Cox study finds dealers believe in AI but still hesitant to adopt fully

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Car dealers can be slow to embrace change, but according to the latest research from Cox Automotive, they’re beginning to come around on artificial intelligence.

Cox’s AI Readiness in Auto Retail Study found 81% of the 537 franchise dealers surveyed said they believe AI is here to stay, 74% believe it can create more benefits than risks for their dealership and 63% said investing in AI now is critical for long-term business success.

That said, dealers aren’t exactly all in when it comes to AI. In fact, the vast majority are still just dabbling, at best.

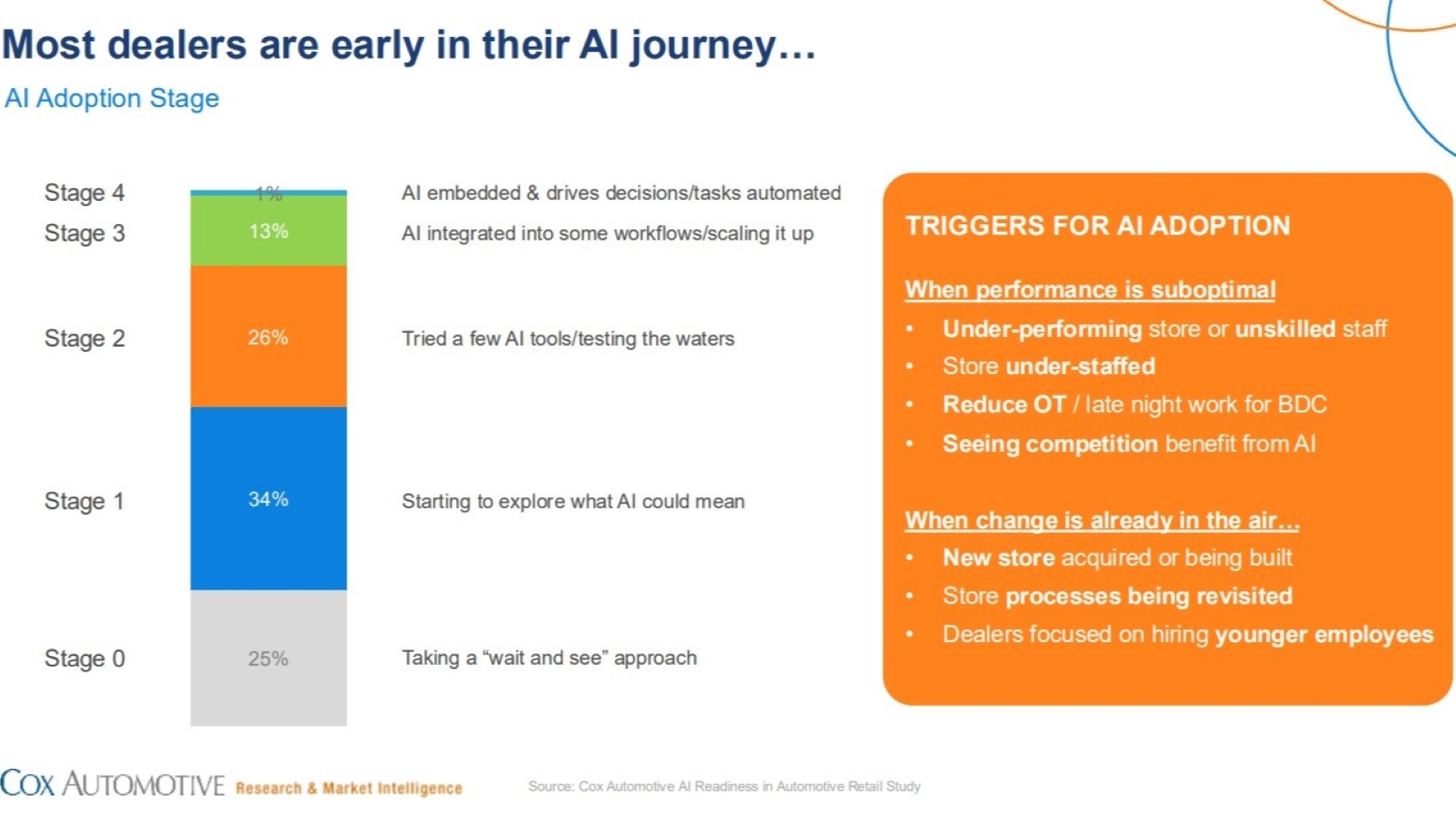

The study showed 59% of survey respondents are still taking a “wait and see” approach or just starting to explore what AI can do, with another 26% saying they’re “testing the waters” by trying a few AI tools. Another 13% said they’ve integrated AI into some workflows and are scaling up, and a mere 1% said AI is “embedded” into their operations, automating tasks and driving decisions.

The study said marketing is serving as a key entry point for exploring AI, with dealers using it most to engage with customers 24/7 through AI chatbots (52%), send personalized automated texts and email (48%), predict which consumers are ready to buy and target them with personalized messages (39%), automate data-driven marketing campaigns (38%) and generate SEO content (36%).

In addition to marketing, Cox Automotive said, dealers are testing AI tools in sales, the back office, F&I and service departments. The study found dynamic market-based pricing as the No. 1 area in which AI is producing greater sales and profits, followed by F&I lender comparisons, predictive marketing insights with targeted personalized messages and automated VIN-specific image classification and backgrounding.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

But concerns and uncertainty linger among dealers, with 74% expressing worries about accuracy and errors, 69% lacking trust in AI’s underlying data and algorithms, and 66% saying they need more education and training. The study quoted an unidentified dealer saying, “If we understand the tool, we understand where it’s pulling data from, then the trust is much higher.”

In a news release, Cox pointed to a technology market now crowded with AI tools of every variety, creating what the company called a “credibility conundrum” for dealers and creating confusion in an environment in which the average car dealership already employs numerous software systems.

“AI can’t be just another point solution in a dealer’s tech stack,” Cox Automotive president of retail solutions Lori Wittman said. “It must be connected to sophisticated and proven data infrastructure focused on unlocking intelligence that can solve specific pain points and deliver measurable results. This is where connected data becomes a competitive superpower for dealers.

“Dealers don’t care about AI for AI’s sake. They care about outcomes they can measure — more cars sold, lower inventory costs, higher gross.”

Study results are available here and an e-book outlining AI use cases in dealership operations can be downloaded here.