Study: EV owner satisfaction soars as sales sag

Images courtesy of JD Power.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

There’s an interesting dynamic happening now in the electric vehicle market.

Sales are down. But customer satisfaction has never been higher.

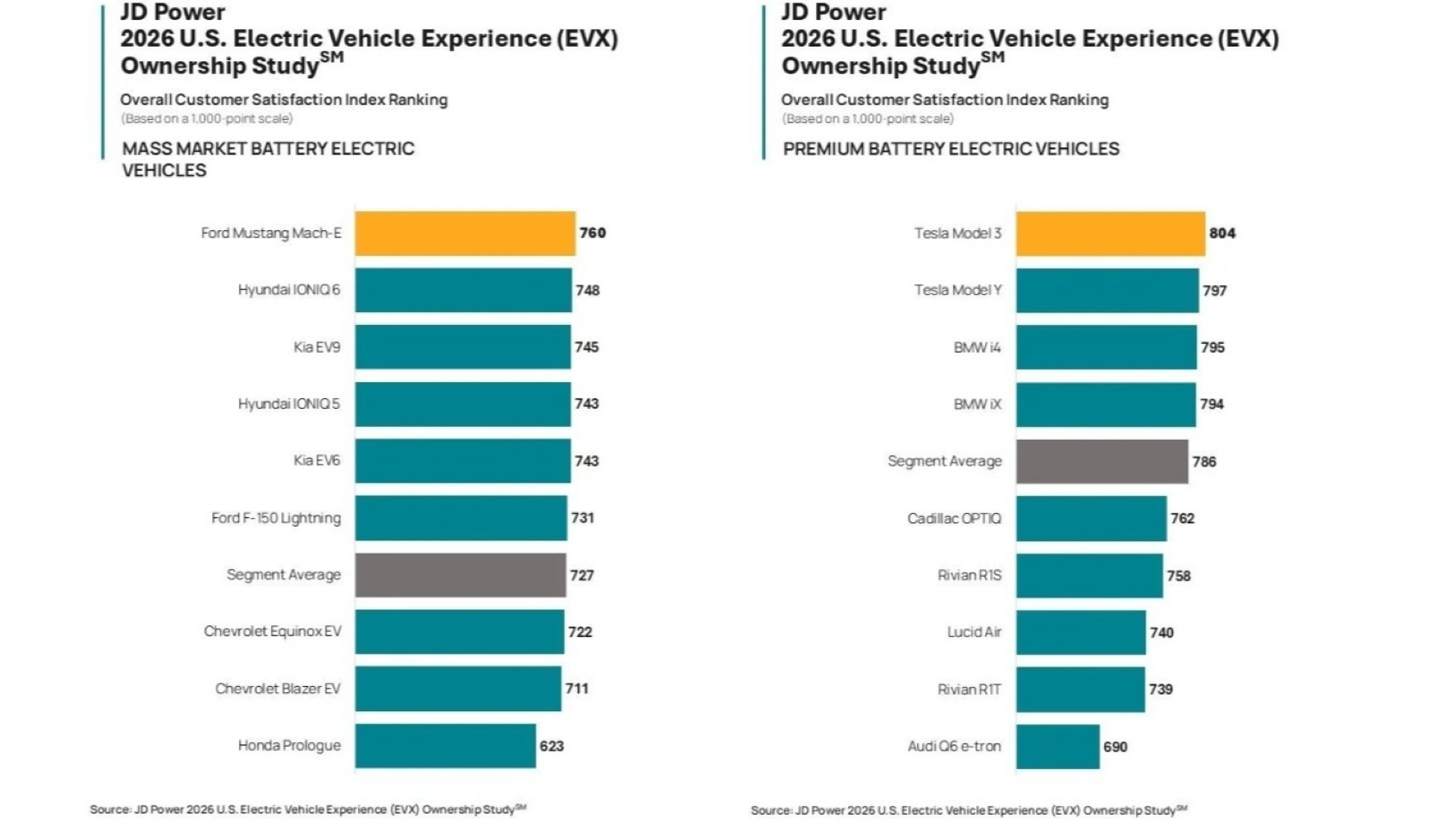

According to JD Power’s 2026 U.S. Electric Vehicle Experience Ownership Study, overall satisfaction among current battery electric vehicle owners is at the highest level in the study’s six-year history, reaching an average ownership index score of 786 on a 1,000-point scale among premium brands and 727 for mass-market vehicles.

The score measures 10 factors, including battery range, cost of ownership, vehicle quality, reliability and styling, safety and technology features, service experience and driving enjoyment, among others.

In addition, a near-unanimous 96% of owners of new BEVs said they would consider another one for their next vehicle, even without the tax credit.

“EV market share has declined sharply following the discontinuation of the federal tax credit program in September, but that dip belies steadily growing customer satisfaction among owners of new EVs,” said Brent Gruber, executive director of JD Power’s EV practice. “Improvements in battery technology, charging infrastructure and overall vehicle performance have driven customer satisfaction to its highest level ever.”

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

The study, conducted in collaboration with EV driver app developer and research firm PlugShare, is based on a survey of 5,741 owners of 2025 and 2026 model-year BEVs and plug-in hybrids taken from August through December 2025.

The results show customer satisfaction is much higher for battery electric vehicles than for plug-in hybrid models when it comes to the cost of ownership. Premium PHEVs scored 114 points lower than premium BEVs in that area, while in the mass-market sector PHEVs scored 117 points less.

While PHEVs benefit from improved battery performance compared gas-powered vehicles, JD Power said, they still carry the maintenance requirements of an internal combustion engine, adding costs and service needs BEVs don’t have.

Even so, the overall owner satisfaction score for premium PHEVs rose 15 points year-over-year to 756 — just 30 points behind BEVs — and the PHEV mass-market score jumped 26 points to 658.

Public charging satisfaction also reached new highs in 2026, with premium EV owners giving it a score of 652 and mass-market owners scoring it at 511 — up more than 100 points from last year’s study in both categories.

JD Power attributed the rise to a continued growth of publicly available chargers and the opening of the Tesla Supercharger network to all EVs, adding satisfaction among Tesla owners is rebounding as they adapt to the expanded access of the charging network.

The rate of problems experienced by EV owners has improved, especially among premium brands, which averaged 75 problems per 100 vehicles (PP100), 15.9 fewer than in the 2025 study. The study said the greatest improvements have come from reducing squeaks and rattles inside the vehicle, as well as fewer problems with driver assistance and excessive noise from the exterior. Total problems among mass-market EVs averaged 92.2 PP100.

As always, the study included vehicle rankings for satisfaction, led in 2026 by the Tesla Model 3, with a score of 804, followed the premium category by a fellow Tesla, the Model Y (797), and two BMWs — the i4(795) and iX (794). In the mass-market segment, Ford’s Mustang Mach-E took top honors at 760, ahead of the Hyundai IONIQ 6 (748), Kia EV9 (745), Hyundai IONIQ 5 (743) and Kia EV6 (743).

There are nine award-eligible models in the premium segment and nine award-eligible models in the mass market segment. Satisfaction among owners of premium BEVs averages 786, up from 756 last year, while satisfaction among owners of mass market BEVs averages 727, versus 725 in 2025.