Spyne report says 2026 will be ‘first true AI Operations Year’

Image courtesy of Spyne.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Will 2026 be the Year of Artificial Intelligence in the auto retail industry?

AI-native automotive retail technology company Spyne believes that will be the case based on the results of its 2026 U.S. Automotive Market Sentiment & Dealer Operations Report, which found 76% of U.S. dealerships plan to increase their AI budgets next year.

That trend, Spyne co-founder and CEO Sanjay Kumar Varnwal said, is an indicator that the industry is transitioning from digital retail experimentation to AI-powered operational infrastructure and that 2026 will be “the first true AI Operations Year.”

“2025 reminded us that the fundamentals of retail can shift overnight,” he said. “Dealers started the year optimistic, but tariffs, payment shock and shifting consumer behavior quickly exposed how fragile traditional workflows had become.

“As buyers moved online and affordability tightened, manual processes couldn’t keep up. Demand was there, but operational bottlenecks held too many stores back. That’s why 2026 has to be the year dealerships treat AI as core infrastructure, not an experiment. The stores that modernize their operations now will be the ones that protect margin and win the next cycle.”

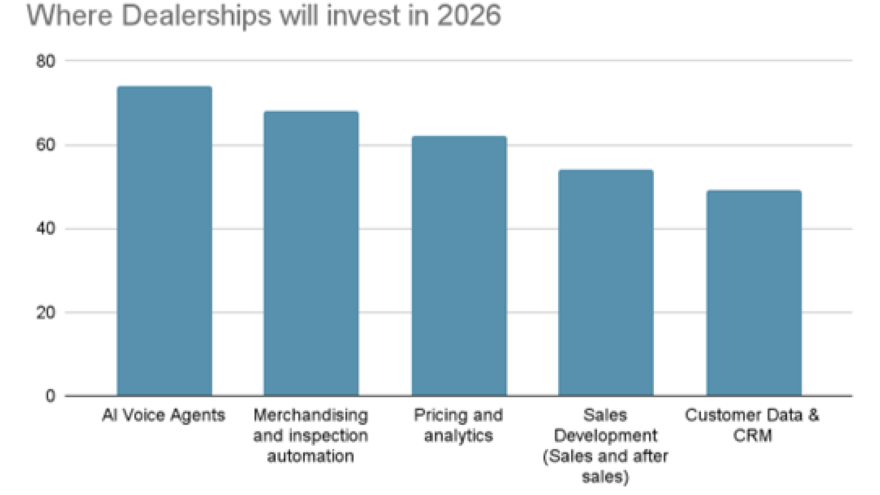

The report, which analyzed responses from a survey of nearly 1,200 dealership executives in 34 states conducted from July through October, found AI voice agents to be the top priority for dealership AI investment, cited by 74% of the respondents, pointing to an emphasis on automation in lead response, inbound call management and service scheduling.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Other areas of focus include merchandising and inspection automation (68%) to speed up time to market, pricing and analytics (62%) to provide accurate used-car values and drive real-time, data-driven decisions, and sales development in sales and after-sales (54%), allocating resources toward BDC processes, follow-ups and fixed-ops revenue.

According to the report, dealerships that used AI for visual merchandising, lead response or inspection automation in 2025 reported a 25-30% increase in showroom appointments, up to 33% reduction in BDC operating costs, a 67% increase in online listing engagement and 12-15 hours saved per week in operations.

“Speed of response and quality of presentation now determine who converts more traffic into appointments and hence makes more margin,” Varnwal said. “With profitability expected to tighten even further in 2026, AI is becoming the operating backbone of the dealership, not a side tool.”

That “early majority” is one of three groups of dealers identified by the report. The others are “fast followers” who have adopted AI in either lead response or merchandising and reported 10-20% games in the functions they adopted, Spyne said, and “laggards” using manual workflows and are experiencing flat/declining sales velocity and margin compression.

“The performance gap between AI adopters and manual operators isn’t linear,” Varnwal said. “It widens quickly.”

Citing Blue & Co.’s projected 25% drop in profit per vehicle retailed for new vehicles and 10% for used in 2026, Varnwal added, “Dealerships can no longer absorb process inefficiencies. Speed of response and quality of presentation now determine who captures shrinking margins.”

Spyne’s report said 2026 will be a year of “recalibration rather than rapid growth,” and made several predictions:

Demand will stabilize, but affordability will remain the ceiling, with elevated prices, long loan terms and consumers continuing to prioritize monthly payments over model preference.

Dealers will focus on gross per vehicle, F&I maximization and long-term customer value instead of chasing unit sales.

Consolidation will accelerate, with multi-store groups continuing to acquire independents. Scale will become a competitive advantage in technology investment, inventory rotation and OEM relations.

EV rollout will remain uneven but unavoidable, and dealers must plan selectively for EV readiness as urban and coastal states lead adoption while other regions favor hybrids and gas-powered vehicles.

Digital retailing becomes non-negotiable. With online research time rising and showroom visits falling, dealers must unify lead capture, pricing visibility, trade-in evaluation and remote financing.

“2026 won’t be a boom year,” Varnwal said. “Rather, it will be a year of clarity. Dealers who invest in digital consistency, price transparency and smarter inventory decisions will outperform those chasing old playbooks. The winners will be the retailers who treat every lead, every image and every customer touchpoint as a revenue moment.”