Lane watch: 2 trends potentially point to healthy status for auctions & dealers

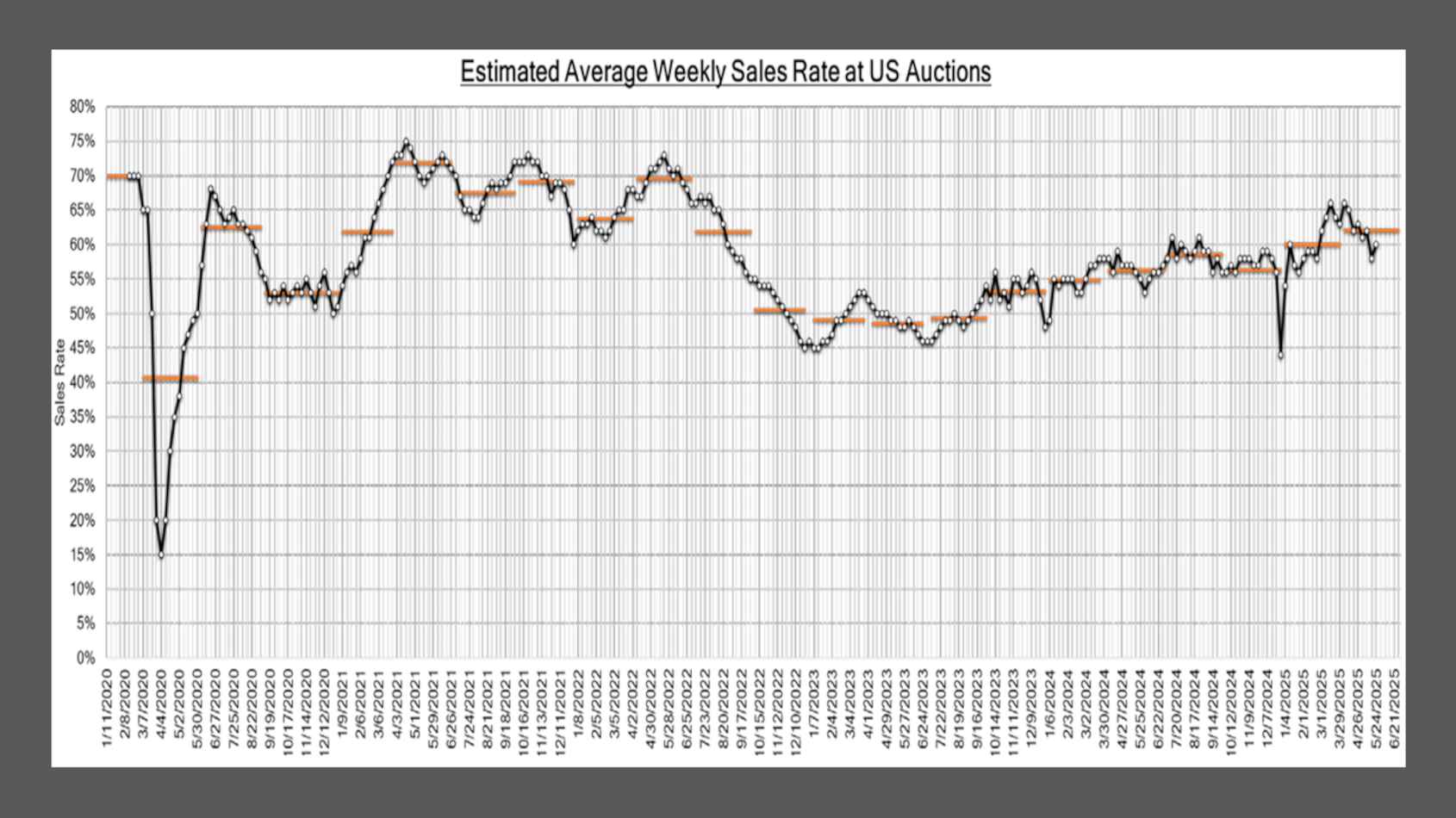

Chart courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Perhaps you could make an argument that the used-car market is almost as healthy as it can be for both auctions and dealerships based on two trends highlighted by Black Book in its latest installment of Market Insights.

On the wholesale side, Black Book said last week’s auction conversion rate came in at 60%, and it has been at that level or higher each week but one since the middle of February.

On the retail front, Black Book reported its estimated used retail days to turn is now at roughly 34 days, which is the lowest point this year. It’s also the first time it’s been this low since this same juncture of the calendar in 2022.

And the only time this retail estimate has been lower was in July 2021, according to Black Book’s report.

With dealers evidently moving metal, they are finding wholesale prices to be “aligned more closely with seasonal norms” if managers are going to auctions to replenish inventory.

Black Book indicated overall wholesale prices ticked 0.07% lower last week.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Analysts noted that after 11 weeks of gains, prices for vehicles less than 2 years old declined for the first time, also edging lower by 0.07%. Values for units between 2 and 8 years old softened by the same rate. And prices for vehicles between 8 and 16 years old dipped by 0.20% last week.

Looking closer at specific vehicle segments, Black Book reported prices for sub-compact cars tumbled by 1.27%. After a short period of four weeks of gains, analysts noted values for these fuel-sippers have averaged a weekly decline of 0.87% during the past three weeks.

Perhaps building in value for the summer driving season, Black Book determined prices for sporty cars now have increased for 10 consecutive weeks, rising by another 0.27% a week ago. Over the past 10 weeks, these models have achieved an average weekly increase of 0.39%, according to Black Book tracking.

In the truck world, Black Book noticed values for full-size crossover/SUVs continued to move higher, rising another 0.66%. Analysts said this segment has posted price gains during 13 of the past 14 weeks.

What’s also interesting about full-size crossover/SUVs, Black Book pointed out prices for units less than 2 years old rose 0.63% last week, while models between 8 and 16 years old declined by 0.66%.

Finally, Black Book said appreciation for full-size pickups is slowing, with a modest increase of 0.05% a week ago. That’s a fraction compared to an average weekly gain of 0.24% over the previous 12 weeks for these units.

Will auctions and dealers maintain these healthy trends as summer officially rolls in?

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.