Survey shows divide in how franchises, independents see used-car market

Image courtesy of Cox Automotive.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

How are used-car sales going?

Depends on what kind of dealer you ask. For franchised dealers, quite nicely, thank you. For independents … not so much.

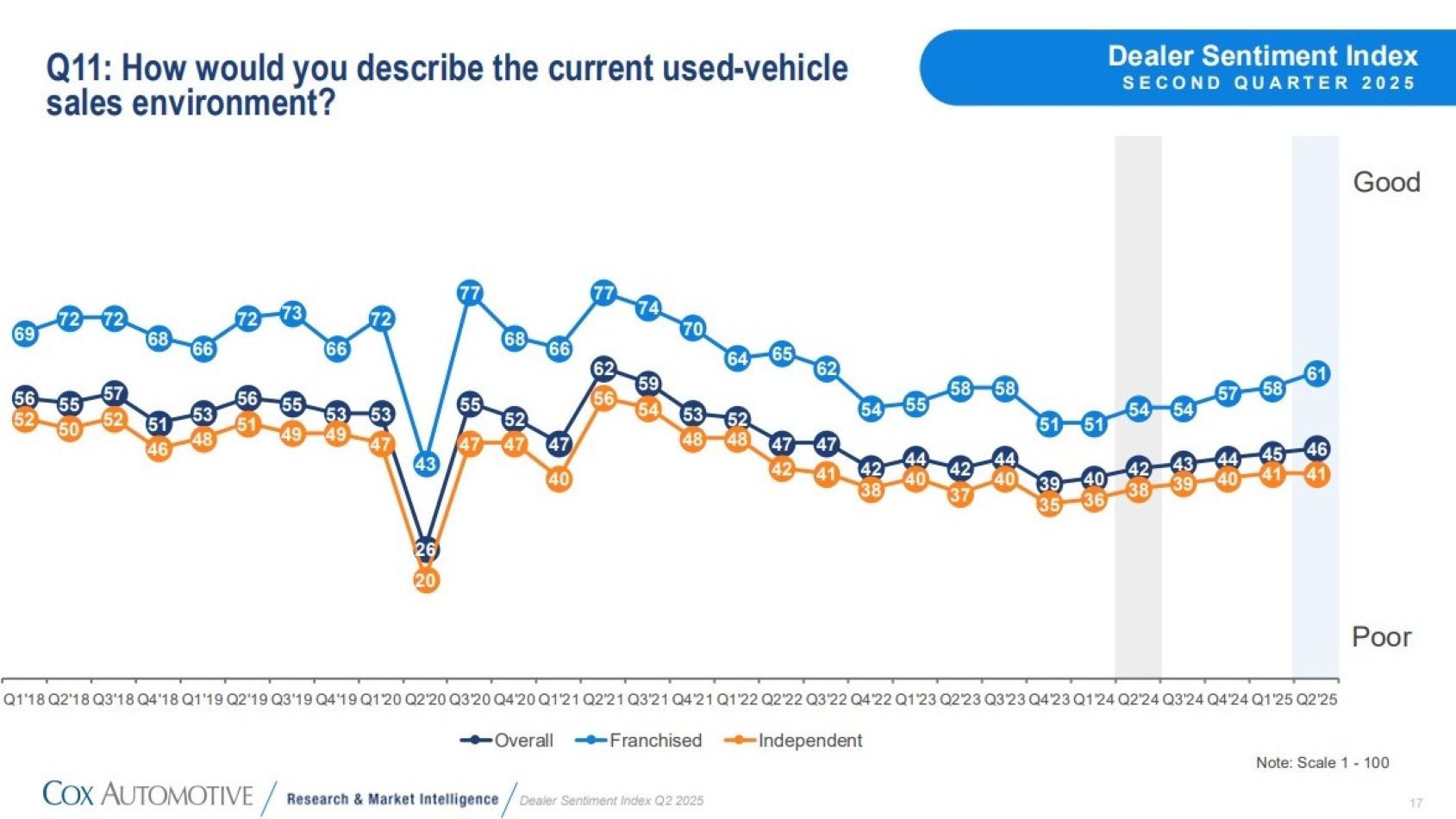

Cox Automotive’s Dealer Sentiment Index for the second quarter of 2025 offered a stark illustration of the different worlds inhabited by franchised and independent dealers in their outlook of the current used-vehicle sales environment.

In Cox’s national survey of 977 franchised and independent dealers conducted from April 22 to May 5, franchised dealers gave the used sales landscape a resounding thumb’s up with an average score of 61 on a 100-point scale, up from 58 in Q1. Independents had a much dimmer view, holding steady with an average of 41, which is actually their highest score in almost three years.

The combined used-vehicle sales index for all dealers improved for the sixth consecutive quarter. But Cox analysts noted the one-point rise to 46 “suggests most dealers continue to view used-vehicle sales as poor, not good.”

The survey found all dealers are struggling with used inventory. Overall, the index dropped six points quarter-over-quarter to 41 — its lowest level since mid-2023 — indicating a shrinking supply of used cars. Independents were down six points to 38 and franchises fell from 55 in Q1 to 48 in Q2, crossing the threshold from growing to declining inventory.

Subscribe to Auto Remarketing to stay informed and stay ahead.

By subscribing, you agree to receive communications from Auto Remarketing and our partners in accordance with our Privacy Policy. We may share your information with select partners and sponsors who may contact you about their products and services. You may unsubscribe at any time.

Like used-car sales, dealers’ expectations for market conditions in their local areas over the next three months also reflected a sharp divide between franchised and independent dealers. Franchises’ outlook was down five points but still landed in the positive range at 56, while independents plummeted 15 points from an optimistic 57 to a glum 42.

“Dealers have a front-line view of the U.S. auto market, which appears to be at an inflection point,” Cox Automotive chief economist Jonathan Smoke said. “The recent sales pace has been a positive, lifting current market sentiment higher for franchised dealers. But as we’ve said before, 2025 is going to be a roller coaster for this industry, and the market could be a lot more hair-raising in the months ahead.”

The ride up on the roller coaster has been fueled in part by car shoppers rushing to beat tariff-fueled price increases, a surge that shows up in a jump in dealers’ scores for customer traffic in Q1, up four points overall and 10 points for franchised dealers. But even with that lift, dealers still put traffic solidly in the weak range with an average score of 37 — 50 for franchises and 32 for independents.

Profitability also took a step up, up five points to 39 overall, with franchises again leading the way with an 11-point leap to 52. Independents reported profits up as well, with the index rising three points to 35.

The biggest changes in the index showed up in the factors dealers see as holding back their business. The economy surpassed interest rates to take the No. 1 spot on that list, cited by 51% of dealers as interest rates dropped to 42%, down 10 percentage points from Q1.

Meanwhile, the political climate and tariffs shot up the chart to tie for fourth at 33%. Politics jumped 12 percentage points from quarter-over-quarter, while tariff concerns soared all the way up from 7% in the previous survey as franchised dealers brace for the effects on their imported inventory.

Cox analysts noted 48% of the franchised dealers who expected future market conditions to be weak included the word “tariffs” in their response, “suggesting the current administration’s policies on imported vehicles is front of mind for dealers concerned about the market in the coming months.”

Among independents, those two factors rose sharply to 31%, but were far down on the list of concerns, trailing the economy (52%), market conditions (42%), interest rates (41%), expenses (35%), limited inventory (54%) and consumer confidence (31%).