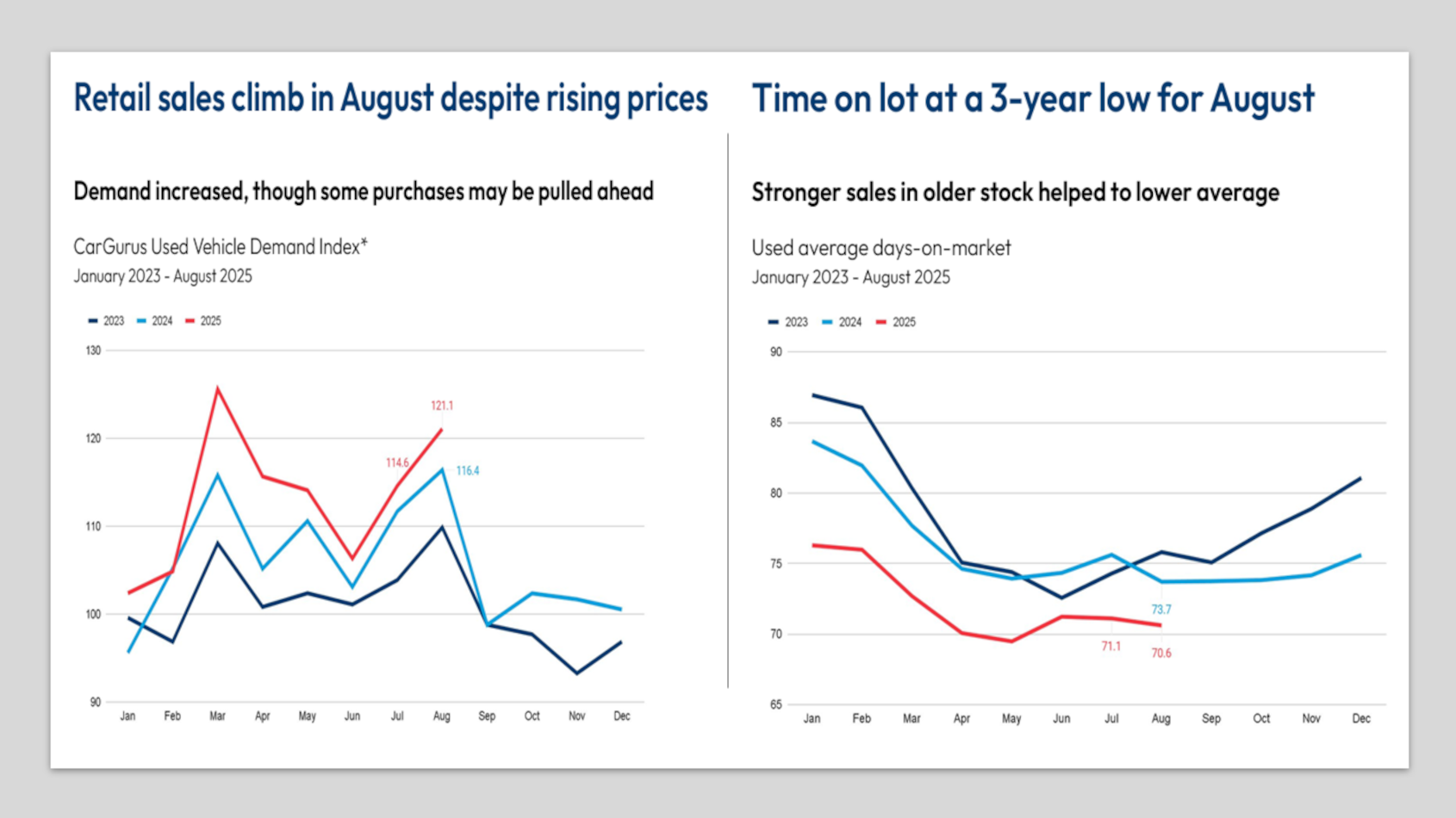

CarGurus: Used inventory time on the lot drops to 3-year low

Charts courtesy of CarGurus.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Even though used-car retail prices moved 6.5% higher in August versus the beginning of the year, CarGurus noticed demand for used vehicles remained strong last month.

Those findings are two of the primary ones from the used market contained in CarGurus’ August 2025 Intelligence Report.

CarGurus indicated time on the lot fell to a three-year low as shoppers continued to transact, and prices held steady month-over-month during a period that usually softens seasonally.

Analysts said used-car inventory remains broader than a year ago, with supply sitting 7.8% greater in August versus the same month last year. CarGurus said that “helps match buyers to budget and segment.”

The result for August was faster sales even with prices higher than in January. That retail activity pushed the CarGurus Used Vehicle Demand Index 5.6% higher year-over-year. Analysts said that’s “a sign that consumers are staying active even as the macro headlines lean cautious.”

CarGurus recapped August generated more negative economic vibes, with consumer sentiment falling about 6% from July and remaining at least 10% below six and 12 months ago.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts also pointed out hiring cooled as payrolls rose roughly 22,000 and unemployment reached about 4.3%. CarGurus went on to mention inflation edged higher in July on the Federal Reserve’s preferred gauge, with core personal consumption expenditures running at a 2.9% seasonally adjusted annual rate.

Even with that backdrop, vehicles kept moving, according to the report.

Along with the positive trends in the used-car market, CarGurus said new-car demand hit a multi-year high in August.

Analysts explained departures outpaced inventory growth, supply tightened, and market days’ supply moved lower even as overall availability held roughly steady versus July and remained below last year.

CarGurus added new-car pricing remained essentially unchanged compared with July and below pre-tariff levels.

With 2026 models now about a quarter of listings, CarGurus director of economic and market intelligence Kevin Roberts said he and his colleagues are watching to see if that mix begins to lift the overall average.

“Even with rising import costs and economic uncertainty, the market is showing surprising strength,” said Roberts, who is among the experts scheduled to appear on stage during Used Car Week on Nov. 17-20 in Las Vegas.

“Prices for both new and used vehicles held steady in August, while demand hit multi-year highs,” he continued. “For buyers, that means strong competition for value models, especially affordable EVs, which surged ahead of upcoming tax credit changes.

“For dealers, it’s a favorable moment to capture this healthy activity, with vehicles spending less time on the lot and shoppers motivated to secure deals before the fall,” Roberts went on to say.