Lane watch: Black Book spotting weekly value decreases not seen since 2022 & 2023

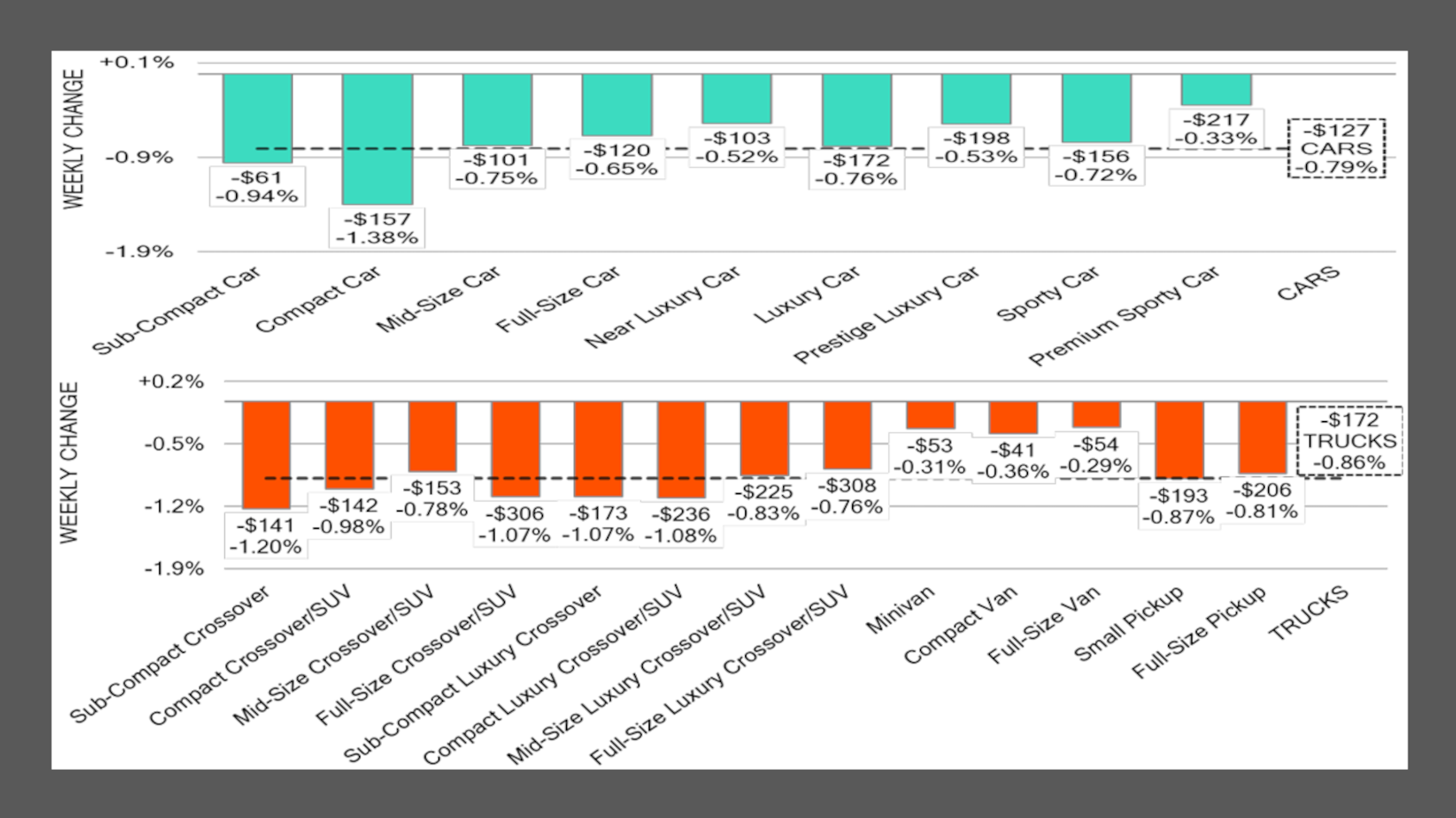

Charts courtesy of Black Book.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Two to three years ago might seem like a long time ago in the car business.

But that’s the timeframe Black Book referenced when analysts dissected last week’s wholesale data and assembled their newest installment of Market Insights.

“Depreciation accelerated last week, with several segments posting single week declines reminiscent of 2022 and 2023 levels,” Black Book said in the report released on Tuesday.

“The overall market for 2- to 8-year-old vehicles fell 0.84%, marking the steepest weekly drop since December 2023,” analysts continued. “Newer used units (less than 2 years old) also experienced a sharp decline of 0.85%, while older 8- to 16-year-old vehicles softened by 0.58%.”

Those overall value decreases surfaced as Black Book reported the auction conversion rate improved slightly to 57%. Analysts also mentioned their estimated used retail days to turn is now at roughly 37 days.

Does that sound like what’s happened at your auction or dealership in 2022 and 2023?

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

“Market sentiment remains cautious but stable, with pricing adjustments generally consistent with typical seasonal Q4 patterns,” Black Book said. “Overall, depreciation accelerated modestly compared to the prior week, suggesting further mild softening through early November before stabilizing toward year-end.”

The talk about 2022 and 2023 wasn’t just limited to Black Book’s overall look at wholesale prices. Analysts spotted more comparison to those years when looking closer at some specific vehicle segments, including:

—Prices for compact cars less than 2 years old declined by 1.62%, while values for 2- to 8-year-old models fell by 1.38%, both representing their largest single-week drops since December 2023

—Values for midsize cars less than 2 years old fell by 1.60%, marking the largest single-week decrease since September 2023

—Prices for subcompact cars less than 2 years old dropped by 2.86%, which was largest decline since this same week in 2022 when those values tumbled by 3.70%

—Values for midsize crossover/SUVs less than 2 years old declined by 0.95%, marking the largest single-week decline since December 2023

Also of note, Black Book mentioned values for subcompact crossover/SUVs less than 2 years old dropped another 1.94% last week. That’s after prices for those units slid 1.27% a week earlier.

Analysts said nine car segments decreased in value last week. Black Book said prices for all 13 truck segments declined, too, with four categories sustaining value drops of more than 1%.

Might Black Book make more comparisons to 2022 and 2024 next week? Or perhaps even more haunting with Halloween straight ahead, drawing parallels to the pandemic, which are already being done by experts looking at delinquencies?

“As always, our team of analysts are focused on the keeping their eyes on the market for developing trends and gathering insight,” Black Book said.