CarGurus’ latest consumer analysis shows continued push toward online buying & selling

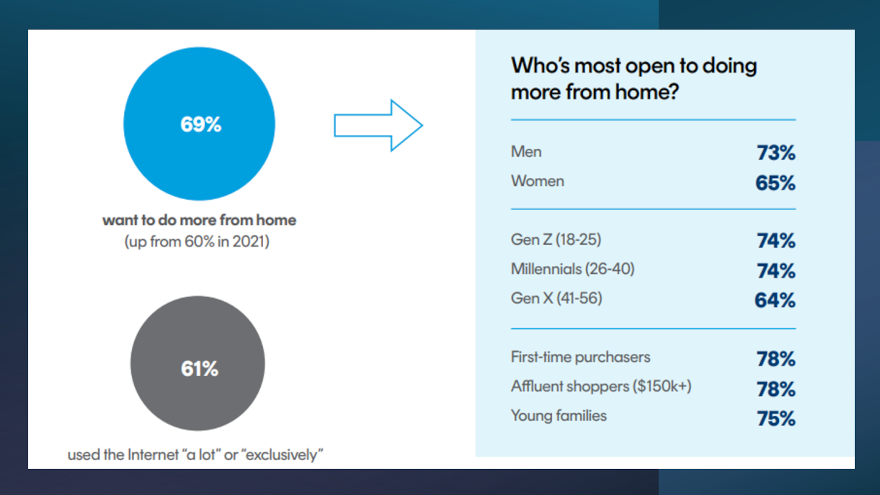

Chart courtesy of the sixth annual U.S. Consumer Insights Report from CarGurus.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Courtesy of the internet, smartphones and other technologies, consumers know more about vehicles and how to acquire them than ever.

Six primary findings from the sixth annual U.S. Consumer Insights Report from CarGurus reinforced this market condition.

The digital auto platform for shopping, buying, and selling new and used vehicles sought to learn more about how shoppers’ habits have shifted in response to an automotive landscape that has three distinct attributes:

—Interest rates and costs that continue to be elevated

—Selection that is growing

—Additional opportunities to do more from home

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The survey of recent car purchasers and/or sellers examined factors influencing why and where people buy and sell, as well as their preferences to navigate some — or all —portions of a transaction online.

For a complete picture of the buy/sell journey, the survey also considered sentiment after the transaction.

“The automotive market has seen incredible change within the last few years, with pricing and inventory levels in flux, EVs becoming more mainstream, and more paths to purchase — especially online — available for shoppers,” CarGurus director of product marketing Alison Ciummei said in a news release. “As we examine how these factors have impacted buying and selling habits, there is a consensus: consumers are taking control of the process in a way that makes the most sense for their individual goals for pricing, convenience, and confidence in the transaction.

“Whether that involves exploring financing options, considering a trade-in, or comparing vehicles against specific needs, shoppers are looking to both digital retail tools and dealership support to tailor the most seamless experience possible,” Ciummei added.

Here are the six survey findings that prompted CarGurus to make those assertions.

- Vehicle reliability and costs were more important to consumers compared to prior years

While vehicle costs and reliability remain the dominant factors influencing decisions, CarGurus noticed more shoppers today are likely to cite reliability (41% versus 35% in 2022), finding a vehicle that fits their budget (40% versus 33% in 2022), and expected costs (26% versus 21% in 2022) as the most important factors in selecting a vehicle.

Findings point to these priorities trumping loyalty to a specific make or model, with 89% saying they’d be willing to switch models and 69% open to switching brands.

- The best price often determines where consumers buy

According to CarGurus’ findings, price remains the top priority in determining the seller they select, with 55% of respondents saying it’s the most important factor, followed by inventory selection (34%), and availability of financing or special offers (26%).

Notably, analysts pointed out confidence in being treated fairly increased (23% versus 17% in 2022).

- Consumers are more open to selling their vehicle entirely online

CarGurus discovered 82% of consumers are open to selling their vehicle entirely online (up from 77% in 2022).

In tandem, the survey showed 69% of shoppers say they want to conduct more of the buying process from home, particularly price negotiation and trade-in estimates.

CarGurus mentioned that the preference to do more from home has remained unchanged year-over-year since rising from 60% in 2021, indicating a lasting shift in behavior.

Steps that mainly occur online (or a combination of online and in-person) include researching what vehicle to buy (81%), assessing the value of a car to be sold (77%), and getting offers to sell a car (69%), according to CarGurus.

- Financing declines year-over-year

According to findings, 42% of buyers apply for financing before a dealer visit.

However, 56% of respondents said they financed (down from 60% in 2022), with many opting to buy in cash due to higher interest rates.

- More young buyers purchased their first car in 2023.

Of those who said they bought or leased their first car in 2023, CarGurus determined 27% were Gen Z, which was up from 20% in 2022.

Analysts indicated the most popular brands among all Gen Z respondents included Toyota, Chevrolet, Honda, BMW and Ford.

- Electric vehicle consideration continues to grow

CarGurus learned more shoppers are considering EVs (27% versus 22% in 2022 and 16% in 2021).

However, analysts noticed purchase rates among respondents remain low, with 8% reporting an EV purchase (up from 5% a year prior).

According to findings, 84% of those that had purchased a gas vehicle are sticking with gas, while 20% of those who purchased an EV, and 25% of those who purchased a hybrid, switched to gas.

The full study from CarGurus is available for download via this website.