Ex-No. 1 Tesla an exception as auto brand loyalty continues steady overall rise

Image courtesy of LexisNexis.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Brand loyalty continued rising in the first half of 2025 — with a very notable exception.

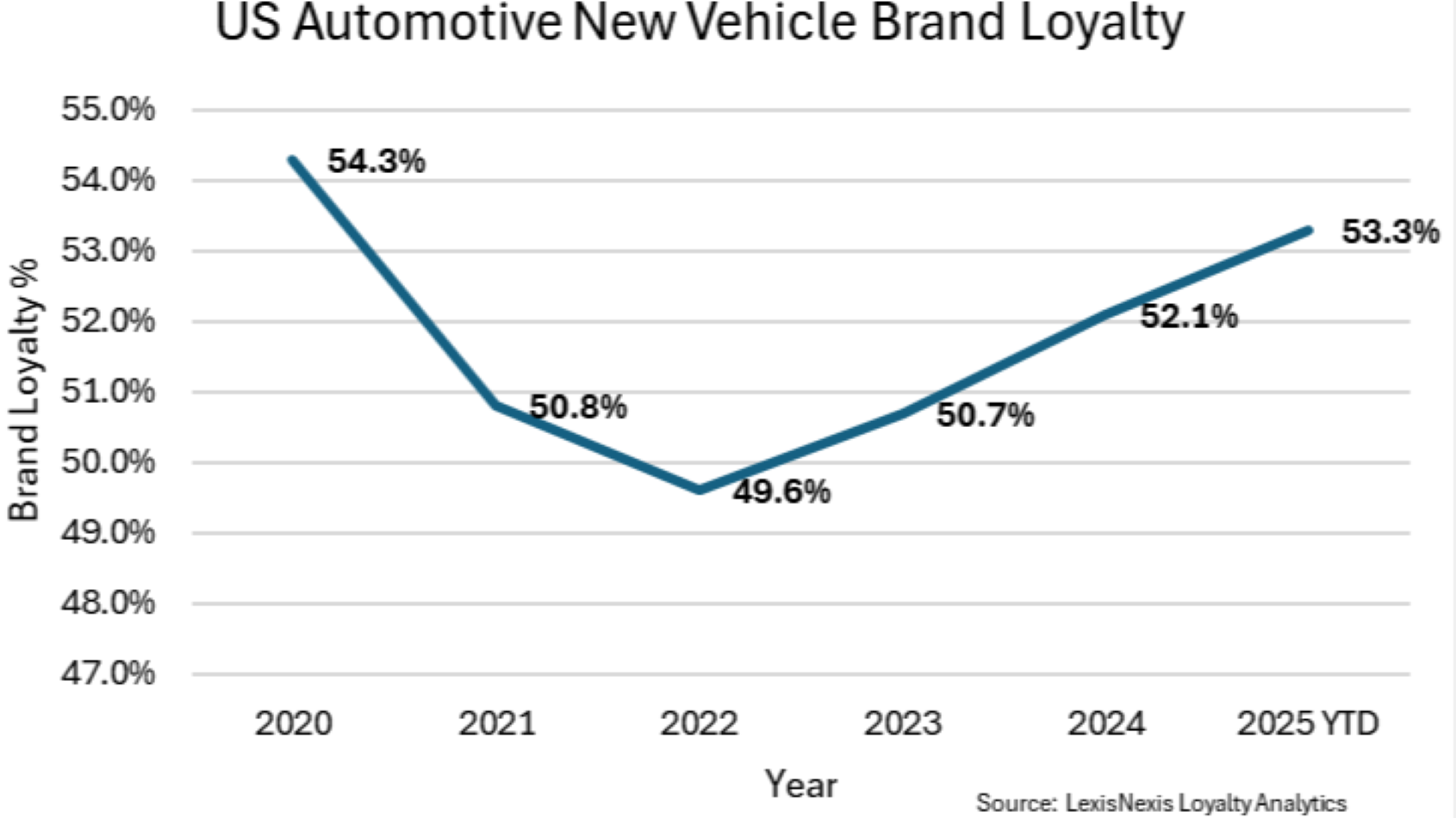

The LexisNexis Risk Solutions Automotive Brand Loyalty Mid-Year 2025 Study found overall brand loyalty for new vehicles rose to 53.3% through June 30, up 1.2 percentage points from the end of 2024.

That continues a steady rise from the low point of 49.6% in 2022 and is closing in on the pre-COVID 54.3% level of 2019.

But that doesn’t mean loyalty is increasing for every brand.

Tesla, which for the past two years has ruled the industry when it comes to loyalty, has fallen from its throne. The electric vehicle manufacturer, which led all brands with a 60.9% loyalty rate in 2024 and 60.7% in 2023, plummeted to seventh in the rankings for first six months of this year at 54.2%, less than a percentage point above the industry average of 53.3%.

The study found a significant part of that decrease has come from Tesla owners replacing their Tesla with another EV. LexisNexis said that group has historically remained loyal to Tesla 88% of the time — last year the rate was 86%. But so far in 2025, that percentage has dropped to 75%, with 25% choosing EVs from other brands.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Toyota led all automakers with a 65.4% loyalty rate, led by what LexisNexis called “the fierce brand loyalty of its RAV4 drivers.” The popular SUV topped all models at 69.4%, the study showed.

LexisNexis said it determines brand loyalty using proprietary linking technology and the LexID unique identifier to link vehicle ownership and purchase data, indexing purchased vehicles against garaged vehicles seeking a match that paired vehicles and labeled the relationship to the appropriate model category, brand or OEM loyalty. The rating is the percentage of garages that acquired a vehicle of the same model or brand.

The study also examined other factors affecting the auto industry — including affordability, tariffs and EV adoption — and their impact on automotive customer loyalty.

The report cited Cox Automotive data showing the average new vehicle cost $48,907 in June, up 1.2% over the average transaction price in June 2024, and dealer incentives and discounts rose to 6.9% of ATP.

But compact SUVs, Cox reported, have been hit with higher import tariffs, lower incentives and flat prices, which LexisNexis said potentially makes them less affordable and could reduce their value and customer loyalty to those vehicles.

Overall, the report said, higher tariffs looming on the horizon have added “significant strain” on U.S. auto manufacturers’ supply chains, as many of their auto parts, semiconductors and vehicles are produced in Canada, Mexico and China. As a result, automakers are trying to change their sourcing and operations to keep prices down for consumers and their own production.

“Geopolitical tensions impact the flow of critical components, including vehicle batteries and raw materials, creating serious vulnerabilities and challenges to automakers,” the report said. “This fragility is apparent in delays and inventory shortages, leading to fluctuations in consumer brand loyalty and an unstable industry.”

LexisNexis noted the nation’s transition to EVs is going more slowly than expected as manufacturers are facing an unpredictable future due to changes in federal policies, emissions standards, incentives and regulations. Consumers who remain brand loyal might elect to stay with a gas engine over an EV model made by the same brand.

To combat that, the report said, OEMs have boosted incentives to make electric vehicles more affordable. While Cox Automotive’s data found the average transaction price for EVs was $56,910 in June — $8,785 more than the ATP for other powertrains — EV incentives increased for the third consecutive month, soaring to a record 14.8% of ATP, more than twice the overall rate. That translates to more than $8,400, almost making up the price difference.

More about the study is available here.