Dealers juggle inventory as buyer demand climbs going into Memorial Day

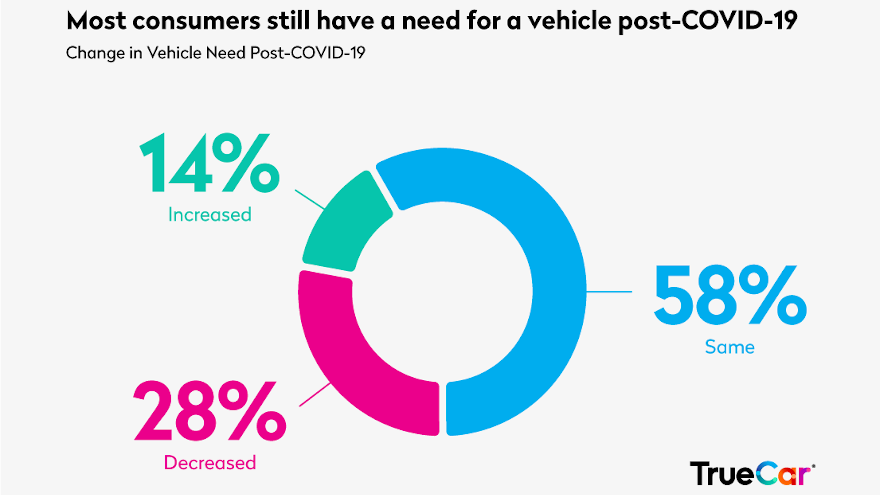

Graphic courtesy of TrueCar.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

LAWRENCEVILLE, Ga., & SANTA MONICA, Ca. –

Dealers are caught juggling how to structure their inventory as shopper activity and purchase intension climbs to levels registered before the coronavirus pandemic arrived, according to information and observations shared by Black Book and TrueCar on Tuesday.

And the trends are particularly important considering that the crucial Memorial Day sales weekend is straight ahead.

TrueCar analysts began by explaining its COVID-19 vehicle-buying insights arrived based on their marketplace data prior to and after COVID-19 social distancing mandates that began to take effect as well as consumer sentiment from a three-wave study of shoppers during the coronavirus pandemic.

“Website traffic and purchase intent returned to pre COVID-19 levels on the TrueCar marketplace in the last two weeks of April,” said Nick Woolard, director of OEM and affinity partner analytics at TrueCar.

“We’re now seeing those numbers increasing going into Memorial Day weekend to levels closer to what we typically see toward the end of the year,” Woolard continued in a news release.

Of course, dealers want to boost their retail performance, but how stores handle the influx of demand is leaving managers with new challenges. Black Book touched on that part of the situation in its newest COVID-19 Market Update.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Last week we continued to see and hear about dealers, in areas with loosened restrictions, who need to fill empty spots on their lots after an unexpected uptick in activity at their dealerships,” Black Book analysts said.

“The demand continues to vary by customer. Those customers that typically need transportation and are looking for that price point, under $10,000 vehicle, or they are looking to take advantage of new car incentives, including the headline-grabbing 0% for 84 months,” analysts continued.

“Hesitancy remains when it comes to sending a trade-in or unwanted inventory to the auction for disposal, but with low wholesale values, the auction has become a good source of inventory,” Black Book went on to say.

While the auction might continue to be a place that dealers can secure used inventory, TrueCar’s information that shoppers might be more inclined to purchase a new model. TrueCar indicated purchase intent for new vehicles compared with used vehicles rose 9% in the post-COVID-19 period.

TrueCar defined the pre-COVID-19 period as March 1-12 and the post-COVID-19 period as March 13 through May 5. TrueCar also reiterated that it calls purchase intent as the connection made when a consumer submits their contact information to a dealer for a price offer on a specific vehicle indicating heightened demand and purchase intent for a vehicle.

“Automakers quickly turning on 0% financing offers in response to COVID-19 actually spurred an increase in pickups and utilities in the period after COVID-19 took effect,” Woolard said. “This was clearly a winning strategy to shore up demand and we see incentives as a driver of purchase intent in our consumer research as well.”

Black Book added an observation about pickup demand, too.

“In our conversations with dealers, we have heard that some have resorted to purchasing new, non-upfitted trucks from conversion companies to increase their available truck inventory,” Black Book analysts said.

“These trucks would have originally been ordered new by an aftermarket conversion company or upfitter, but due to demand, traditional dealers have acquired them from these aftermarket companies to sell new to retail consumers,” they continued.

More insights from TrueCar research

TrueCar analysts highlighted five other marketplace insights from their latest research, including:

— TrueCar marketplace traffic and purchase intent returned to pre-COVID-19 impact levels in the last two weeks of April and have continued to increase going into Memorial Day weekend.

— For new vehicles, large and sporty vehicles saw an increase in purchase intent in the post COVID-19 period. Full-size pickup was up 38%, premium performance vehicles like the Chevrolet Corvette Porsche 911 was up 26%, midsize pickup was up 15% and full-size utility was up 11%.

— Domestic brands showed an increase in share of purchase intent on new vehicles in the post-COVID-19 period, with Ram up 38%, GMC up 17% and Ford up 5%.

— In the period after COVID-19 impact, purchase intent shifted toward more expensive vehicles, up by an average of $800 on new vehicles and up $850 on average on used vehicles.

— Across U.S. states, there was an average decline of 26% in combined new and used purchase intent in the post COVID-19 period, with Montana the only state up, at 2%. Recovery varied widely by state based on timing and details around stay-at-home mandates.

“The pace of change we’ve seen recently is unprecedented, so we wanted to capture consumers needs and concerns around car buying as they rapidly evolved,” TrueCar head of research Wendy McMullin said in the news release.

McMullin explained those insights from TrueCar’s three-wave research during COVID-19. Each wave surveyed 1,200 consumers, screened for those planning to purchase a vehicle within the next 12 months.

TrueCar presented its findings in context with Johns Hopkins University data about the pandemic, including:

Wave 1 fielded March 17: 6,421 cases / 108 deaths in the U.S.

Wave 2 fielded April 9: 461,437 cases / 16,478 deaths in the U.S.

Wave 3 fielded May 4: 1,180,375 cases / 68,922 deaths int the U.S.

“Wave one respondents were feeling less of an impact, which is not surprising given that stay-at-home mandates had just begun and the number of cases was still relatively low,” McMullin continued. “Concerns over safety and economic security peaked in wave 2. Two months into the pandemic in wave 3, we’re seeing the proportion of respondents delaying their vehicle purchase has recovered a bit to wave 1 levels, which is promising.”

TrueCar mentioned concern over being exposed to COVID-19 peaked in wave 2, yet remains a heightened concern in wave 3 (57% very or extremely concerned, versus 62% in wave 2).

In wave 3, analysts discovered significantly fewer respondents stated they were delaying their purchase compared to wave 2. However 32% still stated they are delaying their purchase.

TrueCar noted that half of shoppers surveyed said that lower interest rates and increased discounts and incentives may encourage them to purchase a vehicle now.

Analysts pointed out 8% of shoppers stated their primary reason for purchasing/leasing a vehicle is to avoid public transportation, adding this proportion is 10% for lower income consumers.

Across all 3 waves, TrueCar explained consumers selected aspects of remote retailing — such as configuring a deal online, at home test drives, completing the entire purchase online and video conferencing — as the top reasons they would shop with a particular dealership now. At home test drive showed the most significant uptick between the three waves, increasing in interest 44% between wave 1 and wave 3, according to analysts.

TrueCar went on to add that 65% of shoppers surveyed said they would be more likely to shop with a dealership that offers the components of TrueCar’s Buy from Home experience which offers remote paperwork, vehicle sanitization and vehicle delivery.

“With continuing concerns around being exposed to COVID-19 or exposing others, remote retailing capabilities and safety measures around test driving vehicles and home delivery are critical components dealers can offer to get consumers to engage now,” McMullin said.

“In particular, the third wave of the study highlights that consumers are looking for a more customized way to shop that meets their personal safety expectations. It’s encouraging to see how quickly dealerships have responded and how flexible they have been in making these offerings available,” she went on to say.