Dealership count steady in 2025, but change is still ahead, Urban Science says

Image courtesy of Urban Science.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Much about the auto industry these days is volatile.

The franchise dealership network, on the other hand, has remained remarkably stable.

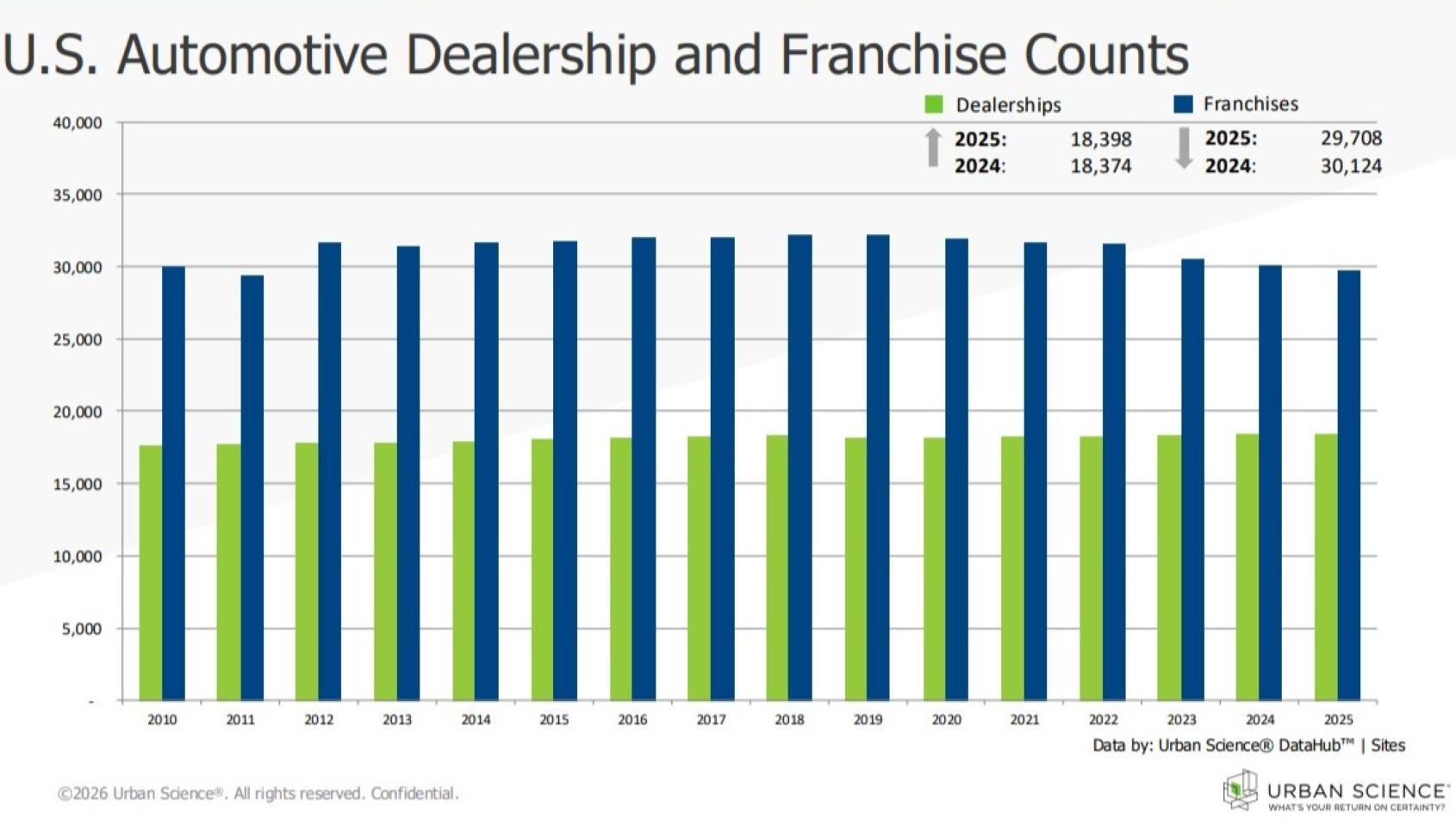

In its 2025 Year-End Automotive Franchise Activity Report, Urban Science reported the number of franchise stores was up last year, but by just 24 rooftops, rising to 18,398 from 18,374 in 2024.

The report showed 95% of U.S. core-based statistical areas had a net gain or loss of no more than one dealership during 2025, with New Jersey gaining nine to lead the nation, ahead of Texas (eight), Florida (six), Georgia (six) and South Carolina (six), while Pennsylvania lost the most with eight, followed by California and Missouri with five each.

And while the number of franchises — the brands a dealership sells — dropped for the third consecutive year to 29,708, that year-over-year decline was a relatively modest 416.

“Despite minor fluctuations throughout the year, 2025 reflected overall stability across the U.S. automotive retail network, but those figures only tell part of the story,” Urban Science global director of data Mitch Phillips said. “Shifting consumer powertrain preferences and evolving buying behaviors are reshaping the market, requiring automakers to remain nimble.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“As the landscape continues to change, long-term, science-driven network planning grounded in daily sales data is essential to confident decision-making and sustained dealership efficiency and profitability. To stay ahead of emerging opportunities and headwinds, leading OEMs are evaluating myriad network scenarios through advanced, real-time visualization — an approach that promotes competitiveness now and in the decade ahead.”

Case in point, Urban Science said, while overall retail throughput, which represents the number of vehicles sold per dealership, increased by 16 units to 889 per store in 2025 — the third consecutive year of growth — the automotive consultancy and technology firm’s latest forecasts project that total to drop back to 877 this year.

The report showed electric vehicle sales jumped 12% for the year, with EV throughput rising to 173 units per store, though according to Urban Science’s Q4 2025 EV Retail Sales Report, EV sales volume fell 19% YOY in the fourth quarter, following the end of federal EV tax credits.

The full report is available for download here.