Cox report shows dealers feeling pressure to drop prices as used sales hold steady

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Used-car sales are steady and inventory is still above last year’s level.

Even so, Cox Automotive’s latest data shows dealers are feeling the heat when it comes to prices.

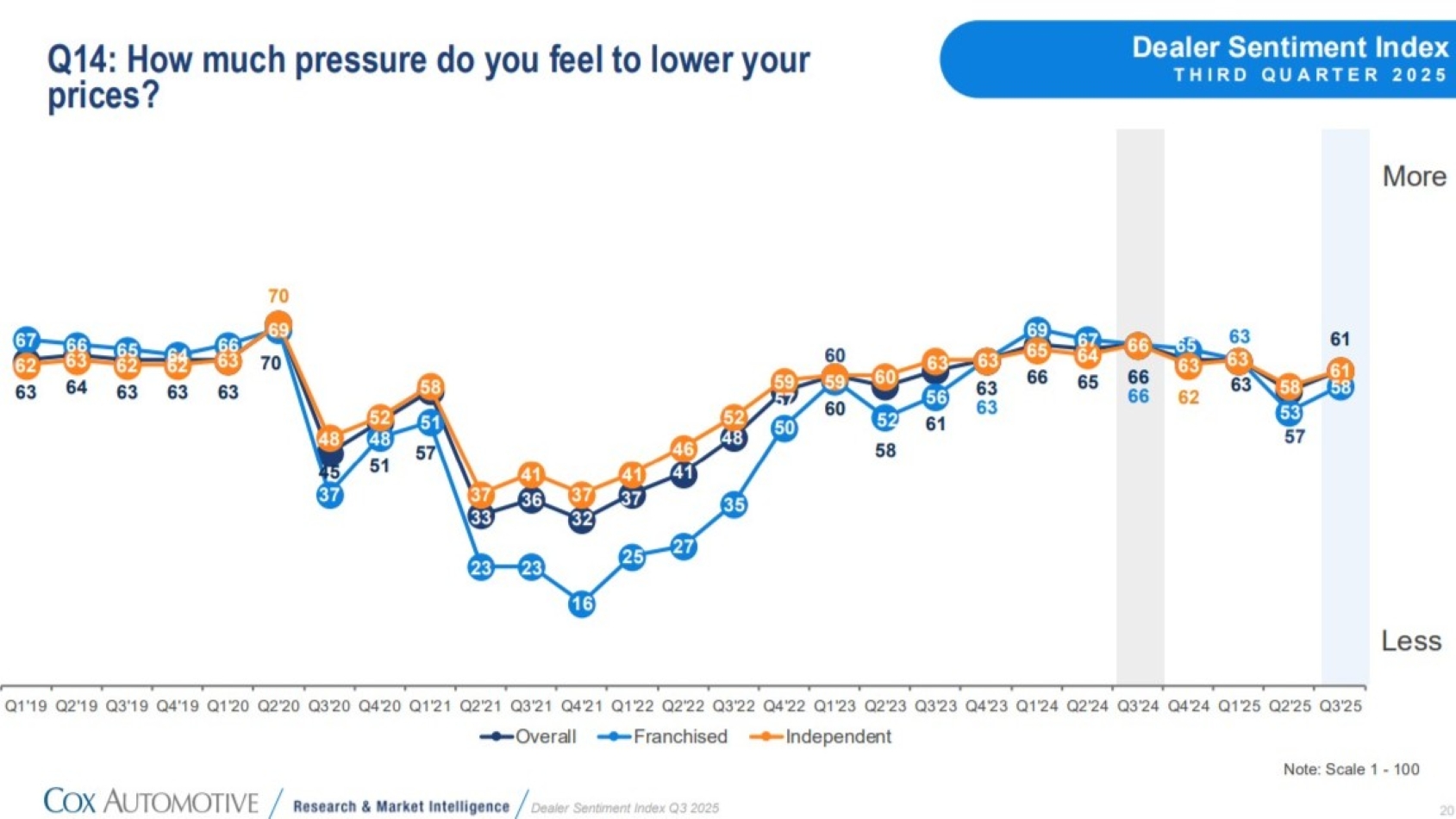

The Cox Automotive Dealer Sentiment Index for the third quarter found a sharp surge in dealers reporting pressure to lower their prices, with the index rising to 61 from 57 in Q2, a jump Cox analysts deemed “significant,” in part because it’s the first increase since the post-pandemic peak of 66 in Q3 2024.

A score greater than 50 signifies more pressure.

The index, based on a survey of 477 franchise dealers and 414 independents conducted in July and August, showed independent dealers in particular are feeling the stress more than franchise dealers, with a score of 61 to 58 for franchises, which Cox said suggests more pressure on the used side than among new vehicles.

The overall used-vehicle sales index remained slightly on the poor side of the 50-point threshold at 46, with franchises solidly on the good side at 60 — though down one point from Q2 — while independents were more pessimistic, with a score of 42.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

But all of those numbers are up from last year and considerably above the low point of Q4 2023, when the overall average sank to 39, the worst score recorded other than the COVID shutdowns of Q2 2020. The independents’ score has risen every quarter since.

Dealers are slightly more upbeat about inventory in Q3, with the index up slightly for both franchises and independents. But, Cox noted, “the overall score of 42 suggests used inventory is declining, not growing.”

For independent dealers, that’s not news, as the used-vehicle inventory index has not reached 50 — the threshold between growing and declining — since before the pandemic, with a post-COVID high of 45 in Q1 this year.

The index showed dealers are still struggling with profitability due in large part to the rising costs of operating a dealership.

Both franchises and independents described their profits for the quarter as weak, with the overall average of 38 falling well into that range, though franchise dealers’ score of 49 was much stronger than independents’ 34. All dealers were consistent when it came to expenses with scores of 70, which Cox said indicates “widespread concern over rising operating expenses.” Still, that’s far down from 77 a year earlier.

While expenses are troubling, dealers’ concerns about the effects of the economy, tariffs and politics in general on their businesses have greatly subsided.

Asked about the factors holding back their business, the economy was still No. 1 on the list, but it was cited by just 44% of the dealers surveyed, down from 51% the previous quarter and 61% a year ago.

Worries about the political climate, cited by 28%, dropped 5 percentage points quarter-over-quarter and 16 year-over-year, while tariff concerns plummeted to 20%, falling 13 percentage points from Q2.

After the economy, interest rates (43%), market conditions (36%) and expenses (33%) were next among issues seen as obstacles.

The full report and commentary can be downloaded here.