments you can make in maintaining the health of your portfolio.

“Resist the urge to cut costs where it matters most,” he added.

Auto, mortgage and student lenders who are interested in receiving a copy of Point Predictive’s annual Auto Fraud Report can send a message to [email protected].

A Massachusetts man is scheduled to be sentenced on June 1 after being indicted by a federal grand jury in Providence, R.I., last summer for alleged participation in a wide-ranging conspiracy to defraud seven credit unions through a scheme involving used-vehicle financing.

According to a news release from the Justice Department, Hiancarlos Mosquea-Ramos of Lawrence, Mass., pleaded guilty in U.S. District Court in Providence, as one of nine individuals involved in the fraud.

Officials said Mosquea-Ramos admitted in July that he participated in schemes as the seller or the buyer of used vehicles, defrauding:

— Merrimack Valley Credit Union

— Sharon Credit Union

— Digital Federal Credit Union

— Metro Credit Union

— Direct Federal Credit Union

— RTN Credit Union

— Workers Credit Union

Officials indicated that Mosquea-Ramos admitted that by using his own personal identification information along with counterfeit earnings statements, fabricated automobile purchase and sales agreements and counterfeit motor vehicle titles, he obtained at least $92,000 in fraudulent financing to purchase fictitious cars.

A co-conspirator, Jonathan Pimental, also of Lawrence, Mass., was allegedly listed as the seller of the cars. Pimental is awaiting trial on a charge of conspiracy to commit bank fraud, according to the Justice Department.

Additionally, officials said Mosquea-Ramos admitted that he posed as the seller of various used cars. It is alleged co-conspirator Rolando Estrella,of Lawrence, Mass., prepared false purchase and sales agreements and counterfeit automobile titles naming Mosquea-Ramos as the seller of the vehicles.

DOJ said the financial institutions approved a total of more than $275,200 in used-vehicle financing, disbursing checks made payable to Mosquea-Ramos. The checks were quickly deposited and the funds quickly withdrawn and divided among participants of the conspiracy, according to officials.

The Justice Department said Estrella also is awaiting trial on multiple charges of conspiracy to commit bank fraud, bank fraud, aggravated identity theft, and fraudulent use of a Social Security Number.