Lotlinx report shows used-car sales lagging behind new in Q2

Image courtesy of Lotlinx.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

While new-car sales made a significant jump in the second quarter, used-vehicle sales took just a small step up, according to the latest data from Lotlinx.

The dealership inventory management platform’s Q2 2025 Quarterly Vincensus Report showed a 7% increase in new sales volume over Q1, a surge it attributed to the “tariff- driven rush” early in the quarter, which subsided by late spring.

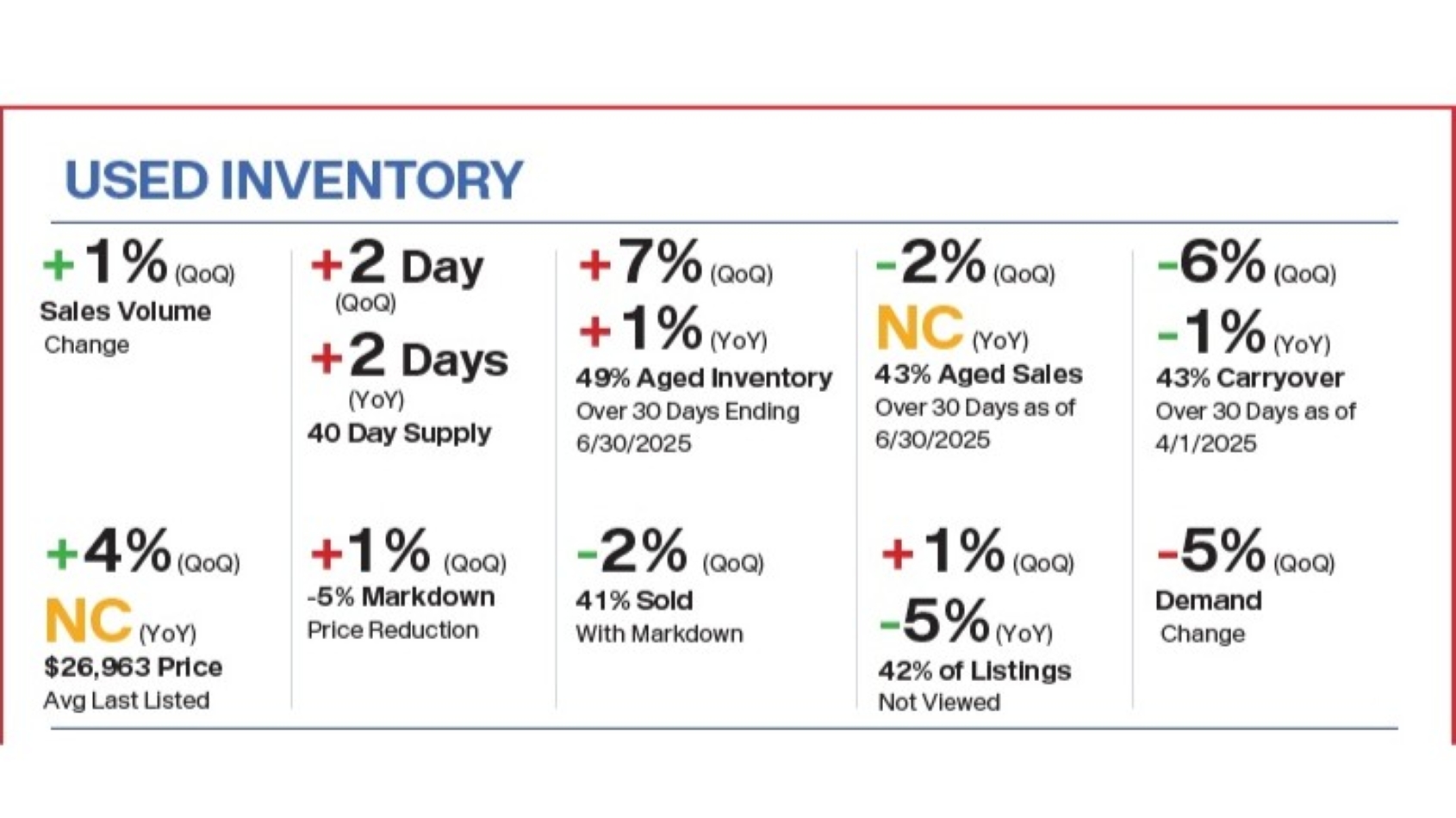

But Lotlinx’s research found the used market was barely affected by that surge, showing a minimal 1% increase in sales, while the overall list price of sold units climbed 4%.

Lotlinx said the report used more than 24 billion proprietary VIN-level data points and machine learning to compile its look at the current state of the automotive retail market for new and used vehicles.

The difference in sales showed up in the report’s inventory data, with new-car days’ supply down by four days while used was up two days quarter-over-quarter to 40 days’ supply at Q2’s end.

In addition, aged inventory in the used-car sector soared by 7%, ending the quarter at 49% of total inventory on the lot more than 30 days. The used inventory the end of June was listed at an average price of $28,888, nearly $2,000 higher than units sold in Q2.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The story was quite different among electric vehicles, where sales of new EVs sagged 2% QOQ despite a 22-days’ supply increase to 100 days while used EVs flew off the shelves with an 11% spike in sales.

The report cited the affordability gap between EVs and internal combustion engine vehicles as the primary issue in the difference between new and used EV volume.

“Affordability continues to be a strong factor as new EVs averaged nearly $55,000, costing over $7,000 more than hybrids and $10,000 more than ICE cars,” the report said. “In the used market, where the EV price was just $4,000 above ICEs and hybrids, sales told a different story, surging 11%.

“This highlights strong consumer demand for EVs when the price is right. Looking ahead, the rest of 2025 is expected to see a cooler sales pace. Expect automakers to rely on incentives to combat consumer price sensitivity, while hybrids continue to dominate the market.”

The full report can be downloaded here.