Now with the pandemic showing a few signs of abating, perhaps normal activities involving the leasing of vehicles can resume, if they haven’t already in some locations and dealerships.

As new-vehicle lease opportunities compete against aggressive financing incentives for new-model buyers, J.D. Power indicated that executing effective lease retention and conquest strategies will be critical for captives, manufacturers and dealers in 2021.

According to the J.D. Power 2021 U.S. End of Lease Satisfaction Study, the key to capturing returning lessees is coordinated communication through the right channels at critical moments in the auto shopping journey — sometimes starting as early as 12 months prior to lease-end.

“There is a formula for optimizing new-vehicle lease recapture and conquest strategies,” said Patrick Roosenberg, director of automotive finance intelligence at J.D. Power.

“With such a high percentage of returning customers leasing again, the key to retaining those customers along with first-time lease customers is delivering the right proactive messaging at the right time via the right channel,” Roosenberg continued in a news release.

“The more lenders, OEMs and dealers can coordinate their communications to connect with customers at the right moments in their leasing journey, the more likely they will be to develop strong, long-term relationships,” he went on to say.

J.D. Power elaborated about four other key findings of the 2021 study, including:

• Returning lessees likely to lease again: Nearly three-fourths (72%) of returning mass market lessees and 68% of premium market lessees lease another vehicle when their existing lease ends. Among first-time lessees, J.D. Power found that those numbers drop to 50% among mass market customers and 57% among premium market customers, illustrating the importance of strategies focused on recapturing existing lessees.

• Customers considering next vehicle a year in advance of lease end: The survey showed both returning and first-time lessees start considering a new vehicle as early as 12 months prior to the end of their existing contract and can be heavily influenced at this stage by proactive communication from fincace companies, dealers and manufacturers.

• Coordinated communication maximizes retention: J.D. Power pointed out that lease customers respond in a variety of ways to different types of communications from finance companies, OEMs and dealers at different phases of their customer journey. Coordination between these three key players can have a significantly positive effect on customer satisfaction and retention, according to the study.

• Inspections and inspectors influence customer satisfaction: The study reinforced the component that inspections play a pivotal role in end of lease satisfaction. J.D. Power said addressing customer pain points or areas of opportunity in the lease return process can lead to a better experience and increase lease retention. Analysts suggested that finance companies need to coordinate efforts with lease inspection companies within their SLAs to ensure the best customer experience possible and execute on multiple KPIs surrounding the process.

After considering those elements, which finance companies enjoyed the most success, according to the study?

J.D. Power said Honda Financial Services ranked highest in end of lease satisfaction in the mass market category, achieving a score of 848 (on a 1,000-point scale).

Hyundai Motor Finance (843) and Toyota Financial Services (843) finished in a tie for second place.

Deadlocked in third place and above the segment average were Ford Credit and GM Financial, which both scored 839.

The 2021 U.S. End of Lease Satisfaction Study is geared to identify lease-end practices and timely marketing opportunities that optimize lease retention for the same brand and at the same dealer. The study is based on responses from 2,761 mass market and premium vehicle lease customers who are within six months of lease end.

The survey was fielded from November through January.

Alliant Credit Union now is originating vehicle leases in four different states thanks to assistance from Credit Union Leasing of America (CULA).

Having supported vehicle leasing for credit unions for more than 30 years, CULA is helping power the expansion of Alliant Credit Union’s vehicle leasing program into Pennsylvania, completing its first leases in the Keystone State in February.

CULA has been successfully working with Alliant Credit Union since 2017, administering its existing vehicle leasing programs in Colorado, Michigan and Florida.

Based in Chicago, Alliant Credit Union is one of the largest credit unions in the nation with more than $13 billion in assets. Alliant’s history spans more than 80 years and it has more than 500,000 members nationwide.

“As consumers emerge from the economic and personal challenges of the pandemic, they are seeking affordable, flexible options in vehicle financing, which is exactly what leasing provides,” Alliant Credit Union vice president of consumer lending Jeremy Pinard said in a news release.

“And, with vehicle leasing representing over one-third of all new auto financing in Pennsylvania, it just makes sense for us to offer it to our members there, and to continue expanding that opportunity to more states nationwide,” Pinard continued.

“CULA has been doing leasing for a long, long time, and they have the historical data to answer any questions a credit union might have. As a partner, they really help you understand the complexities of a lease. Specifically, important elements like residual risk, wear and tear and how that ties into the risks related to leasing,” Pinard went on to say. “With CULA, you can work to create a leasing program that fits your credit union’s desires, goals and expectations.”

CULA enables credit unions to offer the flexibility and affordable payments of new-vehicle leasing, while also helping them grow membership, diversify lending options and increase yield.

CULA experienced first-hand the recent swell of consumer interest in leasing. After the challenges of stemming from spring’s COVID-19 lockdown, the fourth quarter represented CULA’s best quarter ever for lease originations booked through its credit union partners.

“October 2020 was a record-breaking month for CULA, with more than $150M in lease originations in a single month,” CULA president Ken Sopp said. “We finished the quarter strong, and we are well-positioned for a successful 2021.”

And part of the reason CULA can make that claim is because of enhanced relationships with clients such as

“We are excited to further deepen our partnership with Alliant Credit Union as they expand their auto finance offerings into new states,” CULA vice president of business development said Mark Chandler. “Their member-first philosophy, along with their commitment to digital services, means they are well-positioned to meet consumer interest in leasing in today’s new pandemic normal.

“Like Alliant, CULA has a customer-first philosophy, and we are laser-focused on helping our credit union partners achieve their growth goals,” Chandler added.

Visit www.cula.com to learn more details about the firm’s leasing program.

MUSA Auto Finance now is fueled with technology provided by defi SOLUTIONS.

This week, MUSA Auto Finance announced its partnership with defi SOLUTIONS to handle the day-to-day servicing of the company’s entire lease portfolio. MUSA said in a news release that it will now focus all its efforts on growing originations and creating what executives believe to be “a surprisingly easy leasing experience through automation.”

Pete Siciliano, who recently joined MUSA Auto Finance as chief operating officer, said customers will noticeably benefit from this partnership.

“Since our operations will become more streamlined by leveraging defi SOLUTIONS’ existing, scalable servicing platform, we can pass these savings on to our customers in the form of lower rates,” Siciliano said. “We’ll also continue to improve the leasing experience by focusing on what MUSA knows best – innovative technology and automation.”

Before joining MUSA, Siciliano served as COO for Freedom Truck Finance and held leadership roles with Sierra Auto Finance, Exeter Finance, GE Money and Ford Motor Credit. He brings over 30 years of automobile, commercial truck and mortgage finance experience to MUSA Auto Finance.

Siciliano will oversee the defi SOLUTIONS partnership to ensure the successful implementation of MUSA’s servicing strategies in 2021 and beyond.

“By teaming up with defi SOLUTIONS, we will gain tremendous efficiencies in our operations while also providing world-class service to our customers,” MUSA Auto Finance chief executive offer Jeff Morgan said. “We’re thrilled that defi SOLUTIONS brings in-depth servicing experience across the full credit spectrum since MUSA originates from subprime all the way through super-prime.

“In addition, defi SOLUTIONS has a strong history of servicing leases. This is a rare find and especially important to MUSA. Auto leases are structured differently from standard loans, with unique terminology and nuances,” Morgan continued. “We are confident that defi SOLUTIONS will expertly execute MUSA’s servicing strategy, delivering another year of strong performance across the portfolio.”

Susie Storey, chief sales officer at defi SOLUTIONS, said the MUSA partnership is exciting for defi SOLUTIONS because both companies are driven by technology.

“We’ve seen MUSA create first-of-its-kind automation for leases,” Storey said. “And at defi, we’ve developed a modern, modular and robust servicing platform to deliver our servicing operations,” she said. “I see this collaboration as two tech companies joining forces to deliver a fantastic leasing product to the market.”

Morgan added that he looks forward to expanding into new business lines as a result of the efficiency gains.

“Our vision for MUSA is growing larger by the day, and strategic partnerships like this one set us up for hitting those long-term goals even faster,” he said.

For more information, visit www.musaautofinance.com.

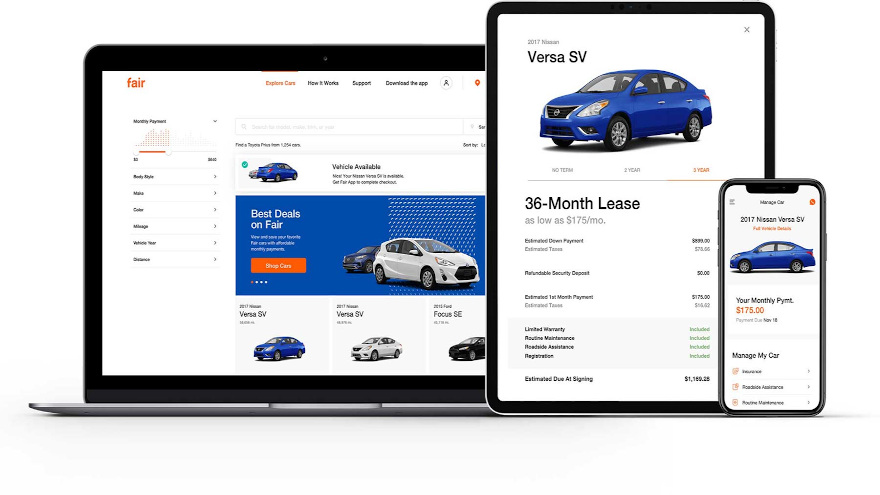

Fair secured a significant new path this week to grow its used-vehicle leasing business, announcing that the platform now will be offered through LendingTree, one of the largest online lending marketplaces.

Through the partnership that Fair called a “true watershed moment,” visitors to LendingTree can be instantly pre-qualified for a personalized monthly payment for either a month-to-month, two-year or three-year vehicle lease originated by Fair, the company detailed in a news release . The user would then receive a link to check out with the Fair app.

Fair highlighted visitors also will be able to shop other local inventory available on its website, select the vehicle they want, sign for it on the web or Fair app and drive it for the length they choose — all without any dealer negotiation or physical paperwork.

In addition, Fair pointed out that every leased vehicle comes with routine maintenance, roadside assistance and a limited warranty that last as long as the leaseholder keeps the vehicle.

“This partnership is a clear acknowledgment of Fair’s market leadership as a simple, affordable and flexible alternative to traditional auto financing options,” Fair chief executive officer Bradley Stewart said.

“For the first time, Fair customers will be able to use LendingTree’s expansive platform to connect with Fair to lease a used car from right where they are and for as long as they choose, representing a true watershed moment in Fair’s adoption potential.”

LendingTree auto loans general manager Mike Funderburk explained why the company entered into this relationship with Fair.

“LendingTree shares Fair’s commitment to improving access to mobility for the millions of consumers who rely on us for straightforward and affordable financing solutions,” Funderburk said. “Together we can leverage our mutual synergies and unique digital platforms to forge a new era for today’s auto shoppers.”

If 2020 has proven anything, it’s that drastic changes can arrive that no one anticipated.

With that thought in mind, Swapalease.com wants to bring automakers and dealerships together with vehicle-lease holders who want out of their contract or to switch vehicles before the term has fully expired.

On Wednesday, the site launched new program called Mobility Leasing by Swapalease that’s designed to create a unique marketplace infrastructure dealers and OEM partners can utilize to help customers add more flexibility into their lease contracts.

For a variety of financial or life event reasons, Swapalease estimated that nearly eight out of every 10 lease drivers want to exit their lease contract before it is completed. However, site officials acknowledged buying out a lease contract to change vehicles is “a serious headache” that comes with considerable financial consequences.

“Life events like marriage, a new child, job transfer and income changes have all prompted consumers to change into a new or different vehicle,” Swapalease said.

A recent Swapalease.com industry report also found that dealers turn away roughly 38% of the customers who are interested in getting a new vehicle simply because they have more than a few months remaining on their lease contract. The new Mobility Leasing by Swapalease program is designed to immediately help dealers help these customers into a new vehicle.

Here’s how the program is geared to work.

Officials explained that when a customer walks into a Swapalease-participating dealership and leases a new vehicle, their salesperson informs them they can return the lease after satisfying an initial grace period (usually 12 months).

When the customer returns to exercise their option, the dealer immediately can begin the process of helping them out of their lease by listing the vehicle on the Swapalease.com lease transfer marketplace, where there is historically more buyers looking for gently-used leases to take over.

When a match is found, Swapalease indicated the customer is free to work out a deal on their next vehicle with the salesperson.

The site emphasized this process can eliminate the frustration and expensive penalty consumers face when they want to buy out their lease early, and it can help dealers offer immediate assistance to those customers hoping to exit their lease because a life event has changed their automotive vehicle preference.

“Auto dealers have had several years of solid sales performance, including 2020 when the pandemic was believed to be far more destructive earlier in the year,” Swapalease.com executive vice president Scot Hall said in a news release. “Despite all of this, many dealers are still missing out on millions in additional or lost revenue by having to turn away customers who want to shop for a new vehicle but feel stuck in their lease contract.

“Our new program eliminates all of this friction on both sides and enables dealers to immediately help their customers add more flexibility into their driving needs,” Hall went on to say.

Dealers interested in participating in the Mobility Leasing by Swapalease program may call (866) 792-7669, ext. 1000 for more details.

Drivers interested in exiting their lease even if their local dealer is not a participant may utilize the Swapalease.com direct-consumer marketplace located at www.Swapalease.com.

Credit Union Leasing of America (CULA) recently recorded its best month ever, generating the highest single month of originations in its more than 30-year history.

The company that processes indirect vehicle leasing for credit unions booked more than $150 million in lease originations in October. The volume represented a 31% increase over the same period in 2019.

CULA highlighted that its partners include nine of the top 10 credit unions offering leasing in the U.S.

“Vehicle sales have been leading the recovery during this pandemic, and are a bright spot on the path to economic stabilization. Vehicle leasing is uniquely positioned to meet this moment as borne out by the record number of credit union members CULA helped into leases,” Credit Union Leasing of America president Ken Sopp said in a news release.

“Leasing has historically represented about one-third of all new vehicle sales,” Sopp continued. “In today’s uncertain climate, consumers want flexibility and affordable payments, something that leasing offers.

“Couple that with the trust consumers place in their community credit unions — and the growing importance of the personal vehicle — and we believe leasing is poised to be an increasingly critical component of credit union portfolios,” he went on to say.

According to an Edmunds forecast, consumers purchased 30.6% more new vehicles in the third quarter of 2020 than in the second quarter in the immediate wake of the COVID-19 pandemic’s emergence.

As consumers head back to a new-car market, CULA can enable credit unions to offer flexibility and more affordable payments of vehicle leasing, while helping them grow membership, diversify lending options and increase yield.

CULA said its clients consistently report an average increase in yield of 60 to 100 basis points over retail installment contracts.

“CULA’s growth during these difficult times is a validation of the strength of leasing as a lending product and of the durability, and importance, of credit unions as financial service providers to their communities,” CULA vice president of business development Mark Chandler said.

“As the largest credit union-focused leasing partner in the credit union industry, CULA offers a leasing solution that increases yields, deepens dealer relationships, enhances credit union offerings, and improves the overall member experience,” Chandler went on to say.

MUSA Auto Finance is looking to capitalize on the leasing market, especially with more happening digitally nowadays.

This week, MUSA Auto Finance announced plans to expand both its new- and used-vehicle leasing platform nationwide through a partnership with two large U.S. financial institutions working together toward securitization.

Auto Fin Journal asked MUSA Auto Finance representatives for specifics about these financial institutions, but the company said it was not permitted to share those details publicly.

In a news release, MUSA Auto Finance chief executive officer Jeff Morgan shared what details about this development that could be revealed.

“We are excited to continue MUSA’s growth through this exclusive, and we believe, first-of-its-kind funding arrangement,” Morgan said. “We remain committed to increasing the use of what we call intelligent automation here at MUSA.

“In fact, our proprietary leasing and lending platform is very popular with our dealer partners nationwide,” he continued.

Since its inception, MUSA Auto Finance has tried to automate what can be a time-consuming, manual process traditionally associated with leasing and buying a vehicle.

One of MUSA’s technology platforms can process the application, calculate the lease, automatically decision the application provide an approval back to the dealer partner and accurately pre-fills the lease contract in seconds.

The company added that automated approvals normally occur in just a few seconds, and consumers can upload supporting documents via their mobile device.

“My team and I specialize in new and used auto leasing, which has consistently been the biggest growth sector of auto finance for the past several decades. Leasing performs remarkably well in any type of economy when structured properly,” Morgan said.

“In addition, MUSA’s technology and platform have been enhanced to serve higher demand and market expansion, such as retail auto loans, direct-to-consumer for our lease returns and a fully remote leasing and loan experience that can be executed beginning to end, from anywhere,” he continued.

“Our team includes some of the best the industry has to offer, and I intend to make more exciting announcements in the weeks and months to come,” Morgan went on to say.

Because of its robust new-model leasing activities, Honda and Acura usually have a deep well of vehicles that can become certified.

And with a new pilot program orchestrated by Fair, those CPO units now can be leased again.

On Wednesday, the used-vehicle leasing platform announced a six-month pilot program with American Honda Motor Co., marking the first time Fair is making CPO vehicles available to customers with the ability to access Fair-eligible vehicles directly from the digital platform of an individual automaker.

Launching at 13 Honda and Acura dealerships in South Florida and six Honda dealerships in Southern California, customers who participate in the Fair program can select their vehicle directly through the Honda or Acura Certified Pre-Owned vehicle websites at HondaCertified.com or AcuraCertified.com.

Once selected, customers can lease their Honda or Acura CPO vehicle through Fair on either a month-to-month basis or for a longer-term lease with a lower monthly payment.

Fair explained that it can enable customers participating in the new program with American Honda to complete their transaction entirely on the Fair app — with no negotiation, contract or physical paperwork. Once approved, the customer simply signs the vehicle lease contract with their finger, picks up their CPO vehicle at a specified Honda or Acura dealership — or has it delivered for free — and drives their vehicle for the length of their selected lease term.

According to the company, all Fair vehicles come with routine maintenance, roadside assistance and a limited warranty that lasts as long as they keep the vehicle.

Through this pilot program, Fair added that American Honda will assess consumer interest in leasing high-quality CPO vehicles on flexible terms and bundled with warranty and maintenance protection.

“Launching this new pilot program is an exciting expansion for Fair with the addition of Honda and Acura Certified Pre-Owned vehicles, known for their standard of quality and reliability, as an option for our customers,” Fair chief executive officer Brad Stewart said in a news release.

“This new program also provides a seamless channel between one of the world’s great automakers and a discerning, yet loyal base of young customers and first-time customers, who are looking for access to a vehicle the same way they access the other services in their life: available on demand, and for the amount of time they want or need that vehicle,” Stewart went on to say.

Westlake Financial is deepening its presence in vehicle leasing, expanding upon that market segment it entered via an acquisition three years ago.

This week, Westlake rolled out its own lease program with franchised dealers in California and Arizona while looking to move into more markets throughout the rest of 2020.

The company said franchised dealers will receive automated approvals on lease applications submitted through RouteOne.

“Our goal is to offer full-spectrum finance solutions to our dealer partners,” said Ian Anderson, group president for Westlake Holdings. “Adding auto leasing to our product mix gives dealers another tool to help them finance more customers and sell more vehicles.”

Westlake Financial is familiar with leasing as the company purchased Credit Union Leasing of America (CULA) in 2017. CULA currently holds more than 85,000 prime credit leases, according to a company news release.

“With Westlake’s auto leasing program, we are looking to strategically offer leasing in markets where we currently do not have credit union coverage,” CULA president Ken Sopp said.

For more information on its lease program, visit www.westlakefinancial.com/auto-lease-program.

PowerBand Solutions continued its recent stretch of development activity on Monday by announcing it’s accepting an additional $2.7 million investment from Texas-based D&P Holdings as it prepares vehicle lease originations in the United States to begin this month.

PowerBand chief executive officer Kelly Jennings said the company has completed its mission that’s taken more than two years to offer a cloud-based platform aimed at transforming how consumers buy, sell, lease and finance vehicles. Jennings explained the platform removes “unnecessary middlemen” in the automotive retail sector and offers cloud-based solutions, allowing automotive transactions to be carried out from any location on smartphones and other devices.

The company indicated the latest capital injection from D&P will assist PowerBand’s U.S. leasing platform — MUSA Auto Finance (MUSA) — to begin offering leases in June, which Jennings says will “make it as easy to acquire a car with PowerBand as it is buying a product on Amazon.”

The investment will also be used to launch PowerBand’s consumer app, Driveaway, that can enable people across the United States to access virtual auctions to buy and sell used vehicles, from dealers and directly between consumers. Driveaway will offer consumers and commercial partners a wider auction audience to ensure the value of their vehicles is recognized, eliminate the cost of transporting vehicles to physical auction lots and charges fees only upon success.

“This is a milestone month for PowerBand, as we prepare to offer extensive credit facility agreements, from major US financial institutions, on our U.S. leasing platform, MUSA,” Jennings said in a news release. “We are preparing to begin U.S. lease originations in June.”

“I’m also delighted this additional investment from D&P minimizes dilution to our shareholders, who I want to thank for their unwavering patience and support as we now complete our two-year mission to deliver consumers, dealers and other commercial enterprises a powerful digital platform that eliminates unnecessary middlemen,” Jennings continued.

“PowerBand will allow consumers to buy, sell, lease or finance their vehicles on a smartphone or other digital device, from any location, as easily as they buy a product on Amazon. This is the digital innovation solution the automotive industry desperately needs, particularly as it emerges from the retail challenges of the COVID-19 pandemic,” Jennings went on to say.

D&P, which works directly with more than 850 dealerships in all 50 states, is one of the largest administrators of automotive warranty and insurance products in the United States. To date, it has invested $6 million in PowerBand.

“Our latest investment — part of our decision to invest up to USD $10 million in PowerBand as a whole — reflects our confidence that PowerBand’s cloud-based platform will transform how Americans buy, sell, lease and finance their vehicles,” D&P chief executive officer John Armstrong said.

“This is game-changing technology for the sector, particularly as automotive dealers look for ways to recover from the COVID-19 pandemic. D&P will also be offering consumers automotive insurance products on the PowerBand transaction platform, yet another benefit for consumers,” Armstrong went on to say.

MUSA, which is 60% owned by PowerBand, is already working with RouteOne. As a result of its proprietary technology, MUSA was awarded a contract by Tesla Motors to become a national leasing partner in 2018.

Driveaway is a smartphone-based app that is being piloted by D2D Auto Auctions. D2D is co-owned in a 50-50 partnership by PowerBand and Arkansas-based financier Bryan Hunt, director of J.B Hunt Transport.