March brings surge of inventory, falling prices, Cars Commerce report finds

Image courtesy of Cars Commerce.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

When tax season arrives, dealers know customers are coming — and they need cars to sell them.

Not surprisingly, then, the monthly Cars Commerce Industry Insights Report for March showed a big surge in inventory.

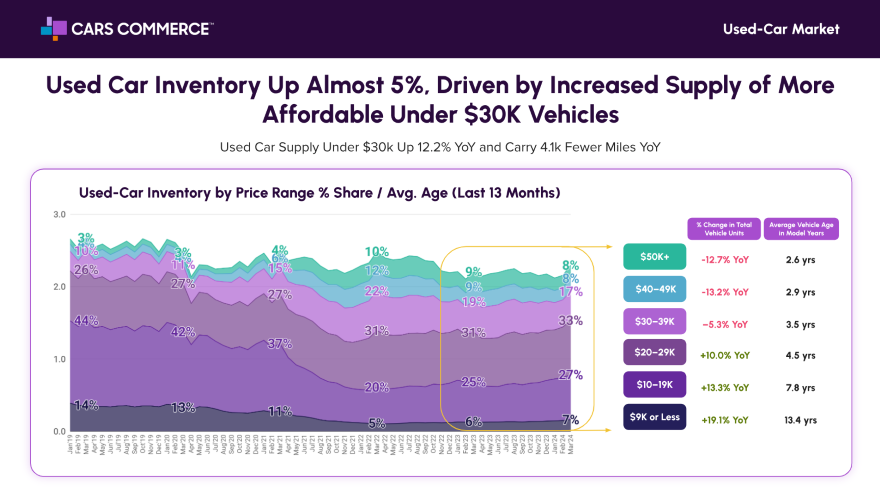

The report found used-car supply jumped 7.6% from February to March, based on the company’s marketplace inventory, as dealers stocked up for the tax-season rush. That was also 4.7% higher than March 2023.

At the same time, used-car prices plummeted 5.1% year-over-year, to an average of $28,433, its lowest level in 32 months.

“March’s data shows the new- and used-car markets are adjusting,” the Cars Commerce analysis said, “with new-car prices continuing to drop and used-car prices hitting their lowest point in years, signaling a move toward more typical pricing.”

The report, compiled by Cars Commerce’s data analysts, looks at supply, demand, pricing and consumer behavior data from across the company’s platform, including Cars.com, Dealer Inspire and AccuTrade.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The inventory increase has been driven by the lower end of the price scale, with the supply of vehicles priced less than $30,000 up 12.2% from last year. The largest sectors of the used market — $20,000-$29,000 and $10,000-$19,000 — were up 10% and 13.3%, respectively. Cars under $10,000 were up 19.1%.

That said, those cars now have more miles on their odometer than similarly priced vehicles in the past. Those priced less than $20,000 now average 8.6 years old with 93,000 miles, three more years and 24,800 miles more than in March 2019.

The report found trade-in values continuing to drop — down 15% from their 2022 peak to $28,433 for vehicles 2-6 model years old, though still more than $5,000 above pre-pandemic levels.

Leading the way in that decline is the 3-5-year-old Tesla Model Y, which, according to Cars Commerce, has dropped $13,580 worth of trade-in value in the past year to its current $26,520, a 33.9% decrease.

But that’s not far out of line for used electric vehicles, which have fallen more than 20% year-over-year to an average of $36,429. Used-EV inventory and demand are also up, according to the report, with inventory soaring 49% year-over-year and 16.5% month-over-month, and demand, as measured by searches on Cars Commerce’s platforms, up 14.5% since February and 37.6% since March 2023.

The complete report is available here.