Dealership traffic drops in Q4 amid economic uncertainty, affordability issues

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

For independent dealers, the view inside the dealership looks like recent business as usual.

For franchised dealers, it looks … empty.

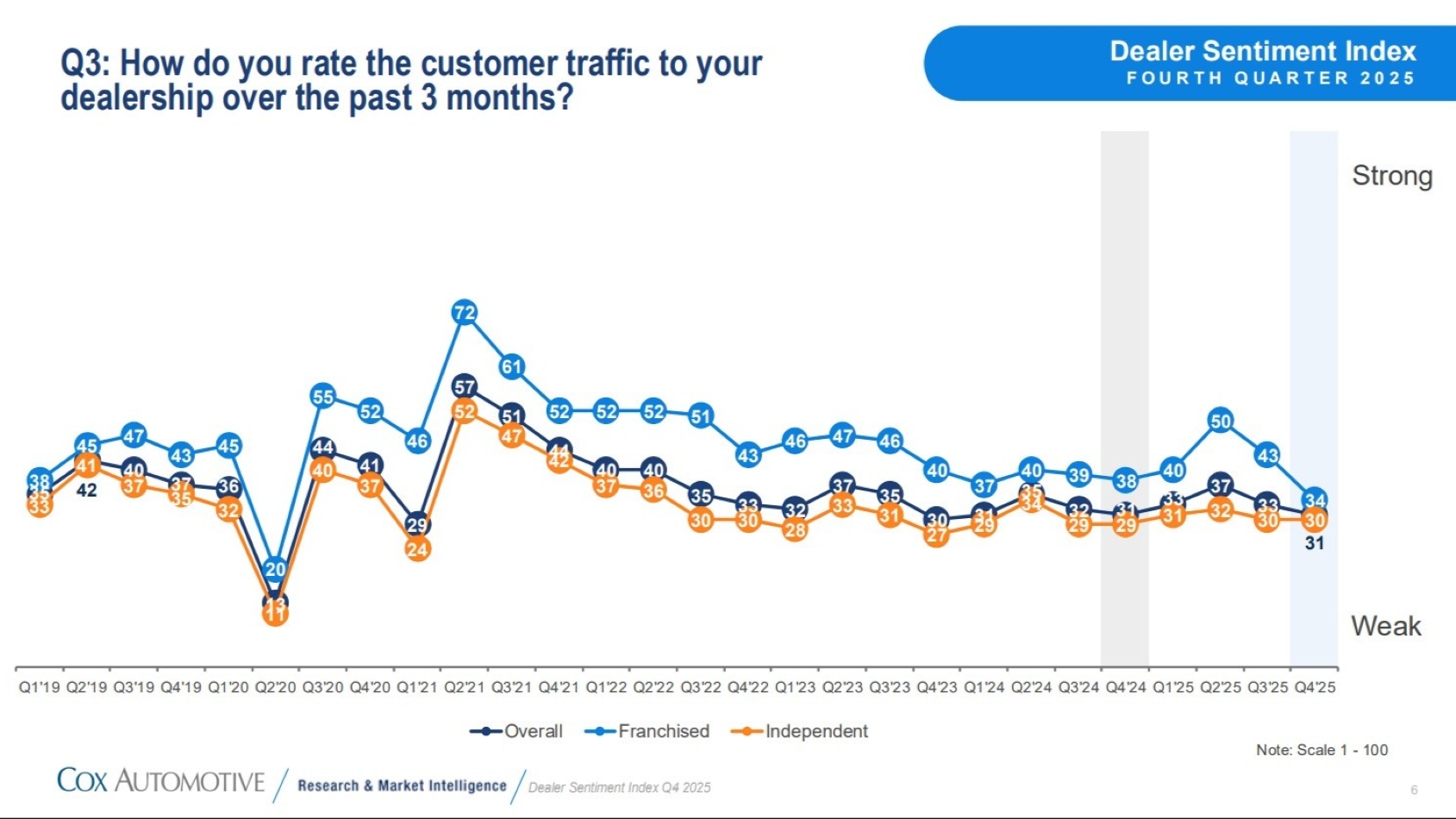

According to Cox Automotive’s Q4 Dealer Sentiment Index, customer traffic in dealerships overall during the past three months matched its lowest level since the depths of the COVID pandemic in the second quarter of 2020, with dealers rating it at 31 on a 100-point scale.

Independents’ score was even lower — 30 — but that was actually unchanged from the previous quarter, down just two points from Q2, and actually above their score of 29 in Q4 of last year.

The story for franchises was much different. Their assessment of customer traffic has plummeted 16 points over the past two quarters, from 50, the midway point between strong and weak, to a very weak 34 — again, the lowest since Q2 2020.

Dealer confidence in the market as a whole is down among both sectors, with an overall index of 38, another post-COVID low. And while there’s a little less pessimism about the coming three months, with an overall index of 42, that’s down four points from the Q3 assessment, as dealers face rising costs, higher prices and economic uncertainty, Cox Automotive said, all contributing to weaker demand.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Dealers are signaling caution as 2025 ends,” deputy chief economist Mark Strand said. “Persistent economic uncertainty and fading consumer confidence are weighing on sentiment. Compared to the rest of the year, the current market feels like it’s running out of gas.

“As we look ahead at 2026, renewed market momentum is entirely possible, especially if we get material interest-rate relief and a rebound in consumer confidence.”

The index is derived from a survey of 919 dealers (492 franchised and 427 independent) conducted in October and November.

Dealers haven’t had a positive view of the economy for the past four years and their view of it fell again in Q4. The majority of dealers (51%) saw it as a factor holding back their business, up from 44% in Q3, and it was again the most cited negative factor, ahead of interest rates (43%) and market conditions (41%).

Among franchised dealers, the economy was cited by 53%, a quarter-over-quarter increase of 10 percentage points.

Dealers’ perception of the used-vehicle sales environment dropped as inventory remained tight, with independents obviously feeling the squeeze more than franchises. Indeed, while the index fell seven points from Q3 among franchise dealers, they still see the used market as positive with score of 53. The independent index was a pessimistic 39, down three points QOQ.

On the other hand, franchise dealers were more affected by profitability concerns in Q4, as their perception sank to 44, in the weak range, down five index points from Q3 following a spike to a positive 52 in Q2. Independents saw a more stable, though weaker, view of profits at 33, down one point QOQ and within two points of the past four quarters’ results.

Cox said the downward trend reflects margin compression from rising costs and softer demand.

The difference between franchises and independents was also evident in their view of the future of electric vehicle sales. Franchised dealers’ view of EVs has dropped off the table since the announcement that the federal tax credits would end, falling from 38 in Q2 to 33 in Q3 to the current reading of 24.

Meanwhile, independents, seeing a surge of off-lease EVs coming into the used market, had a more positive view with an index of 31, up three points from last quarter, though still well below the Q2 score of 37 with the tax credits still in effect.

The full report and commentary can be downloaded here.