Napleton sets record in topping dealer group rankings for internet lead response

Image courtesy of Pied Piper.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

When it comes to responding to internet leads, the best got better.

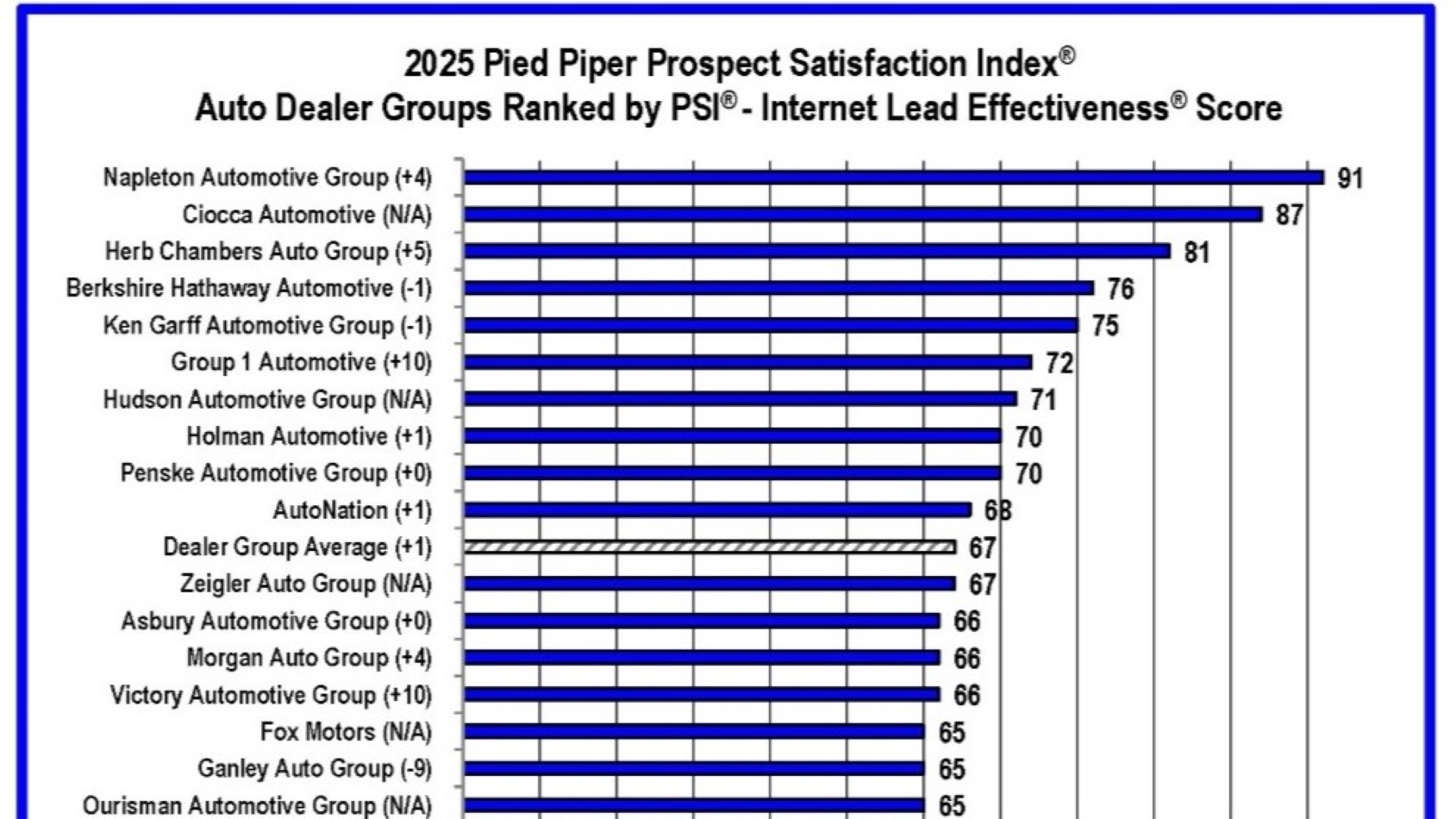

Napleton Automotive Group earned the top spot in the 2025 Pied Piper PSI Internet Lead Effectiveness Auto Dealer Group Study, its fourth consecutive No. 1 ranking — and it set a record in the process.

Napleton’s average internet lead effectiveness score of 91 among its dealerships is the first to break the 90-point barrier in Pied Piper’s annual study carried the dealership group past Ciocca Automotive, which score 87 to place second.

Herb Chambers Auto Group (81), Berkshire Hathaway Automotive (76) and Ken Garff Automotive Group (75) were also among the top five.

Pied Piper’s study measured responsiveness to internet leads submitted by mystery-shopper inquiries through the individual websites of 2,105 dealerships representing 26 of the nation’s largest dealership groups. The study evaluated the speed and quality of the dealerships’ responses by email, telephone and text message within 24 hours, using more than 20 measurements based on the practices mathematically most likely to generate sales to create a total score ranging between 0 and 100.

In a news release, Pied Piper said Napleton, which operates more than 70 franchises from some 50 locations in seven states, improved its score by four points from 2024 with superior performance in four important categories: reliably answering customer questions fast, use of text to answer questions, rapid phone responses and “doing both fast”.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The study found 90% of Napleton customers received an answer to their question by email/text within one hour, up five percentage points from last year and 30 points better than the 2025 average for all dealerships groups.

Napleton dealerships improved 19 percentage points year-over-year in using text, rising to 73% of the time on average, and responded to 96% of its website customers by phone within 24 hours, with three out of four customers receiving a call within 15 minutes.

Those numbers illustrate Napleton’s success in what Pied Piper calls the “did both fast” measurement — answering an inquiry by both email/text and phone within one hour, which the company said “greatly improves the odds of reaching customers.” Napleton dealers “did both fast” 82% of the time on average, almost twice as often as the average dealership group.

The dealership group average ILE score of 67 was up just one point from 2024, in part because only two of the eight new groups added for this year’s study — Ciocca and Hudson Automotive Group (71) — were among the nine that scored 70 or better. Pied Piper noted that represents a substantial improvement from three years ago, when just two groups reach that mark.

On the down side, four groups — Greenway Automotive, Ed Morse Automotive Group, Premier Automotive and Bergstrom Automotive — scored less than 55, compared to three in 2022.

Nine of the 26 groups studied in 2025 improved their ILE scores over the past year, led by Group 1 Automotive (72) and Victory Automotive Group (66), which each bettered their 2024 scores by 10 points.

Pied Piper said those nine groups did better because they offered appointments 7% more often, answered customer questions within an hour 9% more often and used text more effectively, with texts 6% more likely to answer customers’ online questions.

Ganley Auto Group’s score of 65 was down nine points from the previous year, the largest drop of the seven groups that posted lower year-over-year scores, followed by Serra Automotive (64), down eight points. The groups that lost ground “did both fast” 5% less on average in this year’s study, as well as responding by phone to online inquiries 5% less and sending texts 12% less likely to send a text, and their texts answered the customers question 6% less often.

Pied Piper noted 73% of the dealerships from the five highest-scoring groups posted ILE scores better than 80, which company said shows quick and thorough personal responses, while just 6% scored less than 40, failing to personally respond to website customers. That’s far better than the industry averages of 40% of dealerships above 80 and 19% below 40.

“Identifying a brand or group’s dealerships scoring under 40 and over 80 is an efficient way to determine where improvement efforts should be focused,” Pied Piper vice president of metrics and analytics Cameron O’Hagan said. “Historically, we have found dealerships that improve their ILE performance from scoring under 40 to scoring over 80 on average sell 50% more units from the same quantity of website customer leads.”

Other study results include:

- Ciocca, Herb Chambers and Napleton dealerships emailed or texted an answer to a website customer’s question more than 90% of the time on average, while Ed Morse and Bergstrom did so less than 60% of the time.

- Napleton, Ciocca and Holman Automotive were the leaders in responding by phone at more than 90%, with West Herr Automotive Group, Greenway, Premier Automotive and Bergstrom at less than 45%.

- Groups whose dealerships offered to set an appointment for a specific date and time most often were Napleton, AutoNation, Berkshire Hathaway and West Herr at more than 50%. Serra, Premier, Asbury Automotive Group, Greenway and Bergstrom came in at less than 20%.

- Napleton, Ciocca and Herb Chambers “did both” more than 80% of the time compared to less than 30% for Greenway, Premier and Bergstrom.

“Modern customers visit dealership websites first, and today’s sales success is driven by how the dealerships respond,” O’Hagan said. “The difficulty is that the website customer experiences are often invisible or distorted by traditional dashboards, which makes this portion of dealership performance easy to overlook.”